The Machines Win Again - SignalFlow AI Performance Updates

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Embrace The Future. Don’t Fight It.

The SignalFlow AI family of standalone algorithmic signal services we provide is doing great. The family now includes three equity services:

- SignalFlow AI Long-Only S&P500

- SignalFlow AI Long/Short S&P500 + Nasdaq-100

- SignalFlow AI Growth

Briefly, here’s what each of these services provide, and an update on their performance.

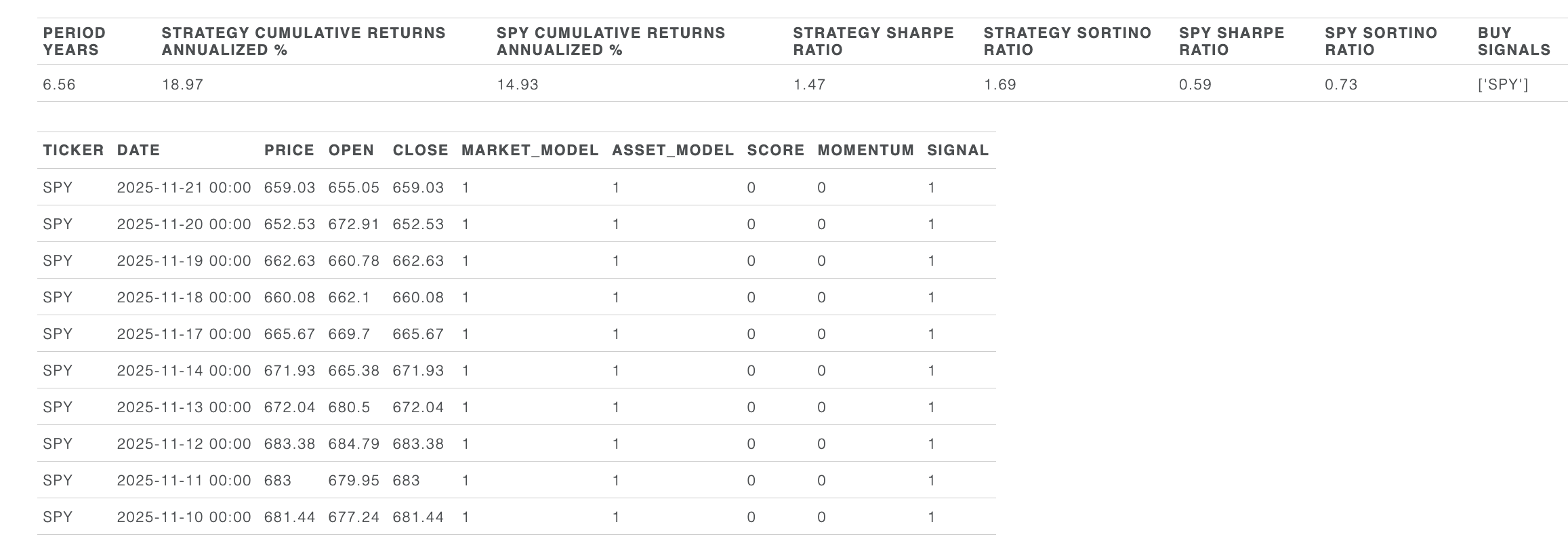

SignalFlow AI Long-Only S&P500

The simplest of the family. The goal of this service is to move capital out of harm’s way when the model thinks the S&P500 is going to enter a material drawdown. The model tries to avoid drawdowns in order to beat buy & hold. So far, it is succeeding.

Live trading began on 17 October 2024; before then the data is backtesting.

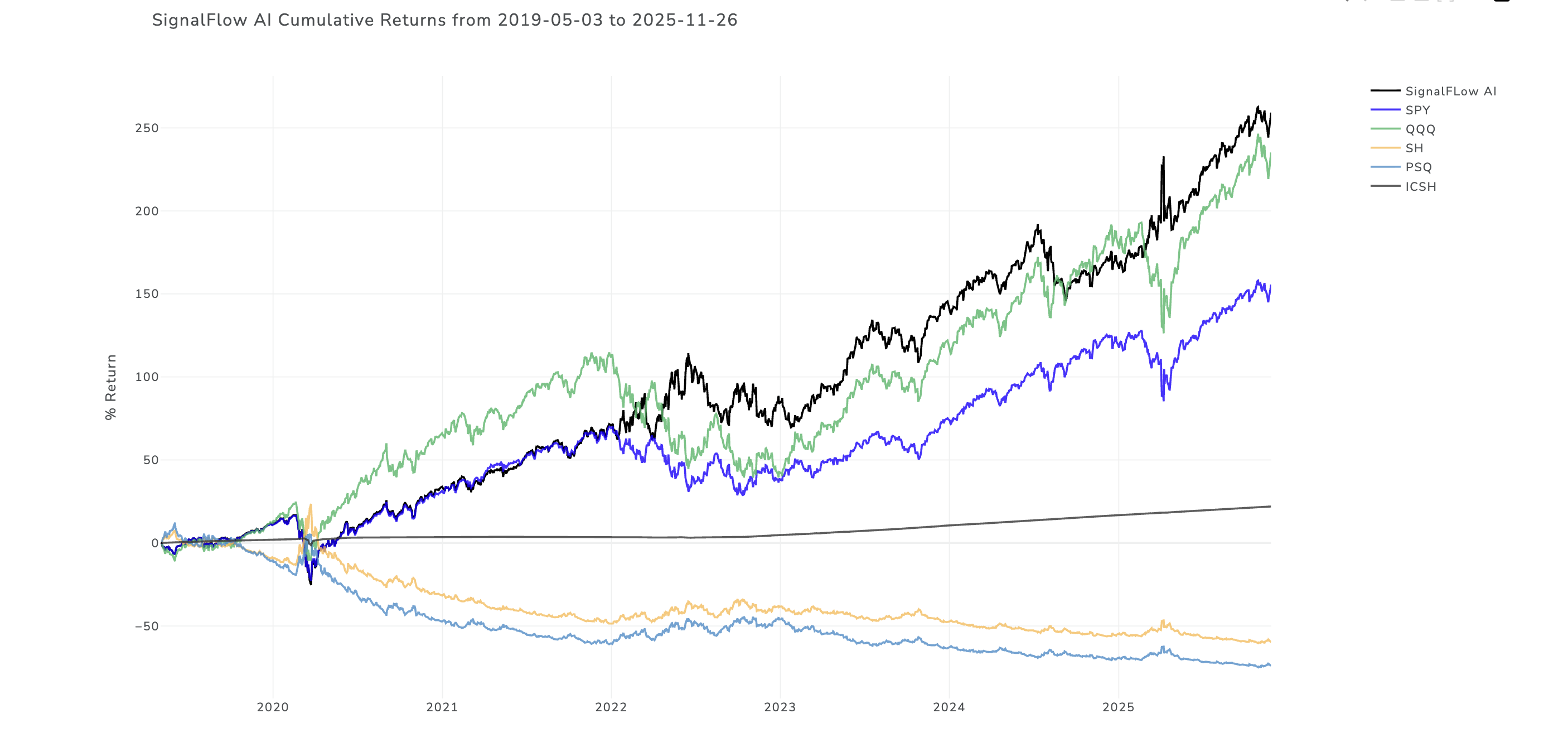

SignalFlow AI Long/Short S&P500 + Nasdaq-100

The goal of this model is to provide market-neutral investing. This strategy is intended to deliver positive returns whether the market is going up or down. The model chooses between long SPY, long QQQ, cash, long SH (1x short SPY) and long PSQ (1x short QQQ) ETFs. As with all the SignalFlow models it prints a signal once per day, just after the close, and it assumes the relevant trade is placed at the following New York open.

Live trading began on 2 April 2025; the data before then is backtesting.

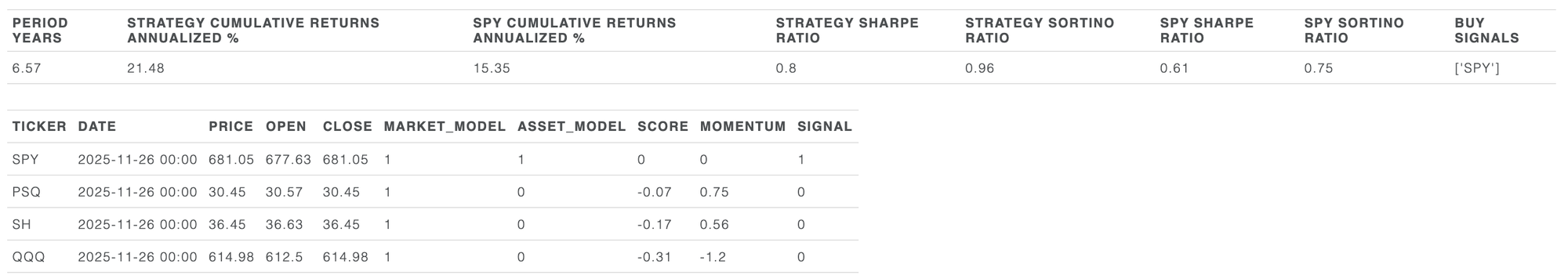

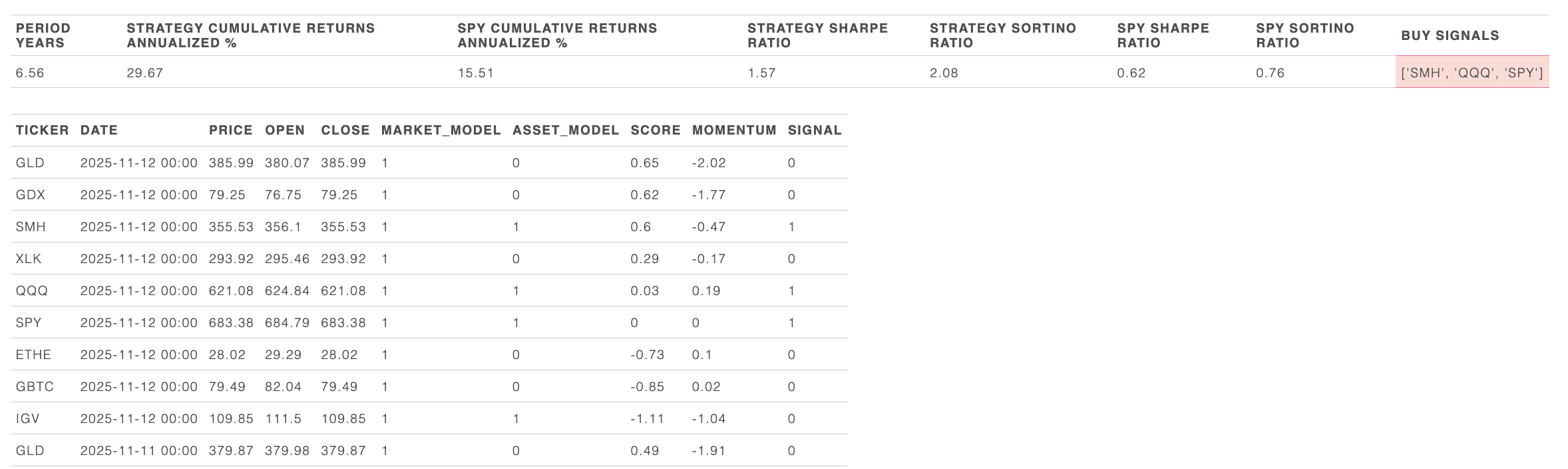

SignalFlow AI Growth

This is a sector rotation model designed to accelerate returns vs. the S&P500 when the model believes the S&P is in a “risk-on” state. The model selects from a list of sector ETFs and, again, prints a signal just after the New York close each day with the expectation that the consequent trades are placed at the following New York open.

The strategy has returned cumulative annualized gains of 29.9% in the last 6.5 yrs, vs a little over half that achieved by buying & holding the S&P500.

Live trading commenced on May 20th, 2025; data before that is backtesting.

Use The Machine.

Personally I use each of these SignalFlow AI services religiously. I allocate a pool of capital to each of them and follow the trades precisely. This is working great for me.

It involves reading brief notes after the close each trading day, delivered in our enterprise-grade Slack environment, so available on your phone and computer alike, and then setting any trades to execute either at the New York open the next day or (if I choose to do so) right away, in post-market trading hours.

We also operate a discussion channel in Slack so if as a subscriber you have any questions or comments about the services, you can reach myself and/or Prof. Jay Urbain, Ph.D (the models’ author), anytime.

This is low stress and, so far, high performance. The future can be different from the past, of course, but so far - what’s not to like?

Because, why try to beat the machines, when you can use the machines to beat your fellow humans?

You can choose your SignalFlow AI service here.

Alex King, CEO, Cestrian Capital Research, Inc - 26 November 2025.