Market On Open, Tuesday 14 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Headache Is A Feature, Not A Bug

by Alex King, CEO, Cestrian Capital Research, Inc

So. You survived Friday, because you’re a careful manager of risk and you didn’t lever altcoins 50x and you didn’t full-port your way into a basket of pure degenerate stonks. Maybe you had a few hedges here or there, a little cash on the side, you know, the old fashioned stuff. Congratulations! You’re behind the modern-day Druckenmillers who can’t stop posting their returns on X, but you’re ahead of the S&P and the Nasdaq YTD. Nice.

Along comes Monday. You’ve seen crypto recover over the weekend and stocks gap up into pre-market Monday. Time to get back in! You place a few judicious long trades in sensible names, log off, have some dinner, walk the dog, read a book, go to sleep. All is well.

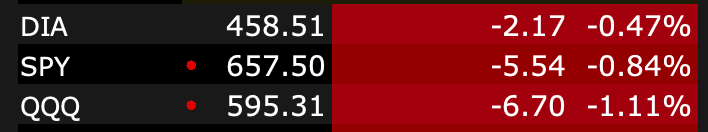

Then you wake up this morning to … this.

Wait, wut??? Didn’t the China Crisis get called off? WHAT???

Look, this is how markets work. In our Inner Circle webinar last night I actually found it pretty amusing that the S&P closed right at the 21-day exponential moving average, which means neither bulls nor bears had a clear signal. Over the 21EMA, usually bullish, below, usually bearish. Right on the nose after a crypto-cray-cray weekend? Who knows what that means?

(By the way, if I had to guess, it would be something to do with the bond market being on the beach yesterday and now getting back to work).

This is why public markets never get boring. They never stop changing, the rules engagement aka. cheat codes keep changing, the semiotics evolve and morph, nothing ever remains static. If you learn to love the game for the sake of the game, if your goal isn’t “I really understand the fundamental nature of discounted cashflow analysis” but instead simply “number go up”, then all it takes is concentration and effort to make number go up. Your belief system of choice should be neither “earnings performance drives stock prices” nor “macro policy drives stock prices” nor “I love quantum computing” but merely … which way is price pointing and how do I point the same way so that number go up?

If securities markets give you a headache, you’re doing it wrong. They should make you feel either nothing (ideal) or slightly amused (acceptable). Stressed? It’s not the market. It’s you. Skill issue. Or, more likely, an attitude issue. The market is there to take your money if you let it; and to give you money if you learn to play by its rules (which, nb, they don’t teach in Wharton or anywhere else).

On the subject of which:

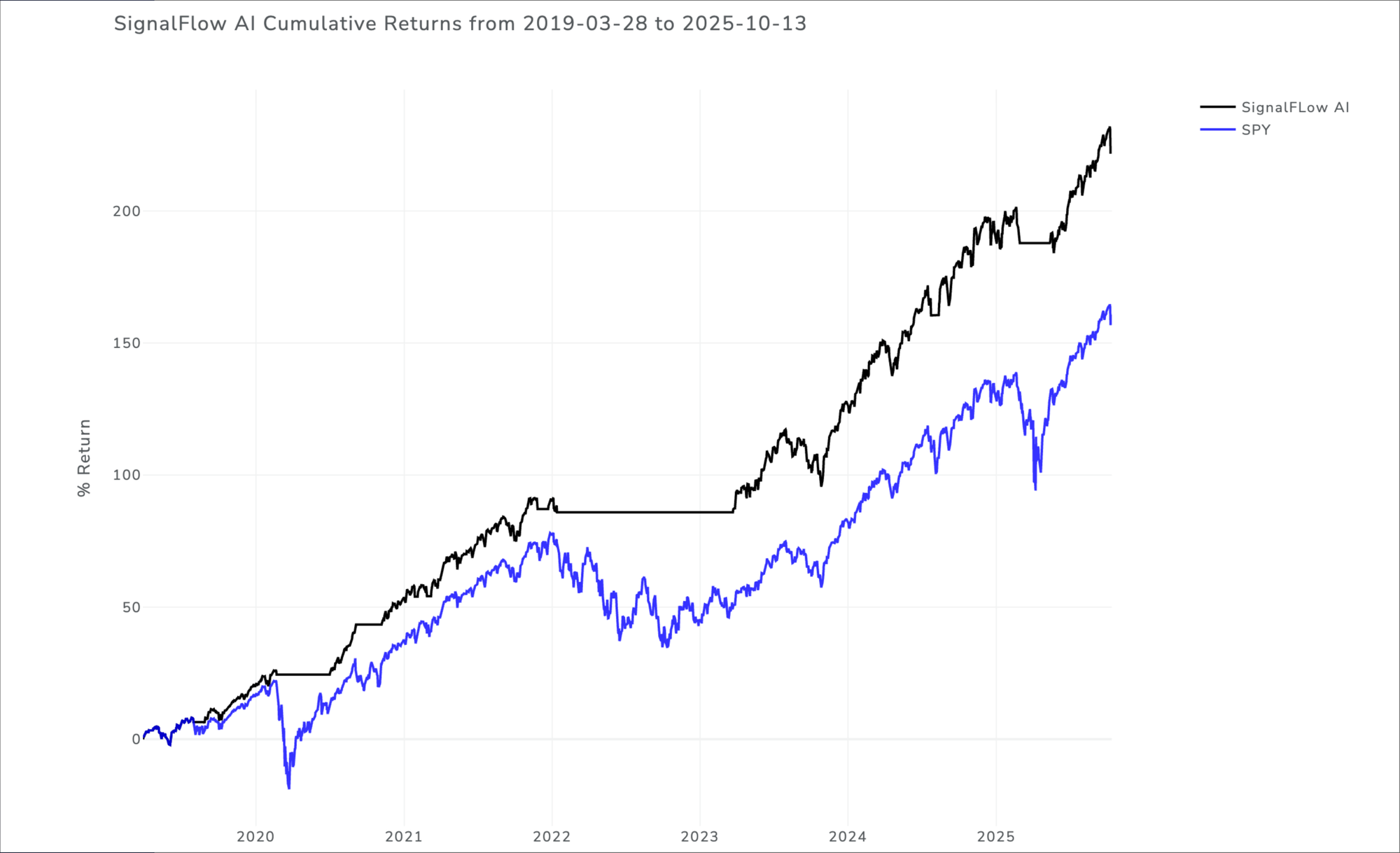

Let The Machine Take The Strain

An update on how our simple long-only S&P500 algorithmic signal service is doing. As a reminder, this is about the easiest algorithmic service anyone could imagine. SignalFlow AI For $SPY prints a one or a zero right after the close each day. A one means the model thinks the market is likely flat or up the next day; a zero means the model thinks the market is likely down the next day. The model is designed to help investors avoid big drawdowns; in other words the intent is that the model flips to 0, risk off, before any big selloff in the S&P. And that if you traded according to model outputs, the idea is that you can step aside whilst the pain torments others, then get back in with your account relatively unharmed - thus preserving (1) capital and (2) emotional balance.

Here’s the cumulative performance of the algorithm vs. simply holding SPY over the same period. The service went live mid-2024; the data prior to that is backtested, the data after that is live trading ie. out in the wild, for real. You can see from a simple visual inspection the benefit of avoiding those material selloffs.

I myself run a pool of capital by following this algo. When it flips risk off, I take this pool of capital out of its S&P exposure. When it flips risk on, I put the capital back into the S&P. I like this a lot. It keeps my capital safe from material drawdowns and it takes the angst away from the decision to go to cash periodically.

You can learn more about this service here (if you’re an independent investor) and here (if you’re an investment professional). If you don’t know if you’re an investment professional or not, you can check our Ts & Cs here (look for section 1.5).

You can also read about the whole family of SignalFlow AI algorithm services here:

OK, let’s do it. Here’s our daily market note, covering yields, bonds, equities, volatility, oil, crypto, and key sectors. Join our Inner Circle service if you’d like this note in your inbox every trading day.