Andy Jassy Is The Tooth Fairy

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Don’t Let It Be You

Mr. Buffett, when once asked to comment about the usefulness of EBITDA as a measure of earnings, was heard to opine “Who do you think pays for the capex? The tooth fairy?”.

In business, you never want to be the tooth fairy. You never want to pay for the capex. The smart move is to let someone else pay for the capex and then you stand on their shoulders and enjoy the monsoon of cashflow that will rain on your head on account of, you know, not having to pay for any capex.

In Ye Olden Dayes, by which I mean maybe pre 2015, capex in tech was primarily a telecom problem. If you ever wanted to own a telco - all of it or just a few shares in it - then your best plan was to wait for a generational network rollout to reach completion and then buy the thing. A very simple example of this is Iridium ($IRDM), the satcomm business. Buy the stock once the second-generation fleet was placed on orbit, sit back whilst the company goes from negative pre-tax free cashflows to very positive free cashflows, then start to pay dividends and play the leveraged-buyback game, and you could have ridden the thing from around $25 to around $65 in only three years or so, all the while sleeping very easily.

You see? Don’t be the tooth fairy.

Want to know who the tooth fairy is now? It’s the folks building the processing plant for other people to run high-margin AI services. First amongst equals, Amazon, who actually promoted their Head of Capex to be CEO. And it shows.

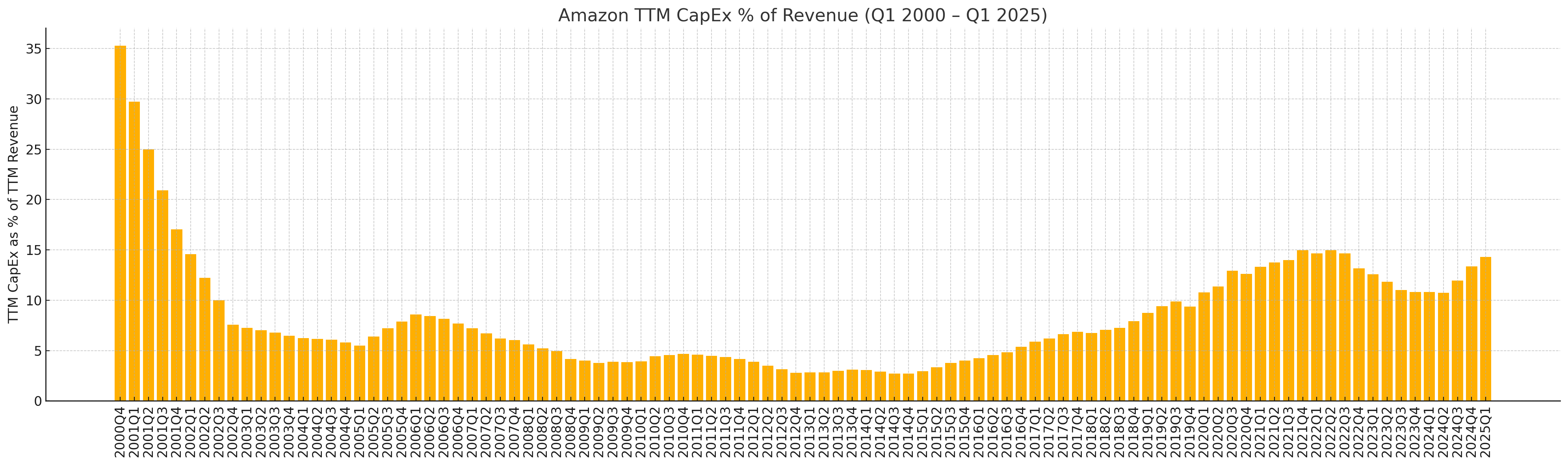

Here’s Amazon’s capex as a % of revenue according to our somewhat recalcitrant first year analyst, ChatGPT. (When I asked it to make this chart, it suggested that I make it myself. Like that.)

During antiquity, being the heady fin-de-siecle days you see on the left hand side of that chart, capex was a big % of revenue at Amazon because there wasn’t all that much revenue. Now, as you know, there is a lot-lot of revenue, so when you see capex ramping like it is, you know it’s a big number.

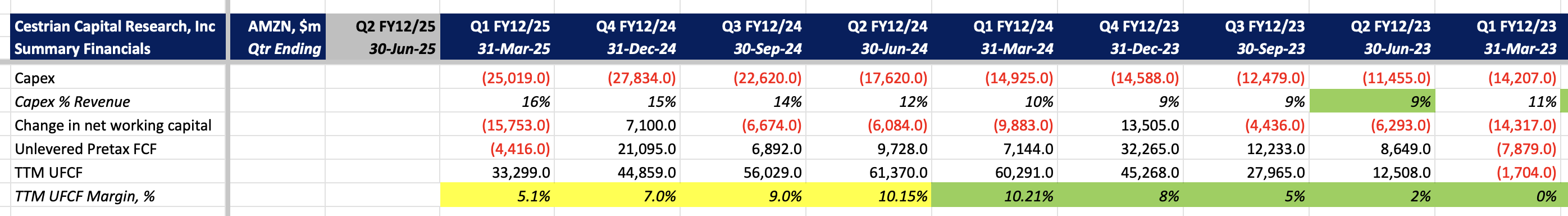

It’s such a big number that Amazon’s cashflow margins are taking a material hit.

Amazon has to spend this money; it’s the same arms race now in datacenter as it was in long-distance and last-mile fiber in the 1990s. It’s also the same build-it-and-they-will come psychology. Today, AI applications are woefully underserved by compute and telecom resources. It takes an age to get anything detailed done well by an LLM even if the robots do decide to do the work themselves. (Do Androids dream of electric union reps?). But tomorrow, we will have more resource than we do calls on that resource. And then after that we will be supply-constrained once more. This is the folly of human capital allocation, otherwise known as the business cycle, and it is as old as humanity itself.

What you cannot do though, if you are Mr. Jassy, is to say - you know what, let MSFT and META be the Tooth Fairies. I’ll just sit this one out. Because as a CEO today, if you do that, you’ll be sitting this one out for a lot longer, in fact you will wind up “spending more time with your family” as a result of your poor life choices.

So, the capex continues, no-one knows when it will lead to increased revenue growth rates or cashflow margins (both continue to decline at Amazon), all anyone knows that if you cut back on the capex, your growth will slow and your stock will be hit.

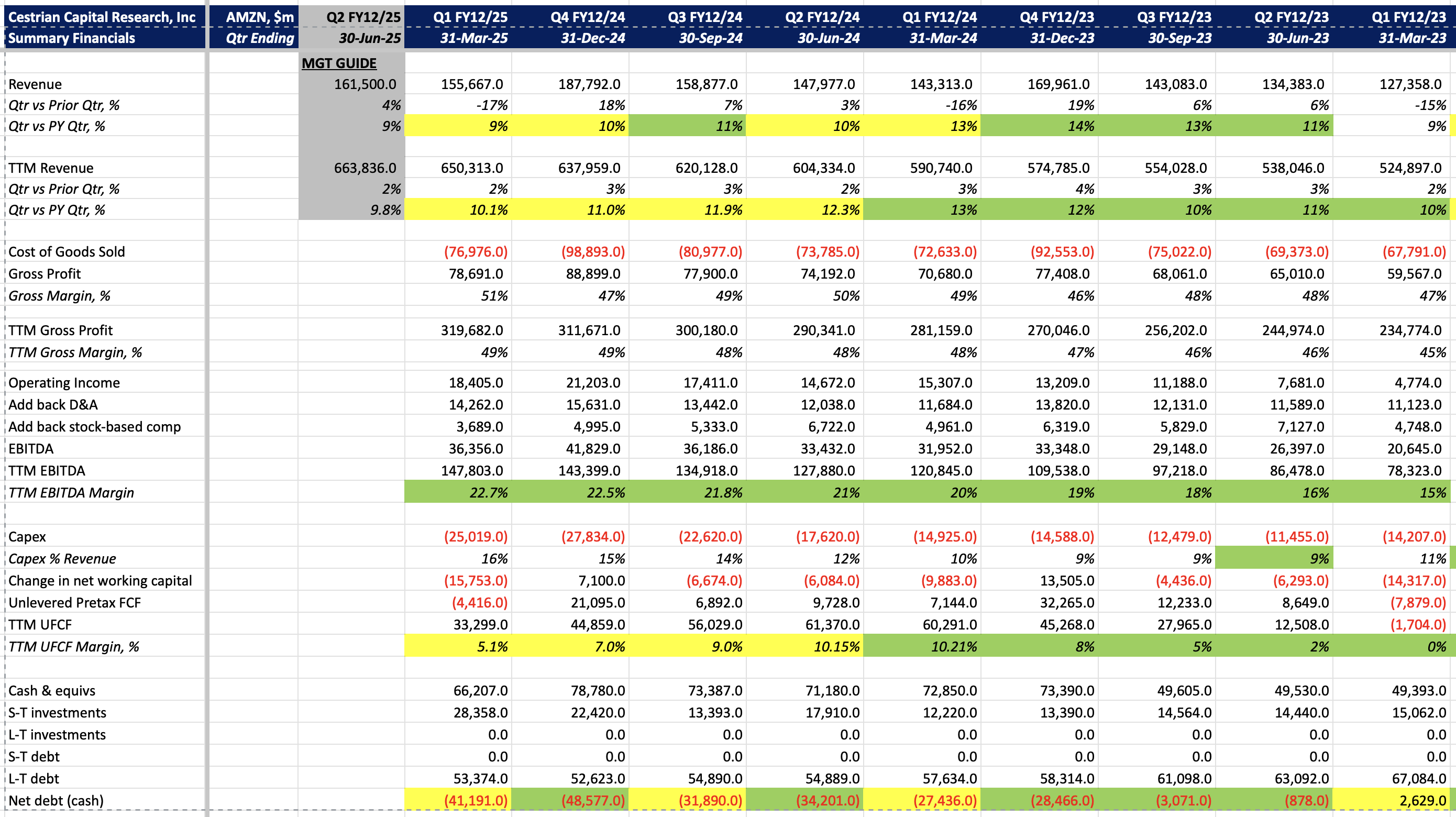

And with that let’s look at the numbers, the valuation, and the stock chart.

Financial Fundamentals

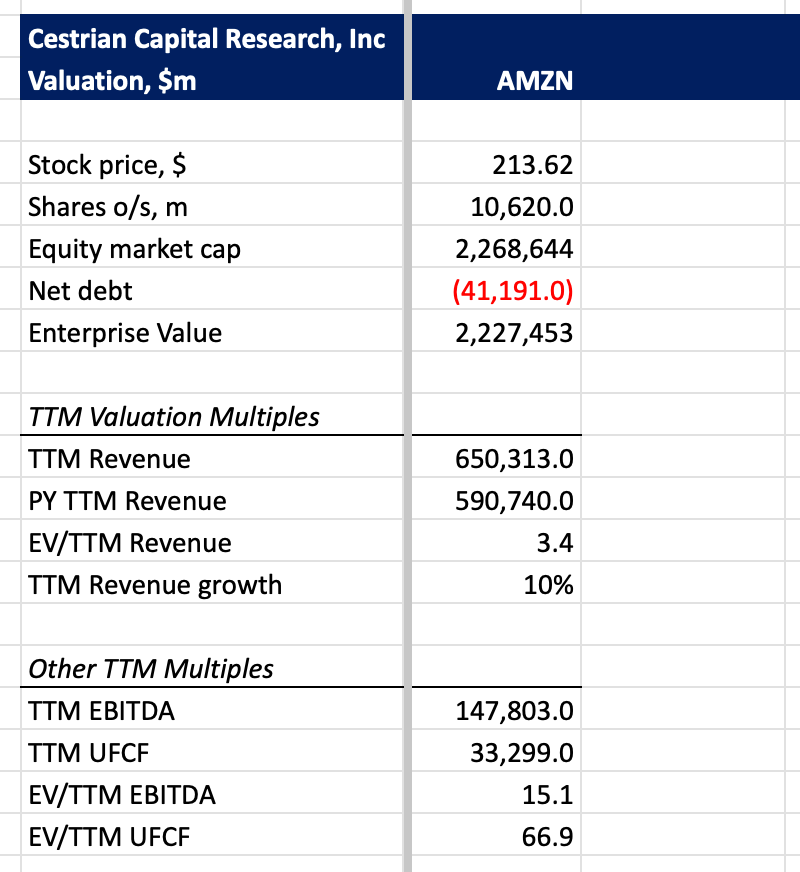

Valuation Metrics

Inexpensive on revenue or EBITDA multiples, AMZN is becoming pricier on cashflows because … you guessed it … capex. (Well, also a big working capital outflow this quarter, but that’s probably going to flow back in over the next 3-4 quarters).

Stock Charts

Here’s our longer-term take on Amazon stock. You can open a full page version, here.

And zooming in - this.

Holding over the 200-day moving average for now.

We rate AMZN at Hold. If there is a market correction in the coming days/weeks, Amazon may present a compelling buying opportunity.

Cestrian Capital Research, Inc - 24 June 2025