Market On Open, Monday 23 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

AI vs. Fear

by Alex King, CEO, Cestrian Capital Research, Inc

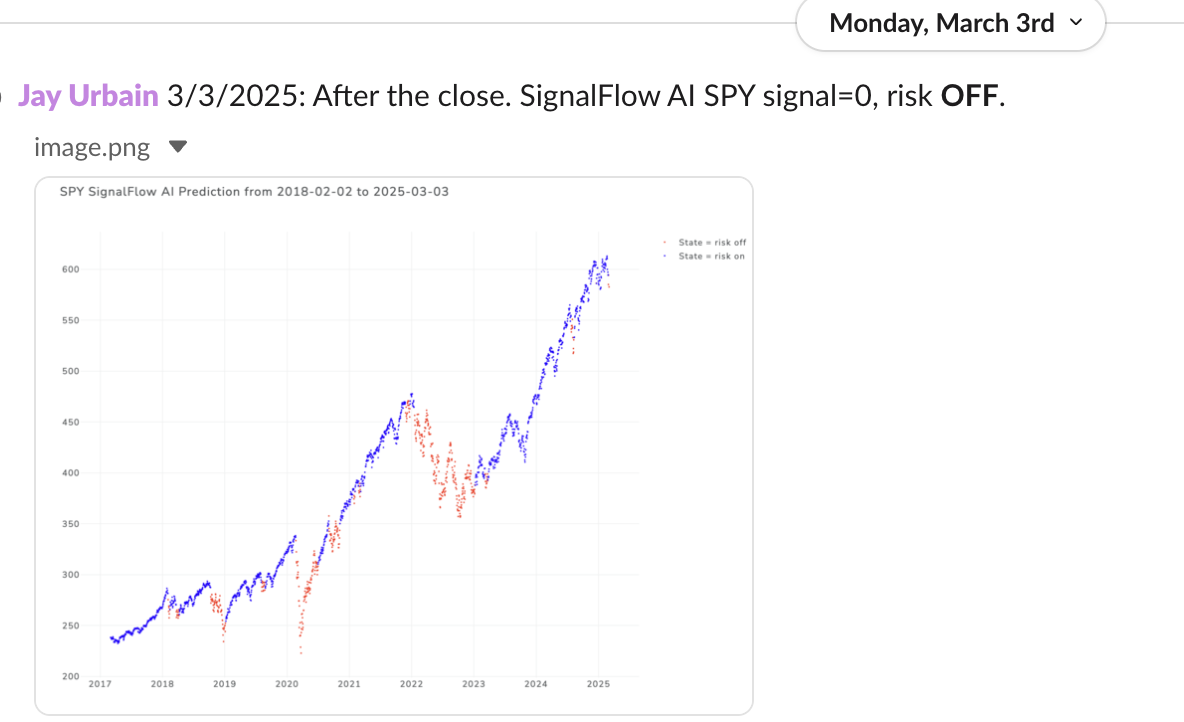

In recent months we’ve seen great success with the quantitative signal services we’ve launched. We host services from two quant providers - Fridi Technologies and Upstream Development - and speaking personally I use their signal services for part of the capital I invest and trade. The experience is pretty interesting, both for the quants and for subscribers. Though the models from each of Fridi and Upstream are built differently, they have one thing in common - in uptrends punctuated by dips, they hold their nerve when traditional analysis methods would have you sell. And thus far, in this bull market, that has proven correct each time. In common with the storied experience of Renaissance Technologies, each of these quant providers will tell you that their models have stayed in risk-on mode when their own technical analysis or plain gut feel would have had them hitting the SELLSELLSELL button. We’ve also seen good results prior to material corrections; our most basic market quant service, “SignalFlow AI For $SPY”, flipped risk off on March 3rd this year. Anyone following its signals would have avoided the entire pre- and post-Liberation Day correction. And as you know, making money in markets is the second most important thing. The most important thing is - avoid large losses!

The future of investing and trading will be driven by AI. In my mind that is an uncontroversial statement. One can resist it, protest it, deny it, but that is merely the modern analog of the Luddites in the 18th- and 19th- century attempting to hold back the tide of industrialization. It didn’t end well for them, even the ones who were not shot by mill owners. As it was with mechanized looms so it will be with investing and trading. I think the choice is either - work out how to embrace AI in your capital management, or be left dazed and confused as to why markets are moving as they are when they “should be” doing something different according to your analysis. We are already seeing the erosion of hitherto-standard technical analysis methods (which themselves largely replaced fundamental analysis as the key method of navigating markets).

If you’d like to learn more about how to use AI in your investing and trading, take a look here:

Bitcoin and Mag7 Signals From Fridi Technologies

S&P500, Nasdaq, and Sector ETF Rotation Signals From Upstream Development

Now let’s get to work.