Market On Open, Thursday 23 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

A Quantum Of Solace

by Alex King, CEO, Cestrian Capital Research, Inc

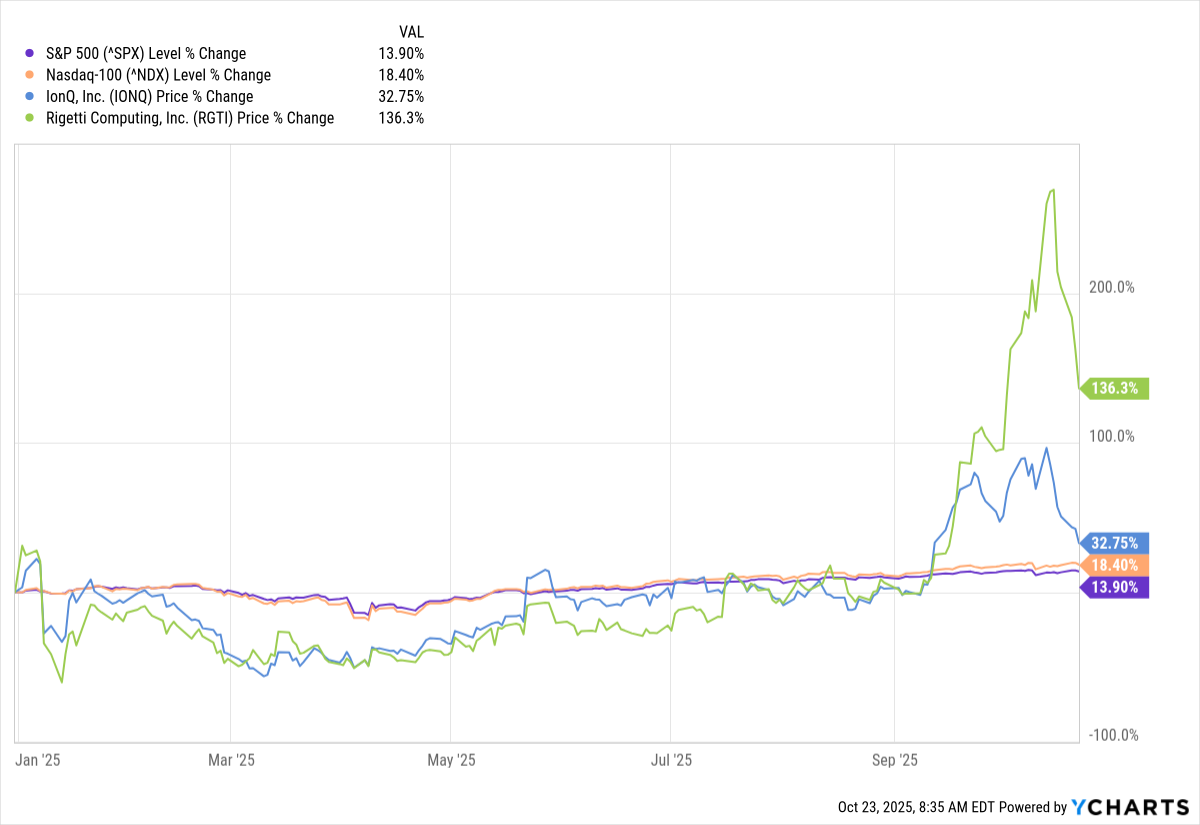

This year’s market yo-yo, quantum computing stocks, just got a shot in the arm from a rumored US federal government investment. No word yet on whether this is factual or not but it is a good reminder that trading story stocks means you have to able to weather extreme volatility.

Here’s IonQ and Rigetti stocks this year vs. the boring ole S&P and Nasdaq.

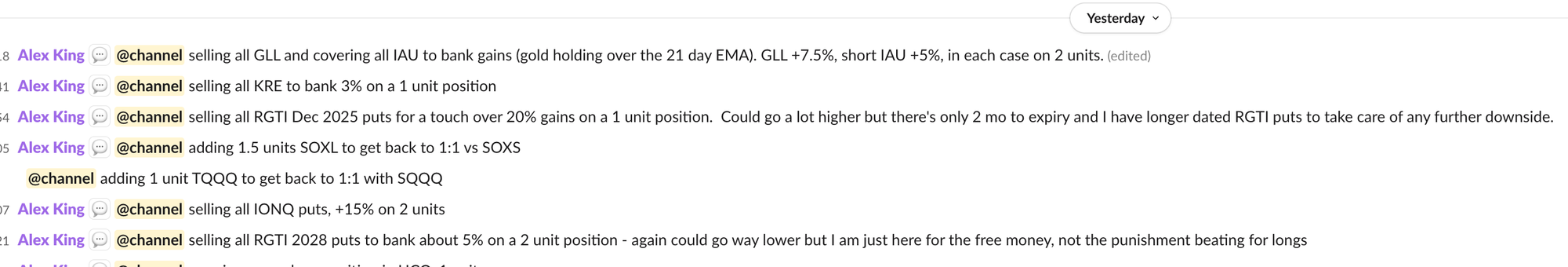

In our work we teach investors how to profit from stocks on the way down as well as on the way up. In a bull market, down is unusual and it’s hard work, but it’s good practice for whenever the next bear market comes along. Yesterday in our Inner Circle service we disclosed taking profits on short quantum positions in staff personal accounts.

Here’s the disclosure alerts from yesterday.

All out of IONQ and RGTI for tidy gains. I myself don’t believe in trying to short things to zero - I’m in it for the money, not the revenge trading - and even when things do go to zero, actually getting paid can be difficult, as short sellers in Signature Bank found in 2023 (here).

Assuming you too are stock-agnostic and just want to make some money, then you can use the self-same tools on the way down as the way up. Here’s the $RGTI chart we used to determine it was time to take gains.

A huge Wave 5 up, with the top marked by extremely thin volume x price; then the price dumps, falling through the 8-day simple moving average (red line) and the 21-day exponential moving average (green line) for a nigh-on 50% drop from the peak. That was enough for me to take the gains and go.

Now, as luck would have it, the news of a potential government investment has RGTI and IONQ (and others in the sector) up in pre-market trading but still, I note, below the 21-day EMA for $RGTI. If you were very brave you might decide this is news which won’t support the price (because that key moving average hasn’t been breached to the upside) and you might decide to go again with a new short. Not for me. Time to move on. Just as you should never fall in love with a bull idea, nor should you become obsessed with a bear idea. Especially in a bull market, when short ideas can cost you dearly if you don’t manage your risk.

Enough with the story stocks.

Here’s our daily market note, covering yields, bonds, equities, volatility, oil, crypto, and key sectors. Join our Inner Circle service if you’d like this note in your inbox every trading day. Oh and also a stream of long- and short- ideas too.