Market On Close, Wednesday 14 January

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Beast Awakens

by Alex King, CEO, Cestrian Capital Research, Inc

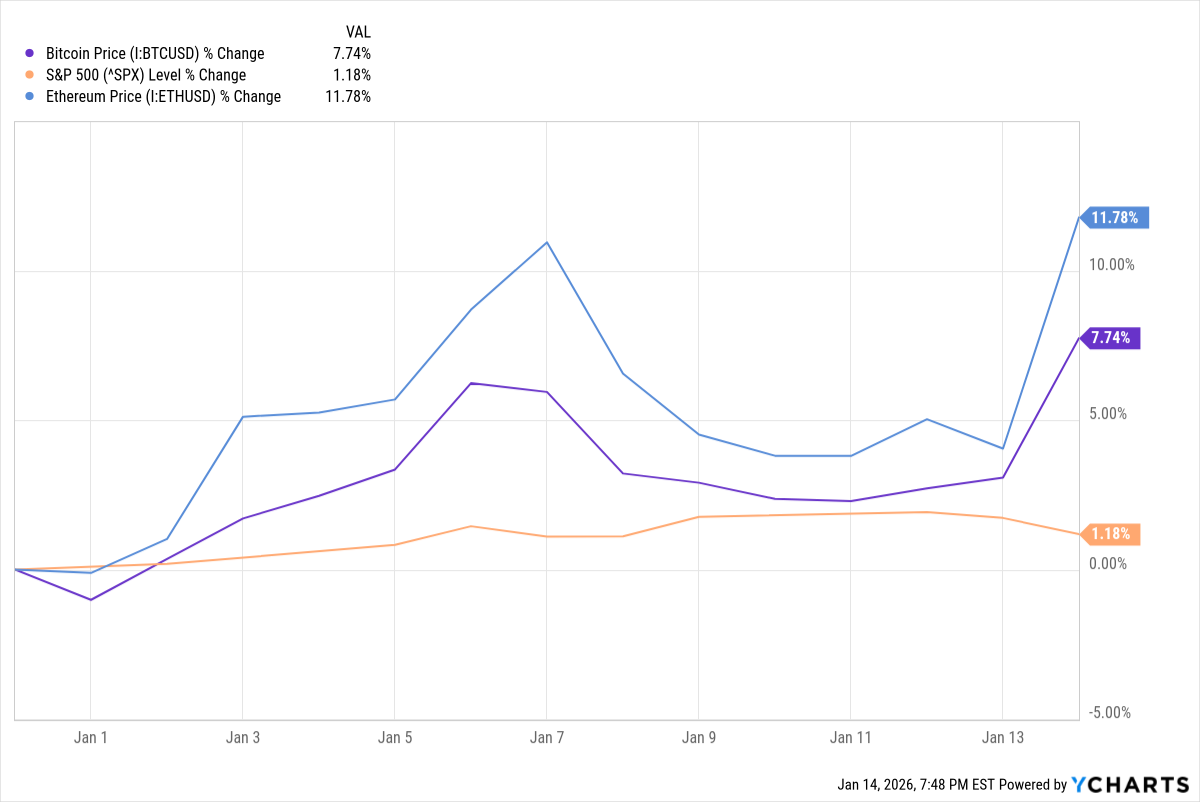

Crypto in 2025 be like:

All going so well until Liquidation Day in October. And then your regular crypto bros just seemed to lose heart and/or got serially liquidated trying to get too cute and trade long/short whilst chaos reigned.

2026 though? Now that all the civilians have been rekt and/or plain ole dissuaded from taking part, of course the weird Internet magic beans start to rally. Capital markets 101.

As you know from our recent note “What On Earth Is Going On In Crypto”, we have a bullish outlook for both Bitcoin and Ether.

Ether in particular is being adopted as a kind of air miles for transaction processing in the new financial plumbing. Tokenization of real-world assets and securities will see a major ramp in usage of the Ethereum blockchain, and the only way to conduct business on that blockchain is to own some Ether. Oh and by the way, in a most TradFi fashion, the stuff also pays a dividend (albeit payable in, of course, more Ether).

If you’ve been burned trying to second-guess the crypto market, or you’ve been cautious and kept away, read up on our YXI Cryptocurrency Algorithmic Signal Service. It’s a cold-as-ice way to play Bitcoin, Ether, Solana, Ripple, and key crypto-related stocks like Robinhood and Coinbase, without having to listen to this week’s cringeworthy crypto-influencer podcasts or second guess what Peter Thiel is planning for his extensive Ether holdings.

This algo service kept its users out of crypto from just before the Grand Liquidation Event Of 2025, and has recently started to turn more bullish just as crypto has appeared to bottom out.

See how boring and cold this is?

You can use it for native crypto or, if you dislike home invasion stress, you can use it for BoomerCrypto aka. ETFs like $IBIT, $ETHA and so on.

That’s how to do crypto folks. Completely dead inside. You can learn more here.

Now, let’s get to work. In addition to the weird Internet money we have to cover bonds, the S&P and the Nasdaq, the Vix, gold, oil, key sectors and more … right here in our Market On Close note which our Inner Circle members receive daily.