NO PAYWALL VERSION: Market On Open, Friday 24 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Carry On Regardless

by Alex King, CEO, Cestrian Capital Research, Inc

The White House yesterday announced a Presidential speech at 3pm Eastern; many market participants duly waited for the event before deciding upon a direction. What was interesting about yesterday is that although the topic in question - narcoterrorism - wasn’t directly market-sensitive, the Administration’s subsequent change of tack on Canadian trade negotiations is something that in recent months would have caused a setback in equity futures overnight (the announcement suspending talks came after the NYSE close). Not so, it seems. I wonder if this marks a change in market behavior; all year we’ve seen the market react abruptly to potential policy, as if the initial machinations were likely to harden into actual policy. Liberation Day being the best example of this. Beneath the surface I suspect that order book chaos monkeys are just having a ball by amplifying investor anxiety around such events, using that to ramp up event volatility; what’s more, I think that the retail cohort has cottoned onto this faster than institutions, which I believe is why retail has continued to buy any dip all year (whereas institutional appetite has been more muted).

Anyway. Enough musing. Time for our daily market note, which for our Inner Circle subscribers covers yields, bonds, equities, volatility, oil, crypto, and key sectors.

This is the truncated no-paywall version, which covers the S&P500, Nasdaq-100, and today includes bonds, gold, Bitcoin, and Ether too.

If you’d like the full version in your inbox each day, join our Inner Circle service. You can learn all about it here.

Longer-Term Treasury Bonds (TLT / TMF)

Still holding over the 8-day for now, but if you are trading this short term, beware of a selldown.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Gold

Still holding over the 21-day; a breach to the downside is an opportunity to go short I think.

Disclosure: No position in gold.

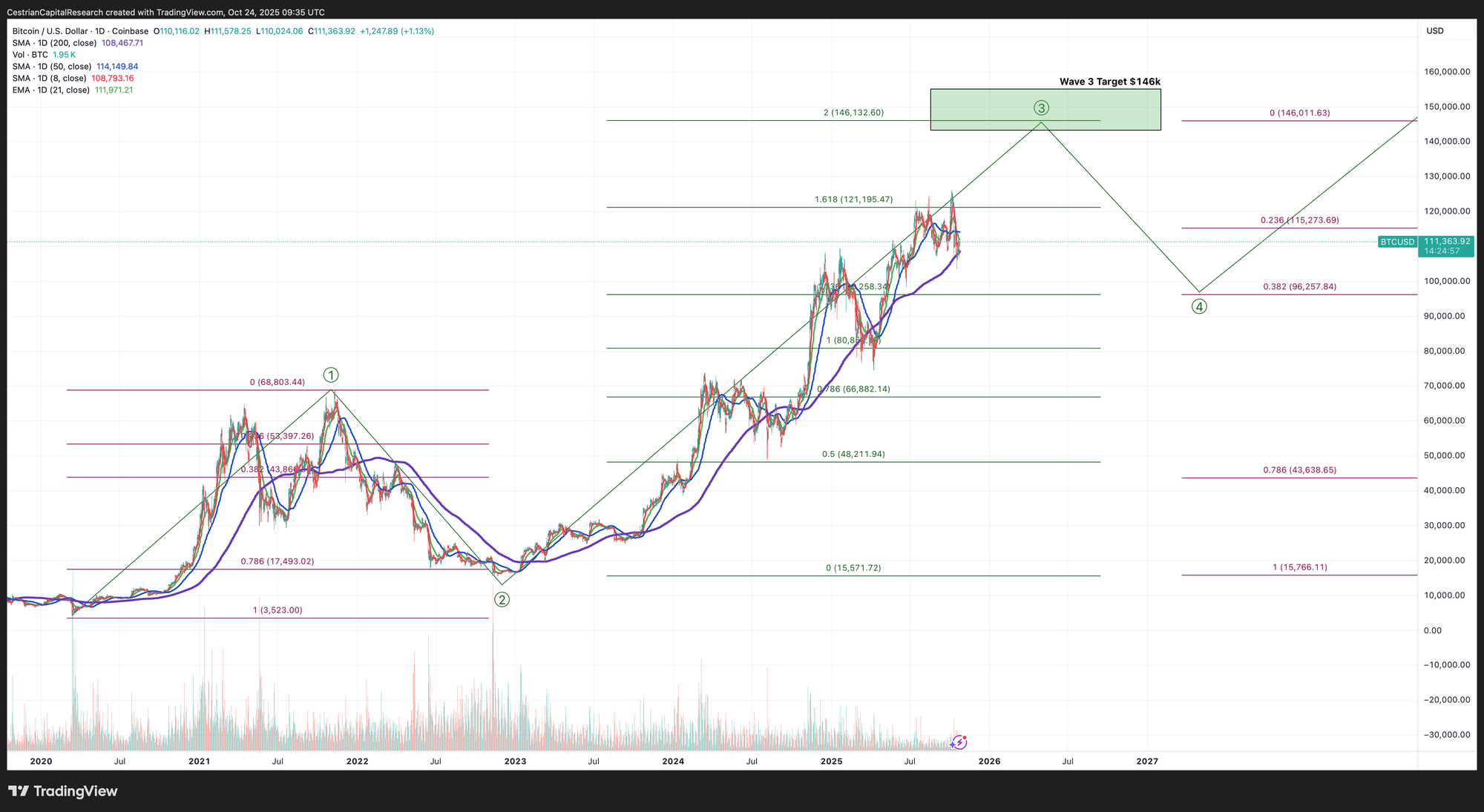

Bitcoin

Price target $146k.

Disclosure: I am long $IBIT.

Ether

Key level now is $4050, that’s the 21-day EMA - over that, another bullish step.

Disclosure - Long $ETHA and others in the Ether complex.

S&P500 / SPY / UPRO

Continues to march upwards.

Must break $676 and turn it into support; if not, our Wave 3 high is in and we can expect a correction.

Disclosure: I am long $SPY, long $IUSA, and long puts for December expiry ie. net long the S&P.

Nasdaq-100 / QQQ / TQQQ

Bullish into year end is my guess.

Must break up and over $612 and turn it into support to keep pushing up. It’s over that level in pre-market trading today but daily closes are what matter.

Disclosure: I am hedged 1.5:1 $TQQQ:$SQQQ, unhedged long $QQQ, have $QQQ calls for December expiry and have $TQQQ and $QQQ puts for December expiry. Overall net long the Nasdaq.

Alex King, Cestrian Capital Research, Inc - 24 October 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, SOXL, SOXS, IUSA, SPY, QQQ, TLT, DTLA, ETHA, IBIT; long December TQQQ, QQQ and SPY puts; long December QQQ calls.