ARM Q2 FY3/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Heating Up

ARM just put in a very nice quarter. Revenue growth is strong, cashflow margins are improving and the balance sheet continues to look solid. I believe that in any kind of sustained datacenter investment environment, ARM can do very well; its low-power-by-design processor IP is entering a great product-market-fit period as the power drain by GPU-based systems is getting to be a real strain on the system.

If the datacenter trade dies, ARM will die with it.

Let’s take a look at the numbers, the stock chart, valuation and our rating.

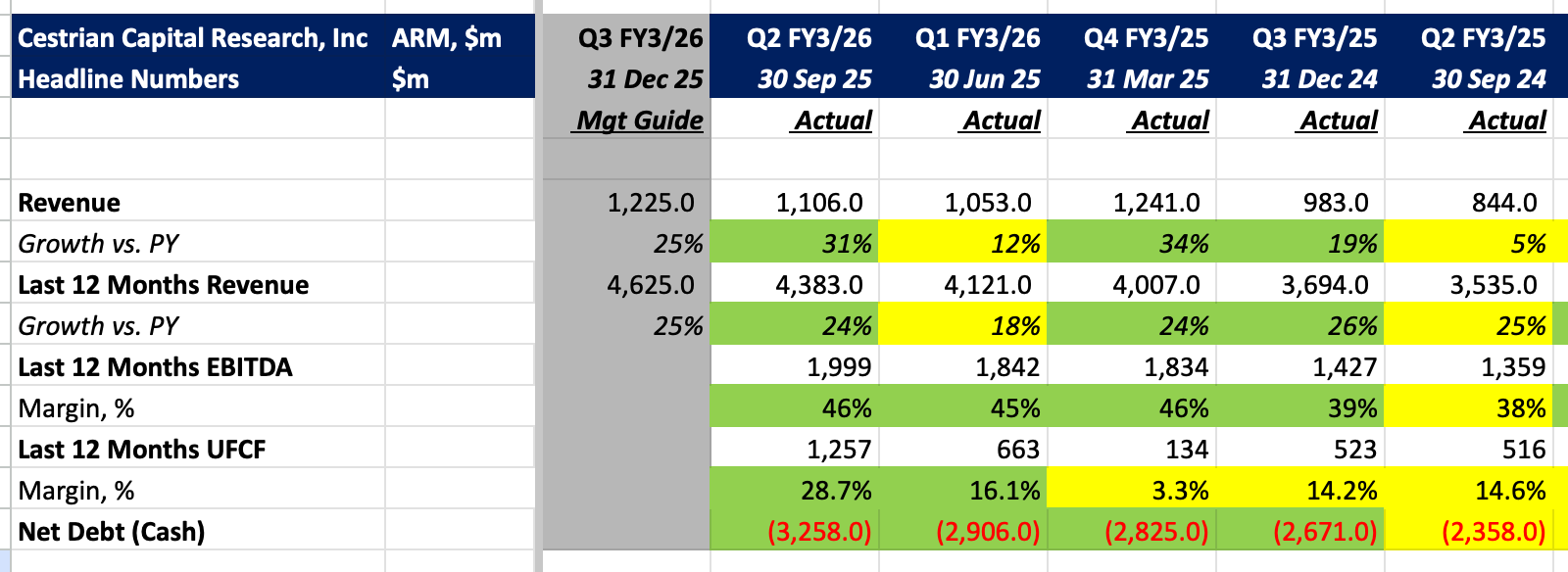

ARM Financial Summary

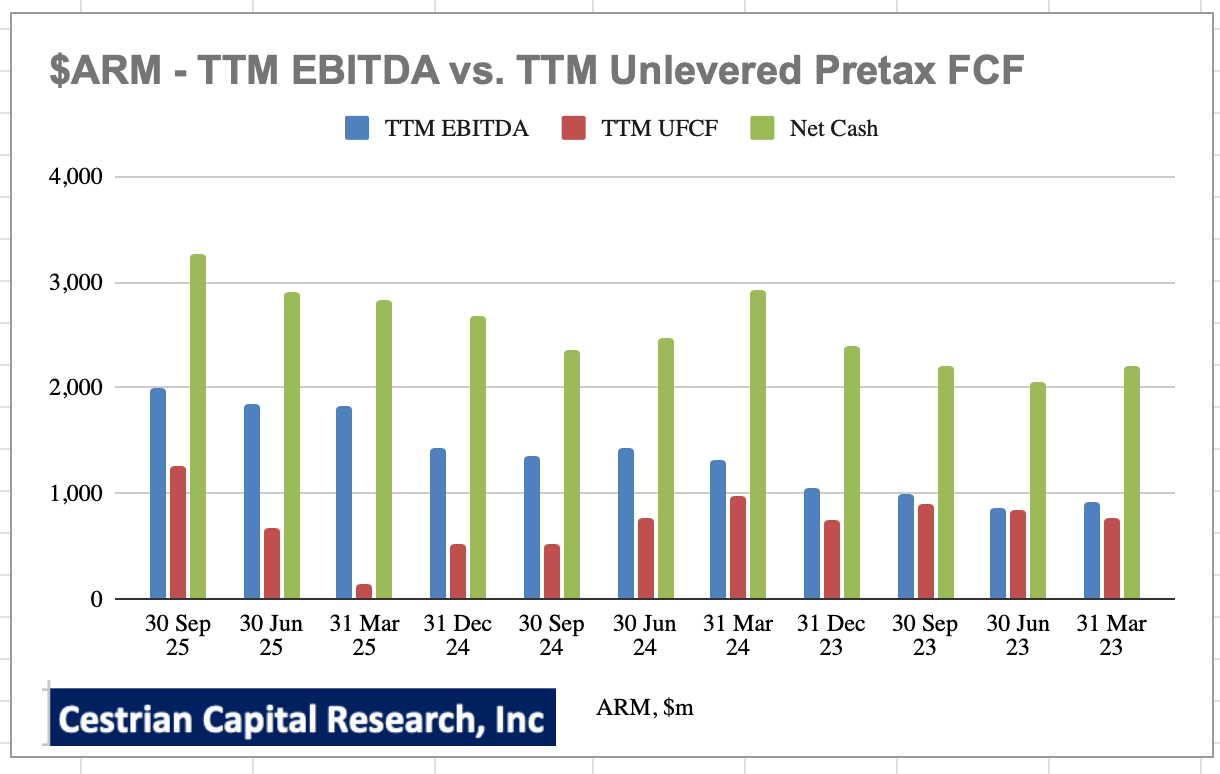

I noted a couple quarters back that something was amiss with ARM cashflows - you can see that with the dip to 3% unlevered pretax FCF margins in the March 2025 quarter. That has more than corrected now.

Cashflow still lags accounting profit but by a reasonable degree at this point - in March 2025 it had the whiff of accelerated profit recognition.

Note that a large percentage of ARM’s revenues come from ‘related parties’ - normally that’s a big red flag because can you be sure that the purchases were independently arrived at? Here I think we have to cut the company some slack - the two related parties are (i) the company’s China distributor and (ii) Softbank, which continues to own in excess of 80% of outstanding stock in ARM. I still don’t like it; related parties are related parties. But ARM has a near-monopoly on low power processor design so if any investor wants exposure to that market position, the related-party issue, and for that matter the giant overhang of Softbank-owned stock, is the price of admission. This would stop me personally having a very large allocation to the stock; it’s not enough to stop me owning smaller allocations.