Airbnb (ABNB) – Q1 FY12/2025 Earnings Review

- Airbnb ($ABNB) revenue growth continues to slow while margins hold steady.

- With its May 13 update, Airbnb is at a critical juncture; this business pivot could drive revenue growth over time.

- Strong balance sheet with $9.5 billion in cash and no long-term debt.

- Read on for detailed financials, technical analysis and our rating.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Next Chapter Begins

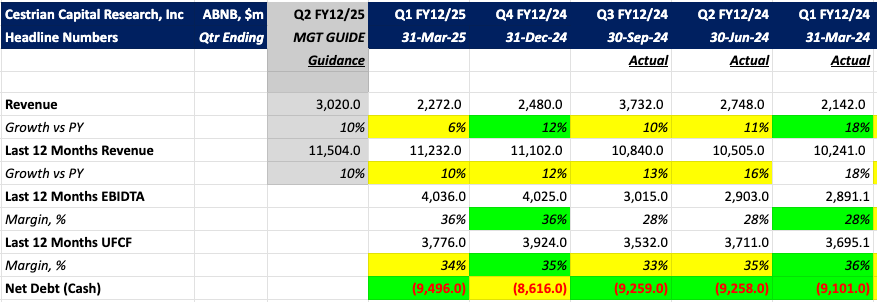

Airbnb ($ABNB) delivered a fair start to 2025. Q1 FY12/25 revenue grew by 6% year-over-year (Y/Y), with the TTM free cash flow margin falling by 100 basis points. The balance sheet is rock solid, with $9.5 billion in cash and no long-term debt.

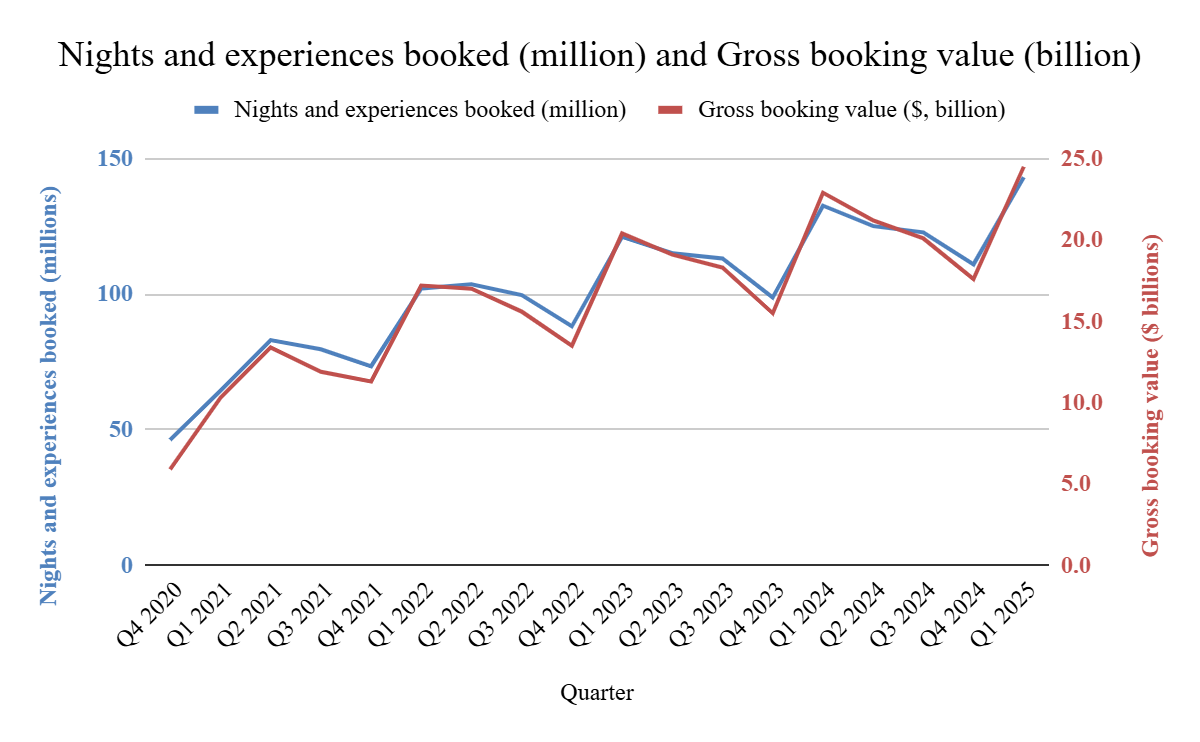

Non-GAAP metrics relevant to the online travel platform business—Nights & Experiences Booked (143.1 million) and Gross Booking Value (nearly $25 billion)—expanded in the high single digits year-over-year.

Expansion Beyond Core Services

With its summer release on May 13, Airbnb launched new businesses—offerings beyond its core home rentals. You can learn more about it here. Management had been laying the groundwork for this strategic pivot for some time by strengthening its core rental product and rebuilding its app on a new tech stack. These new offerings are expected to scale in upcoming quarters and have the potential to drive future revenue growth.

Whether Airbnb will be able to capture more of the travel wallet remains to be seen in the mid- to long-term. However, this expansion into multiple travel verticals might not significantly impact revenue growth in the near term. A $200–$250 million front-loaded investment in 2025 for these new businesses may reduce margins in H2 2025.

Impact of Macro Uncertainty

Globally, Nights & Experiences Booked grew by 8% Y/Y. North America accounts for about 30% of total Nights & Experiences Booked, with the bulk of that driven by the U.S. market, which saw only low single-digit growth. This points to softness in international inbound travel to the US. If macro uncertainty persists, it could become a drag on Airbnb’s overall financial performance.

However, Airbnb’s adaptable business model (born in the 2008 recession and proven through the 2020 COVID pandemic) and its strong balance sheet ($9.5 billion in cash) could help it weather a period of depressed travel demand in the US. Furthermore, if travel demand shifts geographically, Airbnb is well positioned to capture it.