Market On Open, Tuesday 23 September

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Circular Beginning Of The Ignominious End

by Alex King, CEO, Cestrian Capital Research, Inc

Yesterday, Nvidia announced that it was investing “up to $100bn” into OpenAI.

Now, Nvidia does not actually have $100bn, or anything close to it.

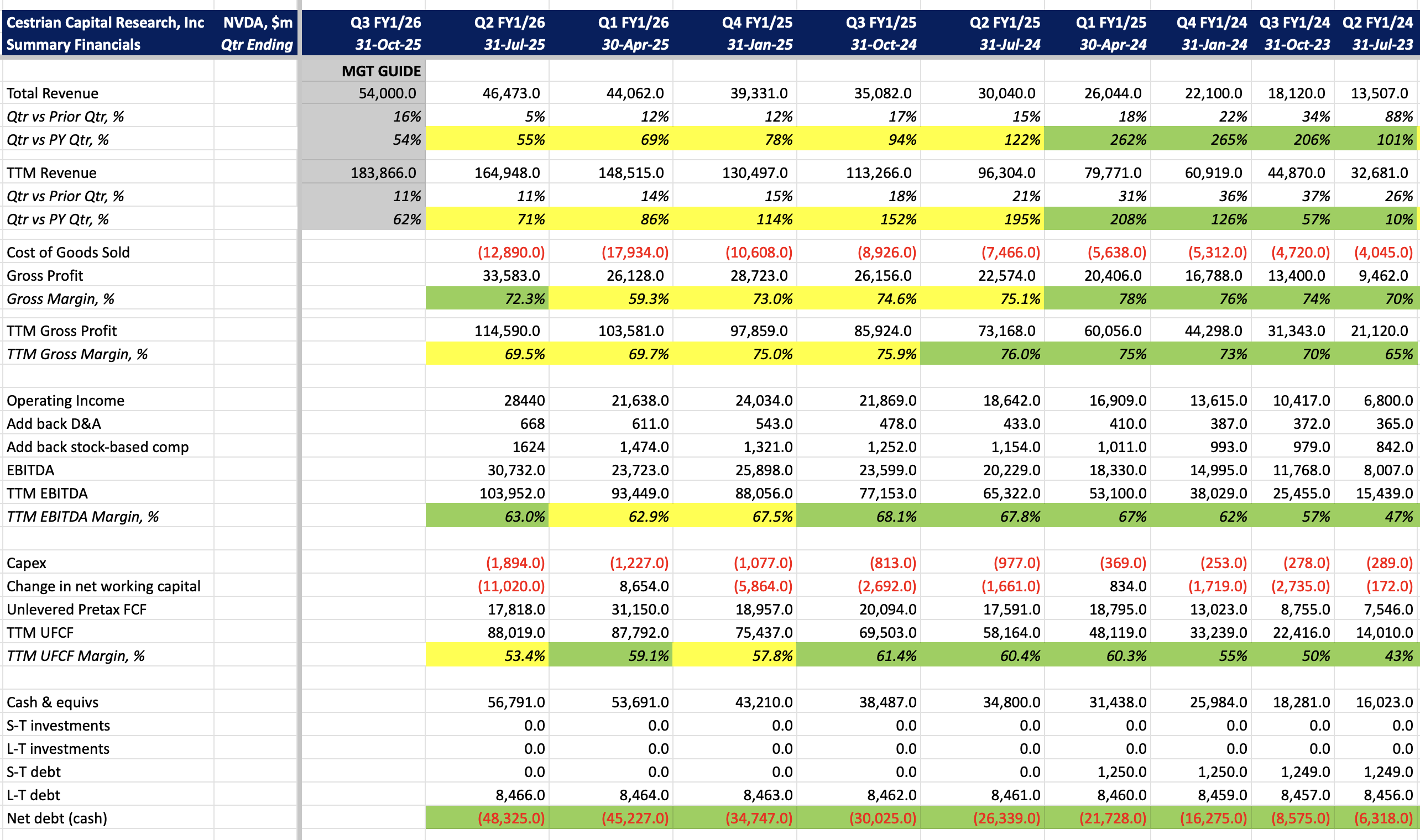

As of 31 July, Nvidia has $57bn of gross cash, $48bn after debt. And in the last 24 months, the biggest gold rush ever known in tech, when Nvidia was the recipient of most of the money spent, it added $42bn of net cash. So, Nvidia first has to earn the money it has pledged to invest.

How will it earn the money? By selling GPUs etc. To whom? Well, to OpenAI and to intermediary companies that also sit between Nvidia and OpenAI; Oracle for one, Microsoft for another.

There is nothing fundamentally wrong with this kind of arrangement, it’s just that these kinds of circular money flows tend to happen as markets are getting a little over their skis. It implies there isn’t enough money coming into the system from outside to sustain the system.

When multinational telecom companies began swapping capacity in the 1990s it didn’t immediately lead to their downfall, but it was an indication that they lacked the outside funds to buy or build capacity of their own, ergo had to enter into partnerships where each agreed to assist the other. The Nvidia / OpenAI deal isn’t the same as that - not least because it does involve actual cashflows - but has enough of an echo of that type of thing to sound an alarm.

What kind of an alarm - a “sell everything and run for the hills” alarm? No. Not for me. It’s an important marker that this particular phase of the AI buildout is reaching a peak. AI economics do not work at the moment, absent a constant flow of exogenous equity funding. Something in the technology - probably GPU design itself - needs to change in order to deflate the economics. (If NVDA made half the cashflow margins it does (because of competition let’s say) then that alone would free up some $44bn of customer cash balances in the last twelve months).

If you missed our note on Coreweave (which isn’t really about Coreweave, it’s about the cost and economics of AI), please take a moment to read it here.

As markets continue to climb I believe this Nvidia / OpenAI deal will have marked an important point; the beginning of the end of the climb to the top.

Now let’s get to work with our daily market analysis. Available every day to our Inner Circle members. We cover the S&P500, the Nasdaq-100, the Dow, tech, semiconductor, Ether, bonds, oil and volatility.