Market On Open, Friday 16 January

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Rotational Awareness, L.P.

by Alex King, CEO, Cestrian Capital Research, Inc

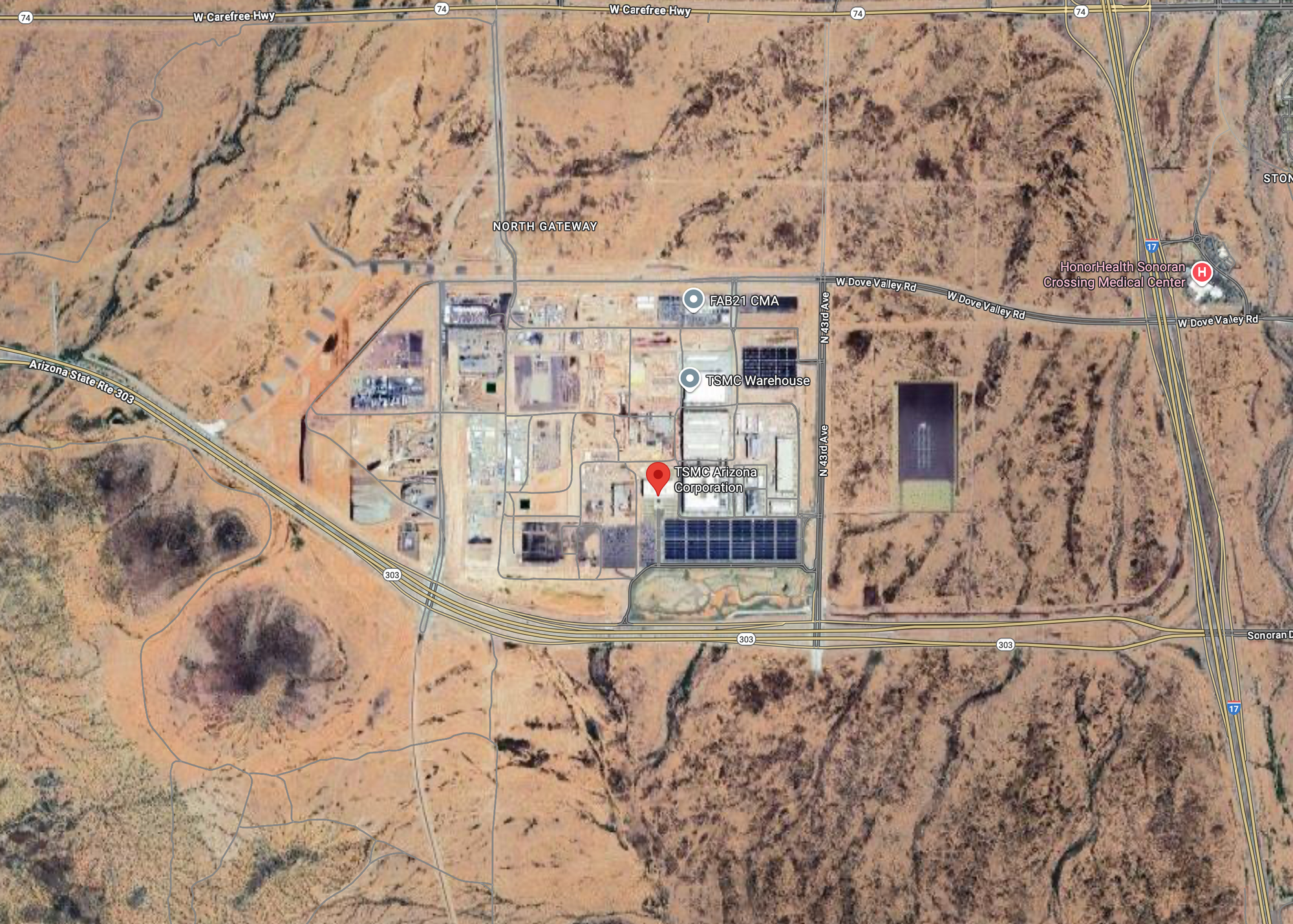

I don’t know if you have ever visited a semiconductor factory (hint, to be socially acceptable in the sector, never say “factory” or even “fabrication plant”, say “fab” as if it is second nature to you) but if you have you will know that they are pretty awful places. They look all nice and shiny on the outside but they generate the most incredible amount of toxic waste and heat output that it’s a wonder everything within 10 miles of these things isn’t just scorched earth.

Oh wait.

Anyway, in the global race to secure physical resources before the last vestiges of globalization collapse under their own contradictions, it’s not just oil and rare earth minerals that matter. Having advanced semiconductor manufacturing capability is today as important as weapons production was in Cold War 1.0, not least because to produce a lot of weapons these days you need … a lot of semiconductor.

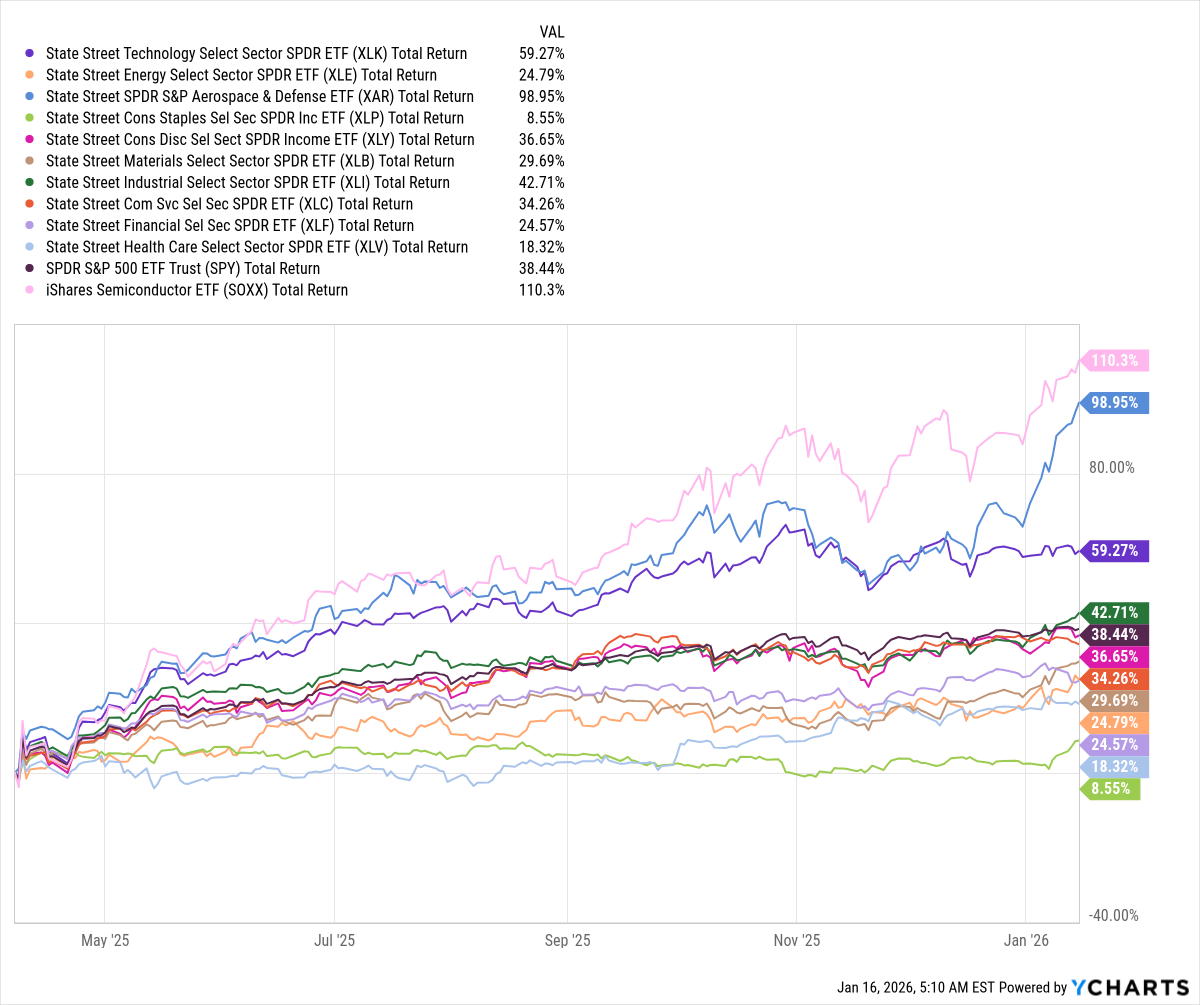

This is why since the Liberation Day lows in early April last year, semiconductor stocks have mooned. Actually, if you look at which sectors have beaten the S&P since that time, it is all stuff involved in gathering hard assets and defending them with scary stuff with pointy ends. Semiconductor +110%, defense +99%, tech +59%, then the S&P itself at +38% and then a bunch of stuff that no-one cared about. (Some of which is now under accumulation of course, but that’s for another day).

As is obvious, the world is changing fast, and understanding sector rotation is key to making money in this world. The S&P500 and Nasdaq bull run will, eventually, come to an end, but there is still going to be money to be made.

There is always a bull market somewhere; it’s lazy to assume it’s always in the same sectors or stocks. The leaders of the past - high cashflow margin services plays like Meta and Google of old - may not be the leaders of the future, and if they are it will be because they adapt to this new, capital-intensive world where manufacturing and labor is going to be located closer to the point of consumption.

We have something special in the works here at Cestrian to help you take advantage of sector rotation - the goal being that whether the indices are moving up, down or sideways, you should be able to make money by being overweight capital in the going-up sectors and underweight in the others.

You’ve seen that already for our Inner Circle members we’ve been expanding the sectors we cover - check our homepage here which has started to divide up our coverage by sector.

And we will be soon be introducing algorithmic sector rotation tools too. We’re finding in our work that bringing together machine learning algos (which run cold as ice) together with the wetware (which is still better at thinking about what to point the algos at and what questions to ask of the algos), we’re getting great results.

Stay tuned.

And let’s get to work.