The Trade Desk Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Back Once Again

by Alex King, CEO, Cestrian Capital Research, Inc.

Not Dead Yet, is the health status we can apply to $TTD, the doom of which was widely foretold by, oh, all market participants just one quarter ago.

Things didn’t improve in March, and the stock was not Liberated in April. So the stakes were high coming into earnings yesterday.

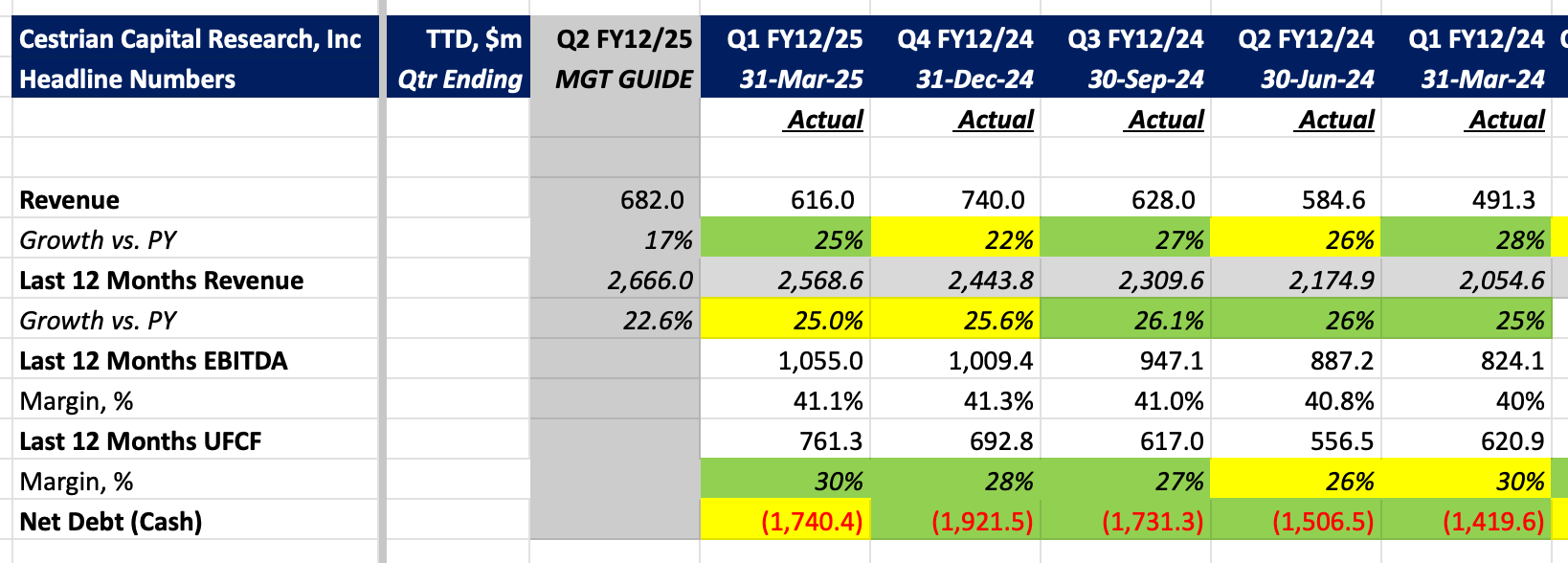

Now, if you look at the earnings reaction (stock up some 20% on the day at one point) you could be forgiven for thinking that, wow, everything must look wonderful. And the funny thing is, everything looks, well, fine. Business as usual. Chopping wood. But it doesn’t look wonderful, nothing transformational, and oh by the way capex spiked like it was going out of fashion. So I think we can attribute the moonage in the stock price (relative to the last few weeks at any rate! - the stock is still a country mile below its ATH) to two things. One, short covering. I am not sure why anyone would be heavily short TTD at these levels, but plenty probably were. And two, the general “Buy Everything!” sentiment that was running wild yesterday.

Anyway, numbers fine, stock chart pointing up, all good, Not Dead Yet. And incidentally if an adtech company is growing revenues at 25% pa. in Q1 there probably isn’t a recession as of the end of Q1.

Let's get into the detail.