Market On Open, Friday 9 May

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Real Deal

by Alex King, CEO, Cestrian Capital Research, Inc

How do you know if we’re in a bull or a bear market? Easy. Like this.

The current trade policy cul-de-sac is a thing because, as everyone knows, the US runs a trade deficit with everyone else, and (in the Administration’s worldview) the dollars received by the US for this are inadequate compensation, and so import tariffs for goods coming into the US are needed in addition to a liberalization of goods exported from the US to third party countries. The market has gotten all concerned about the impact of this and so stepwise resolution of this should fuel an upward move in markets. Right? OK.

Well, yesterday the US and the UK agreed a trade deal; the US runs a trade surplus already with the UK, so none of the above applies. And yet the market mooned for a little while on the news (and on the exhortation of POTUS to Buy, Baby, Buy). It’s almost as if - the market was going to go up anyway!

The technical pattern in the S&P500 now is, to my mind, that the market will gun for new all time highs. It may not make it; it may get rejected once again at the February high; I don’t know. But if you ignore the April Wick Of Doom then you have a typical correction during March, a flattish digestion month in April (open to close on the month) and the start of a move up in May.

Let’s get into it.

Short- And Medium-Term Market Analysis

US 10-Year Yield

Behaving well technically I would say. Looks like a drop is due.

Equity Volatility

Vix 22 is what ‘calm’ looks like these days.

Disclosure: No position in volatility-linked securities.

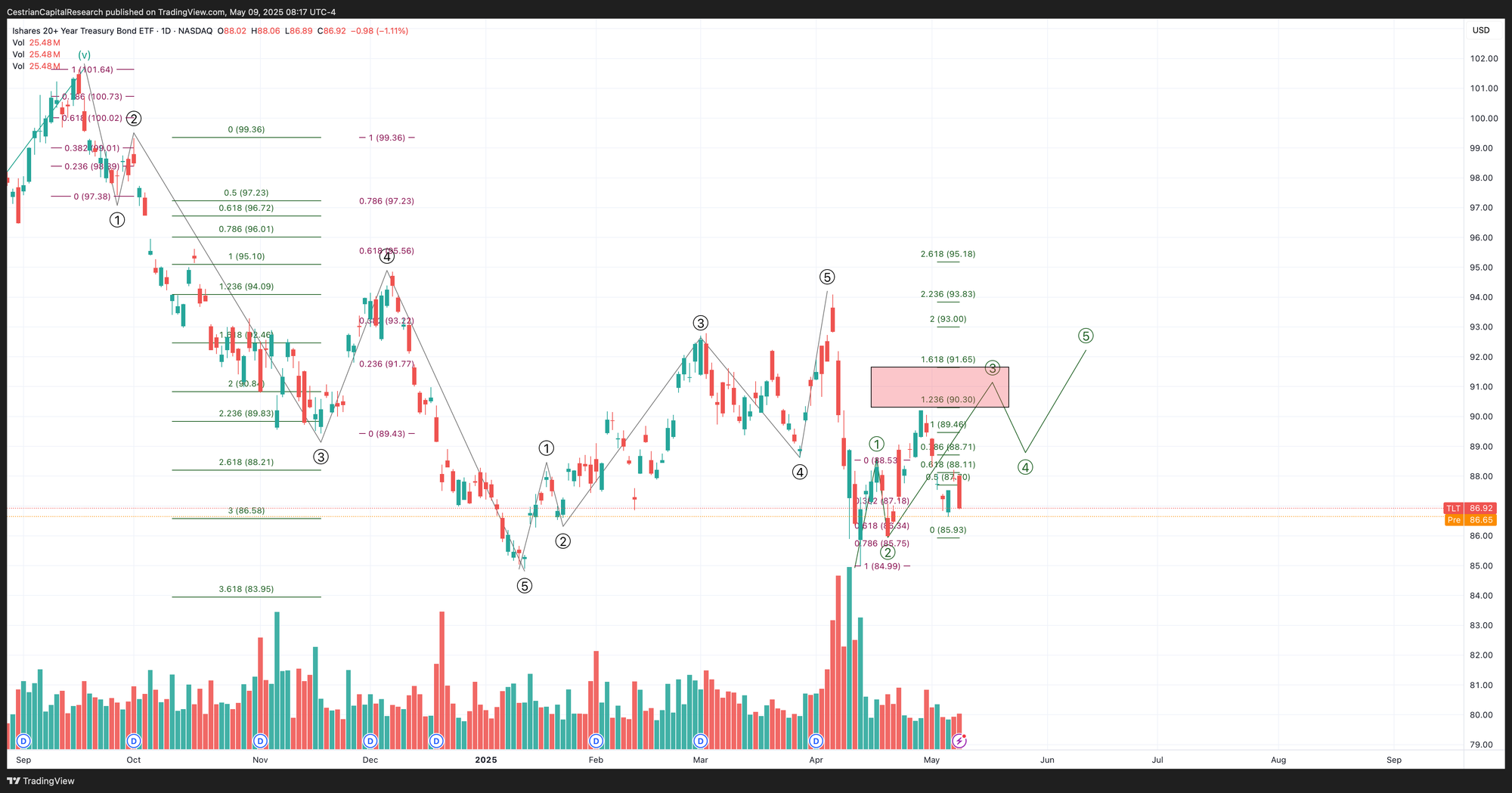

Longer-Term Treasury Bonds (TLT / TMF)

The big volume down here persists.

Still has the look of climbing the ladder to me.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Bitcoin

In great shape for the next 1-2yrs I would say, with de-dollarization and increasing regulation of BTC as fundamental drivers. Crypto bros may lose their minds about the latter but it will attract more investors.

Disclosure - no position in Bitcoin.

Oil (USO / WTI / UCO)

If no recession then more oil demand.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am unhedged long $USO.

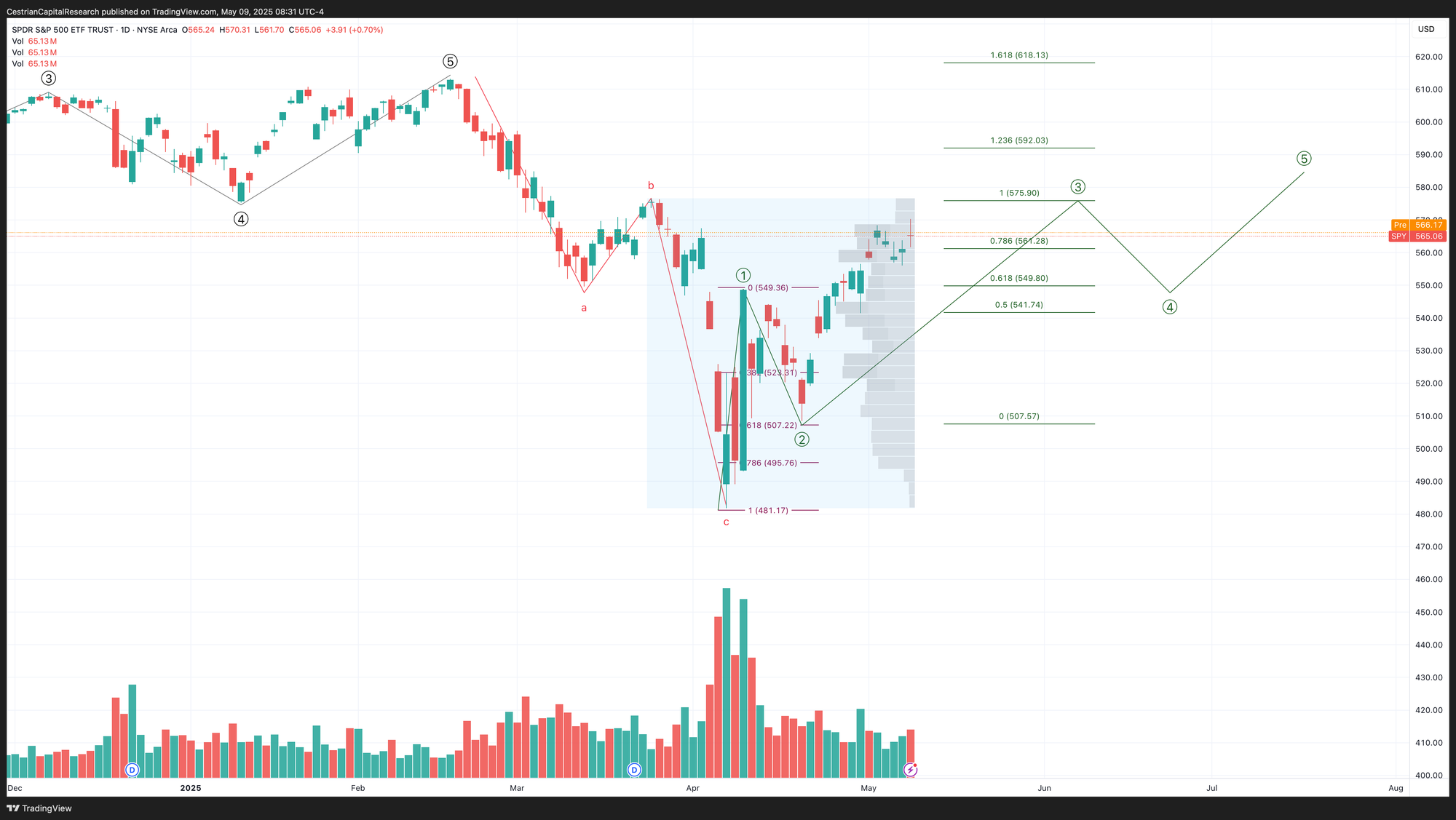

S&P500 / SPY / ES / UPRO

$575 may prove resistance on the SPY.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Over the 50-day, for now.

Disclosure: I am unhedged long $UPRO.

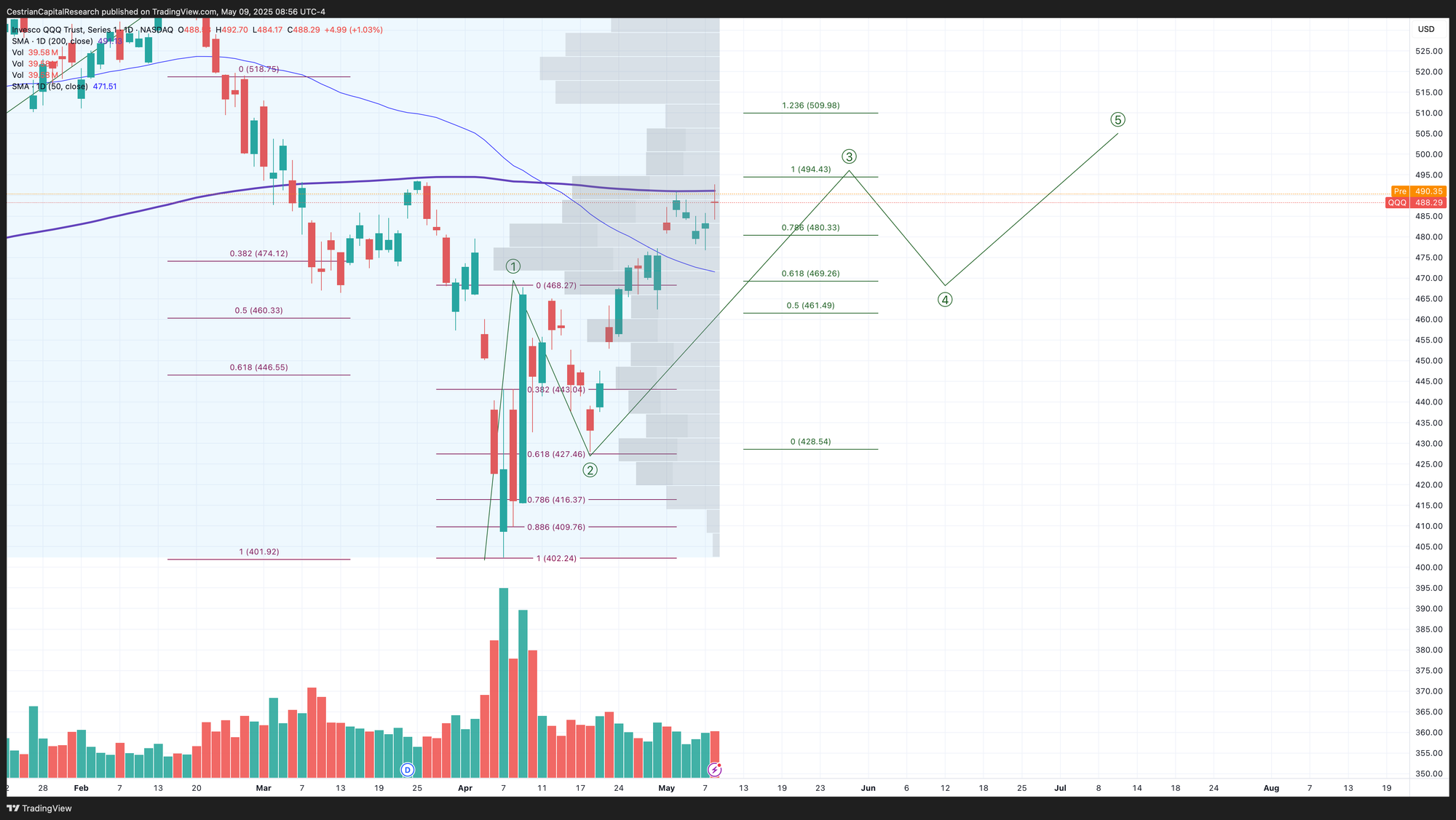

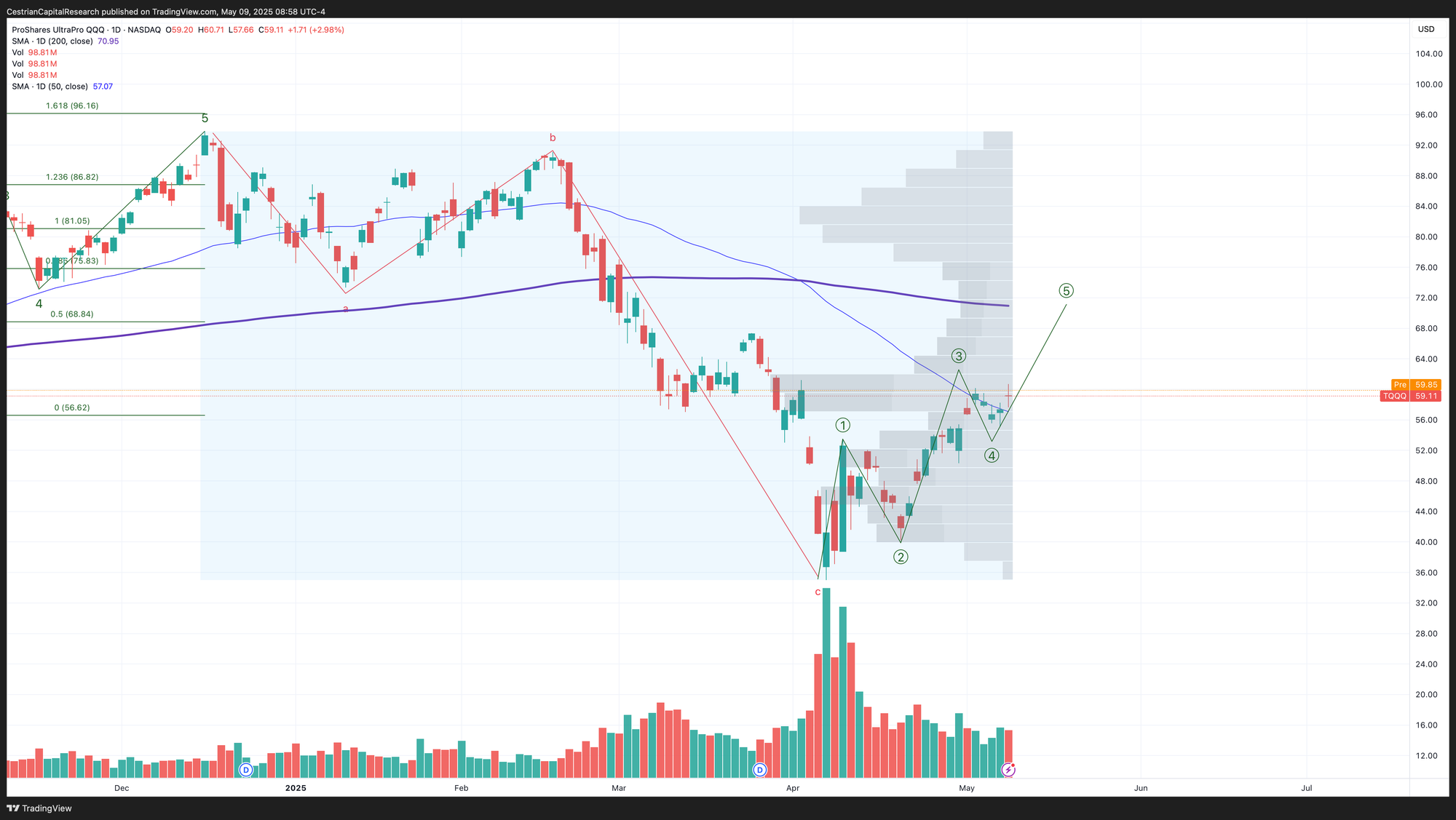

Nasdaq-100 / QQQ / NQ / TQQQ

Now approaching the top of the localized high volume zone - we may see some resistance here.

Just a little higher and QQQ will be over the 200-day, and if it holds at those levels that changes the tenor of the market.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

The hammering provided by the daily leverage on the way down means that TQQQ is barely over its 50-day even when the QQQ is almost back at the 200.

Reasons why if you are going to use TQQQ it is a good idea to learn to hedge with SQQQ!

Disclosure: I am unhedged long $TQQQ.

Dow Jones / DIA / YM / UDOW

Well, no-one was selling the Dow lows it seems!

Held over the 50-day yesterday - Step 5 of the 12-step recovery.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same comments as to leverage re. TQQQ.

Disclosure: No position in the Dow.

Sector ETFs

When POTUS issued the Buy call yesterday … the smart money had already acted on his earlier April Buy call.

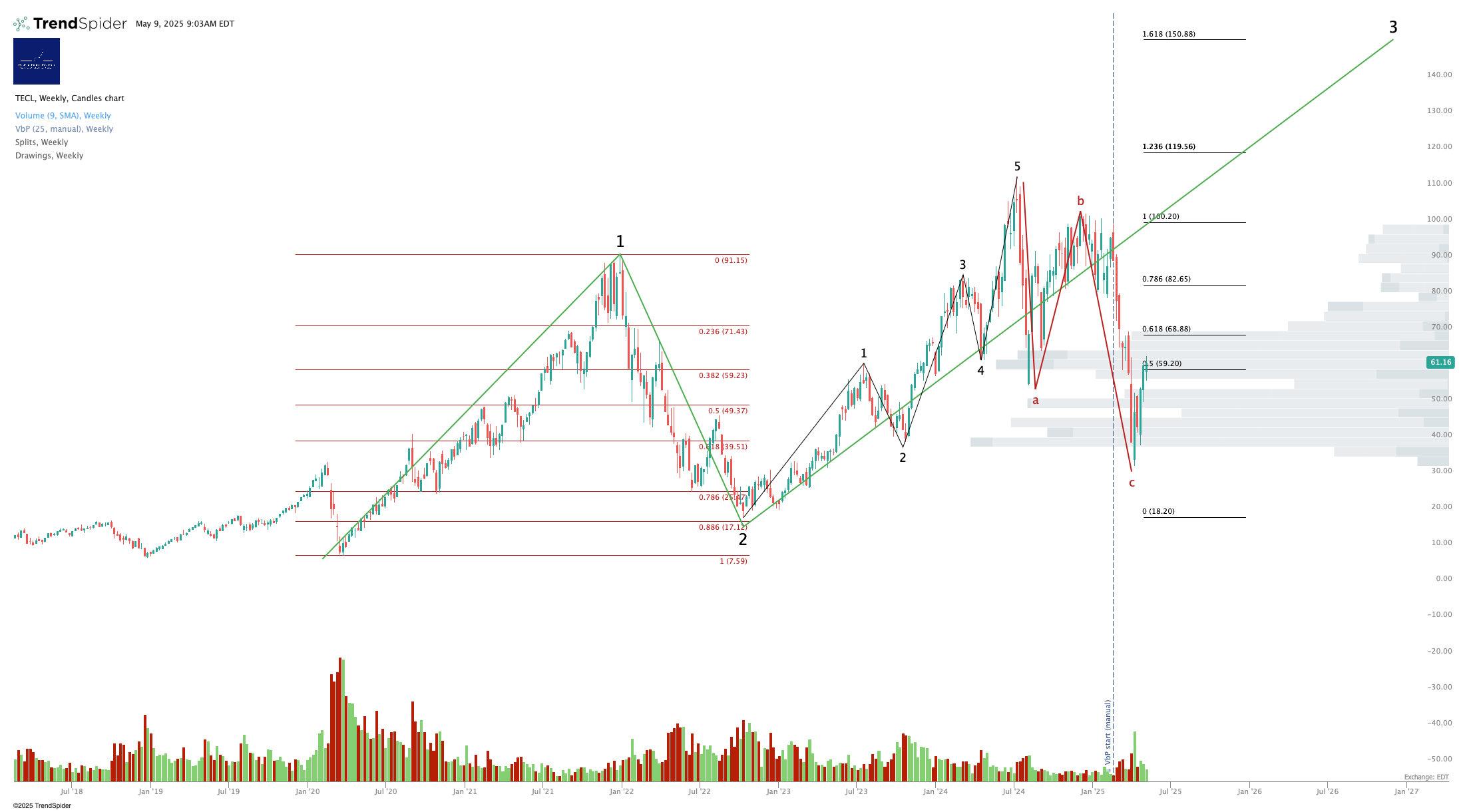

3x Levered Long XLK (Tech) - TECL

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Ditto for TECL.

Disclosure: No position in TECL or TECS

Semiconductor

This is why the market is crazy all the time, and it’s not because of trade policy. It's because of leverage.

Look - no major buying of SOXX at the lows. But (see below) major accumulation of SOXL at those same lows. Degeneracy incarnate!

3x Levered Long SOXX (Semiconductor) - SOXL

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am unhedged long $SOXL

Alex King, Cestrian Capital Research, Inc - 9 May 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, UPRO, IUSA, SOXL, TLT, USO, DTLA.