Upgraded SignalFlow AI Long/Short Service

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

A Fair- And Foul-Weather Friend

by Alex King, CEO, Cestrian Capital Research, Inc

Jay and I designed the SignalFlow AI Long/Short service (this) as a way to use machine learning to try to make money using index ETFs in bull and bear markets alike. Elsewhere in the SignalFlow series of algorithmic services we have strategies for growth, sector rotation, bonds, and global equities, all of which offer multiple ways to trade successfully and which are capable of performing well in any market. But we wanted a service that could deliver profitable signals even in a simple, everything-just-keeps-selling-off bear market, whether a few months’ correction as in 2022, or a long-drawn-out bear lasting years.

The original idea was to rotate through four ETFs, being SPY (long S&P500), SH (short S&P500), QQQ (long Nasdaq) or PSQ (short Nasdaq), or cash. Backtesting over six years or so, and live trading since early 2025, produced pretty good results.

As you can see, it has over the timeframes in this table outperformed buy & hold SPY nicely, and the model’s returns vs. SPY have also been somewhat less volatile (strategy 6yr Sharpe and Sortino ratios of 0.97 and 1.27 respectively, vs 0.6 and 0.7 for buy & hold SPY).

In the first few trading weeks of 2026 however, the sideways chop that has characterized the equity indices - both the S&P and the Nasdaq - has been troublesome for this strategy. The chop has meant that the algo has switched position often, flipping long/short, short/long, and incurring performance drag along the way. We assume that if the market picks a direction soon, the algo performance will return to something more like the table above, but right now it has underperformed simply buying and holding SPY since the start of 2026.

Since no-one can know the future, and since sideways chop can continue for a year, more, we wanted to refresh this service to better account for this type of market environment. We know that the underlying SignalFlow AI model is good at latching on to trends and holding them longer than most human nerves could themselves stand - hence the superb performance of the Growth service in gold and semiconductor in the last 9 months or so, and the Sector Rotation service in metals and defense over the last year - but this chop has proven troublesome in Long/Short.

After running extensive simulations and backtests, trying to optimize returns and the volatility of those returns - and also the number of trades - in directional and directionless markets alike, we have settled on a new strategy that we think is preferable. The long-run backtest returns are slightly lower than the original strategy but the returns under choppy conditions are much better - and crucially the volatility of returns is lower (meaning less headaches and/or more suitability for running a levered strategy) and the number of trades over any given month is also fewer.

This is how the new SignalFlow AI Long/Short works:

- As before, the signal prints daily just after the close. The model assumes that the implied trade is placed at the following open but it is possible for these trades to be placed in post-market hours, because the strategy uses only large, liquid ETFs that can handle sizable capital allocations even outside regular trading hours.

- The model chooses one of three orientations each time it prints a signal. They are (i) Long, (ii) Short or (iiii) Cash.

- If (i) Long, the model proposes “2 x $SPY”; if (ii) Short, the model proposes “1 x $SH, 1 x $ICSH [this can be implemented literally or simply as 1x $SH and 1x cash, according to user preference]; if (iii) Cash, the model proposes 2 x $ICSH [again, can be implemented as 2x cash].

How would this be traded in reality? For anyone trading this mechanically, they would start with 2 units of capital, defined as “the total capital allocated to this strategy”. If the first signal was long, both units would be deployed into $SPY. If the second signal was cash, all of $SPY would be sold and held in $ICSH or cash. If the third signal was short, the capital held in $ICSH or cash would be divided in two; one half used to buy $SH and one remaining in $ICSH or cash. And so on.

Don’t forget that every subscription to a SignalFlow AI service comes with membership of the SignalFlow Discussion Channel, so if anything is ever unclear about what a signal means or how to interpret it, you can reach Jay, myself or members of the wonderful Cestrian member community in that channel.

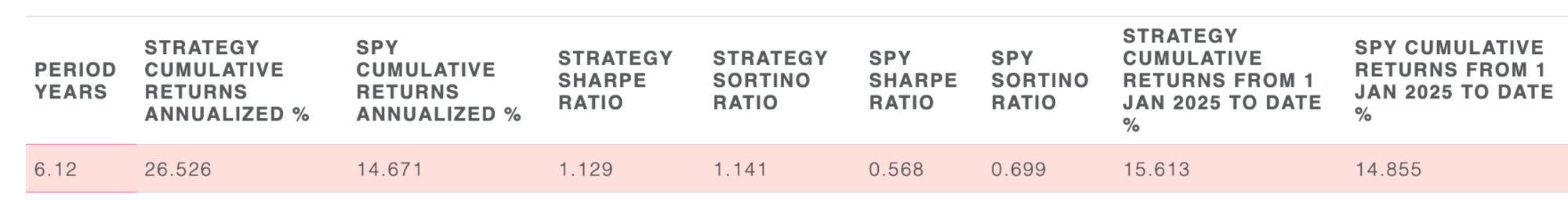

Now, here’s how the backtested returns look like for this strategy.

Slightly better 6-yr backtested returns than the original method; much improved volatility scores (Sharpe and Sortino ratios of 1.13 and 1.14 respectively, vs. prior 0.97 and 1.27 - specifically the Sharpe ratio of >1 means this is a safer strategy to run with leverage than previously); but slightly blunted returns in the period from 1 Jan 2025 to date. This strategy still outperforms buy and hold SPY since 1 Jan 2025 (and since 1 Jan 2026) of course. In addition, the number of trades the model has placed in backtesting is reduced by more than half over the 6-year modeled period.

Again, the point of this service is: provide a mechanized way to try to achieve positive returns in bull and bear markets alike. We’re confident that can remain the case, and we believe the negative impact of market chop will be much improved with this approach.

If you’re already a SignalFlow AI Long/Short subscriber, you’ll see the new strategy live as of the signal printed after the close on Tuesday 17 February.

If you’d like to sign up for SignalFlow AI Long/Short, you can do so here.

Any questions, hit me or Jay up in Slack Chat (SignalFlow and/or Inner Circle subscribers) or in comments to this note.

Cestrian Capital Research, Inc - 16 Feb 2026