Market On Open, Wednesday 24 September

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Greenspan Moment

by Alex King, CEO, Cestrian Capital Research, Inc

Yesterday, Chairman Powell didn’t exactly say equity valuations were frothy, but he kind of implied it. Now, strictly speaking, equity valuations have nothing to do with the Fed - their mandate is inflation control and employment maximization - but since as every fule kno the primary determinant of risk asset prices is “how much money can I get ahold of, and how much will it cost me to borrow it” - true for houses, stocks, bonds, everything - then in fact the Fed is as close a thing as you will find to a single point of control in the equities market.

Stocks promptly sold off by a tiny fraction of the amount they have run up in the last few weeks; futures are in the green at the time of writing; probably Mr. Powell’s comments won’t trigger the next bear.

Know what will trigger the next bear? That there are no more buyers. When will that happen? When all the money that is thinking about buying gives up and says, whatever, in for a penny in for a pound, and YOLOs their way into short dated call options on this week’s zero-revenue hot stock. And then when the selling starts, late-levered-longs will panic and sell hard and tell themselves they’ll never dabble with stocks again. Which they won’t. Until the next frothy market.

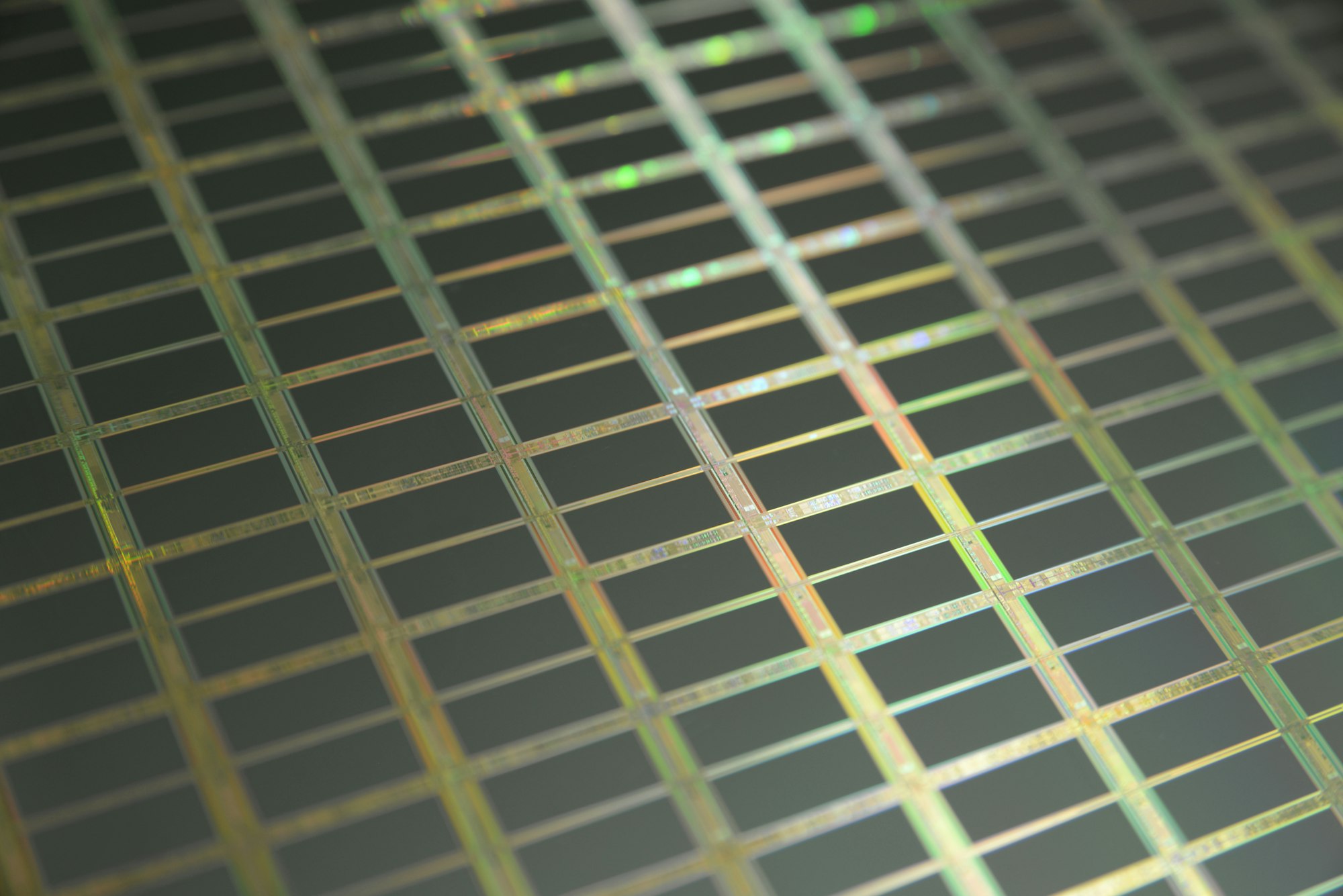

I don’t think we’re at the top yet, but there are signs, as I mentioned yesterday re. the circular flow of cash between Nvidia, OpenAI, Oracle, Microsoft and others. I would suggest you also read our earnings note on Micron published yesterday, here.

Now let’s get to work with our daily market analysis. Available every day to our Inner Circle members. We cover the S&P500, the Nasdaq-100, the Dow, tech, semiconductor, Ether, bonds, oil and volatility.