Market On Open, Thursday 1 January. No Paywall.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Sharpen Up. Do It Now.

by Alex King, CEO, Cestrian Capital Research, Inc

We come into 2026 with equities at all time highs, US government bonds in the doldrums, crypto beaten down by deleveraging events, and commodities ripping it up. Today, U.S. banks were permitted to retain lower capital levels, meaning more credit available to their clients (which usually means more money sprayed around by said clients, for a time at least).

We start a year which will be perilous for labor in my view; AI is real, it’s not a broligarch hallucination, and it absolutely is coming for any task which can be automated and performed in a just-about-good-enough kind of way. Think you’re special? You’re not special. Work out how to beat the machine - how to use the machine - or the machine will deflate your earnings, render you on the sidelines, ruin your future, just as did the first Industrial Revolution to anyone weaving cloth who thought they were special.

And we start a year in which the incumbent Administration is pushing the new digital arms race hard - you doubt me, read the Genesis Mission statement here - and they mean to succeed.

2026 is not going to be an easy year to navigate in markets.

However sharp you think you are? You’re not sharp enough. Complacency is going to be handed back to you on a silver platter. (If anyone can find any silver to make it out of, that is).

The easy options aren’t good options.

- Passive-long index equities? Not according to our charts.

- All in cash? Not according to the direction of the dollar.

- Levered-max-short to benefit from a certain crash? Ask permamiserables how that worked out in the last, oh, ninety years.

Fortunately we are here to help. Our goal is to help you better understand markets and to make them work for you, not against you. We help you work out where Big Money is allocating capital and to find ways to follow them - rather than to hand them your money so they can get richer and you poorer (which is the basic function of securities markets of course!).

Oh, and the machine? We own the machine. We have machines working for us all day and all of the night. If we can automate it, make it numbers not feelings, we do so. All our work features AI in some form, from hooman-assist to pure machine-learning algo.

So come with us to where we’re going. Leave the loom behind, put down your artisan tools and get ahold of the means of production. Remember: the bourgeoisie still own it all, breaking proletariat hearts since at least 1848.

Now, below our latest daily review of equities, bonds, sectors, crypto, oil, gold, volality and more. Usually you can get this only by subscribing to our Inner Circle service; today, to mark the New Year, this is a public post open to all.

If you want to sign up for Inner Circle, do it before January 5, when prices double. We never raise prices on our existing subscribers - the sooner you join, the lower your costs for the whole time you remain a member.

If you’re still thinking about it, read our testimonials.

Happy New Year folks!

US 10-Year Yield

If efforts to drive down the yield, to the benefit of bond prices for holders, and to the benefit of the bigly-refinancing U.S. Government, then this local high could really do with holding.

Equity Volatility

I would be surprised if equity volatility remained low in 2026. Happy, because then life would be easy, but surprised.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

I would also be surprised if $TLT (= U.S. Government bonds, 20+yr term) stayed down here in the doldrums this year.

The local floor here is holding around $87. The key key development needed to see TLT start climbing is for it to get up and over the 200-day and hold over that - this means up and over the purple line on that chart, around $88.20 right now.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

$37 floor is holding; over the 200-day SMA at $39.40 or so is the critical step for a recovery.

Disclosure: I am unhedged long $TLT and $DLTA (an EU UCITS TLT proxy).

Gold

Target $4600-4800 as long as that Wave 4 low holds. If the W4 low is broken, look out below as we are likely to see a material correction.

Disclosure: I am positioned in gold according to our Commodities Algo Service and our SignalFlow AI Growth Service.

Bitcoin

This is a bullish setup. Confirmation would be getting up and over the 50-day SMA at $89,650ish. Incidentally for the more relaxed at heart I caught a very interesting podcast with Mike Novogratz, CEO of Galaxy Digital recently - the standout view for me was “don’t bother getting bullish until BTC is back up and over $100k”.

Disclosure: I am long $IBIT.

Ether

Also setting up nicely for a Wave 3 run in my view. You can strike that if Ether drops below $2150.

Disclosure - Long $ETHA and others in the Ether complex.

Oil (USO / WTI / UCO)

To repeat from New Year’s Eve: Oil “should” continue to sell off; the chart is setting up bullish in the short term in my view though.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

That futures chart above is the easiest way I know to trade the UCO / SCO pair.

Disclosure: I am positioned in oil per our Commodities Algo Service.

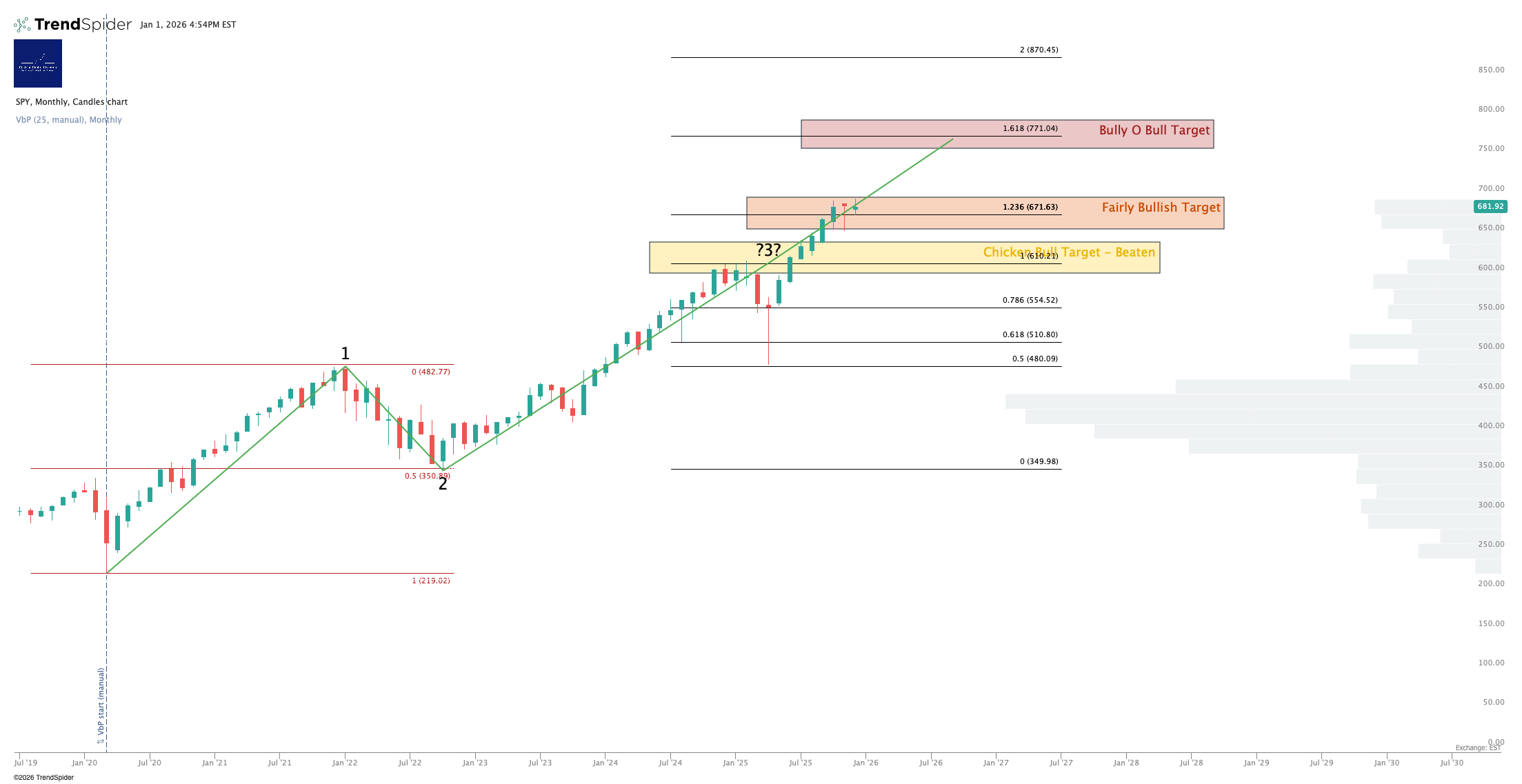

S&P500 / SPY / UPRO

Off we go folks! Let’s see what 2026 brings to the Big Dog.

Closed Wednesday below the 21-day EMA; a second daily close below that level (the green line on this chart below) means caution.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Some signs of life in SPXU (3x short SPY) but I suspect that reflects a year end liquidity crunch. Let’s see what happens once the money-spigot opens Friday morning.

Disclosure: I am long $SPY and long $IUSA ie. unhedged long the S&P.

Nasdaq-100 / QQQ / TQQQ

My 2026-8 roadmap. Route A or Route B. Ask me if unclear!

Closed the last day of 2025 below the 21-day EMA and below the 50-day SMA which isn’t wonderful. Again let’s see what happens with liquidity entering the system tomorrow.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Ugly candle on Wednesday for TQQQ.

Disclosure: I am hedged approx 2.2:1 $TQQQ:$SQQQ ie. net long the Nasdaq.

Dow Jones / DIA / UDOW

Here’s another roadmap. The Dow tends to move somewhat in concert with the S&P and the Nasdaq, and oddly it often leads the way. So I am using $DIA to see if we get a near term correction in the S&P and the Nasdaq - like this:

Again, the low volumes in the last week or two mean prices are little less meaningful that at other times in the calendar. Volume should start to pick up from next week and then see a local high into Q1 options expiry in March.

3x Levered Dow - UDOW Long / SDOW Short

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in the Dow.

Sector ETFs

Bullish over $144, bearish below. Closed below on Wednesday.

Disclosure: I am positioned in XLK per our SignalFlow AI Growth Service.

3x Levered Long/Short Tech - TECL/TECS

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in TECL or TECS

SOXX (Semiconductor)

Closed Wed right on top of the 8-day SMA; that’s a bullish sign for indices since SOXX is a much riskier play than the SPY or the QQQ.

3x Levered Long / Short Semiconductor - SOXL / SOXS

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged approx 3.3:1 $SOXL:$SOXS

Alex King, Cestrian Capital Research, Inc - 1 January 2026