Palantir Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Dare You Catch The Tiger By Its Tail?

by Alex King, CEO, Cestrian Capital Research, Inc

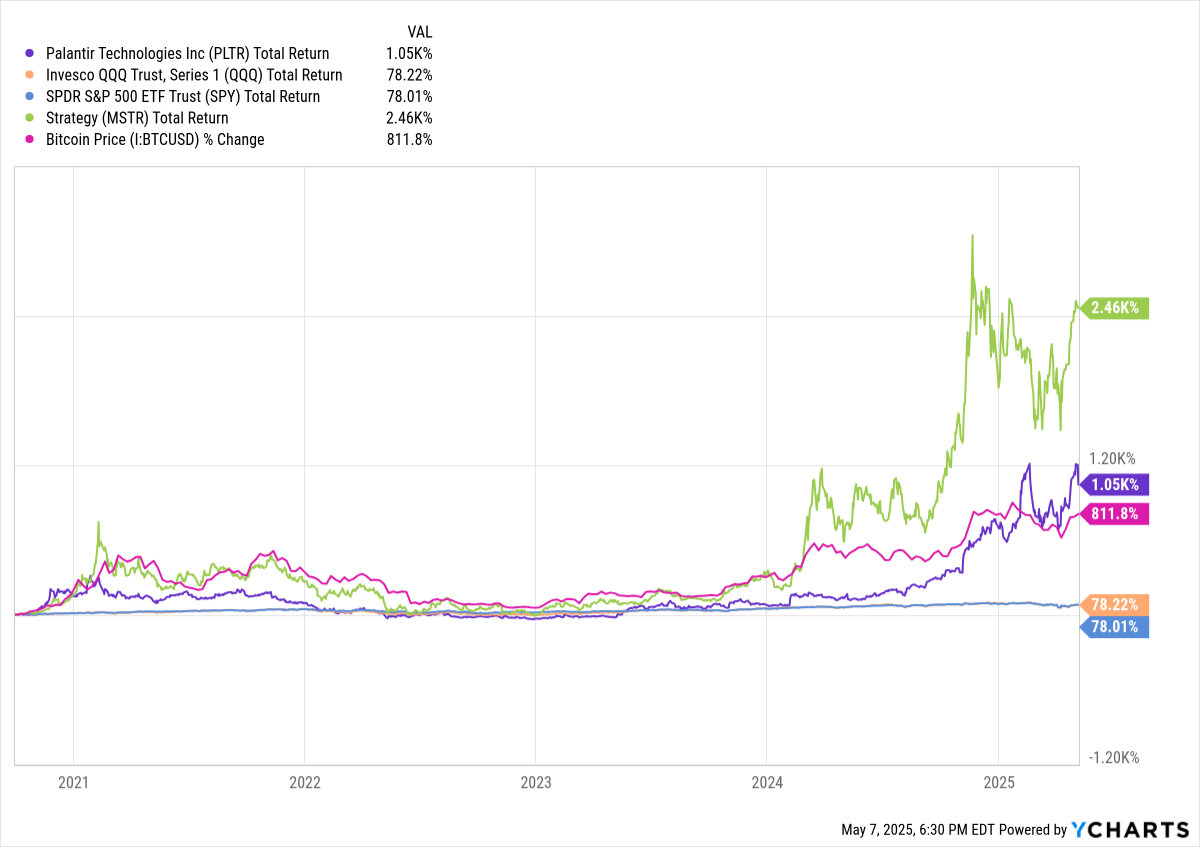

Palantir stock has been a tremendous success story since its direct-listing entry to public markets. After a slow and volatile start, capped by repeated insider selling in size (which was the reason for the direct-listing rather than a conventional underwritten, insiders-locked-up IPO, of course), from Q1 2024 the stock has just mooned. It has crushed the S&P, the Nasdaq, even humbled Bitcoin. You have to find something as crazy as Strategy ($MSTR) to outperform $PLTR.

Both the fundamentals and the stock have benefitted from association with the new US Administration. Peter Thiel was a co-founder of Palantir in the early 2000s, and since the Thiel diaspora are well represented in the current Administration it is no surprise to see actual business between the US Government and Palantir on the up. That should not be a surprise - this is how business works and it’s how government works, and how it has always worked. That the company is known to be close to the Administration has benefitted the valuation multiples assigned to the stock, or to be more accurate, has ramped demand for the stock ergo dragged up valuation multiples en route.

Personally I sold out of PLTR a long time ago - incorrectly as it turned out! - because the insider selling kept putting a lid on the price. Since when the stock has gone more or less vertical; dumped hard on the Liberation Day shock like most all high beta names - and has since more or less doubled, at least until the earnings print this week.

I salute anyone who knows how to play PLTR at these levels. It’s too hard work to sell short, because it’s embedded in government; and for me it is too hard to buy long, because the valuation is at extreme highs and because the Liberation Day banana skin tells you that the name can drop hard in a crisis.

The stock, and the company’s CEO, are in full-on hubris mode.

Hubris in a company and a stock can last a long time, which is why I think it is a brave investor that shorts Palantir right now. But in the end, hubris ends in ignominy, and I don’t doubt that will be true one way or another for $PLTR.

Let’s get into the detail in a moment. For now, the headlines.

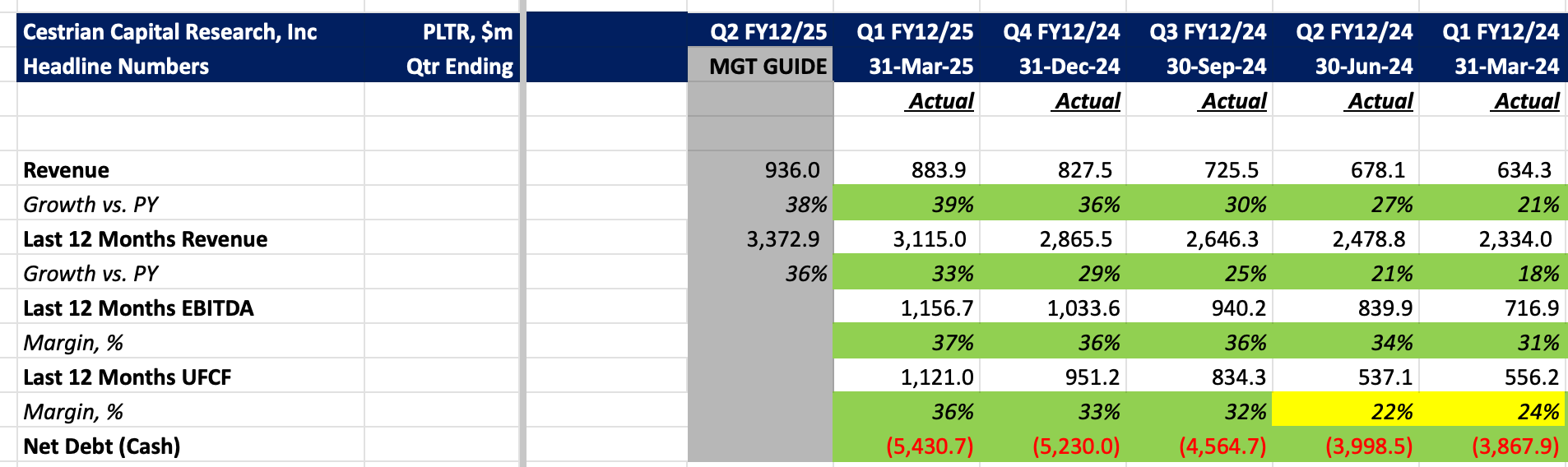

Superb numbers, as simple as that. Accelerating growth, rising margins, rising cash, no debt. Guide for a modest slowdown but let’s assume that too is crushed!

Next - valuation, full financials, our stock chart and rating.