Autodesk Q1 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

IRL Proxy

That’s how I think of Autodesk $ADSK company fundamentals - they are a proxy take on the real economy. Specifically, new orders is a proxy for the real economy capex program, and the real economy capex program is a proxy for grownups’ confidence in the real economy.

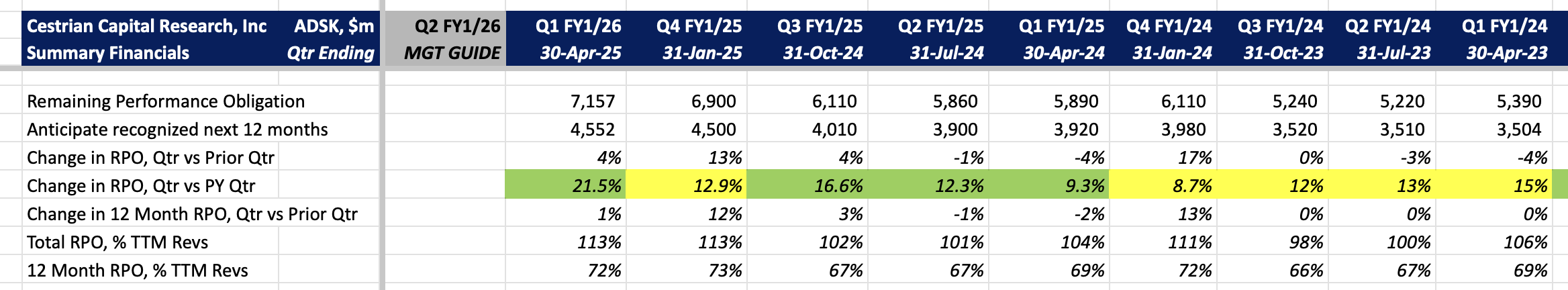

Well, here’s how ADSK’s order book (“remaining performance obligation”) is shaping up.

The order book is 21% bigger than last year, that’s the answer. Moreover that same order book is seeing sequential acceleration in growth rates for four of the last five quarters. It’s almost as if consumer- and corporate demand is in good shape despite all the narrative we hear to the contrary.

Let’s take a look at the fundamentals, the valuation, and the stock chart.

Financial Fundamentals

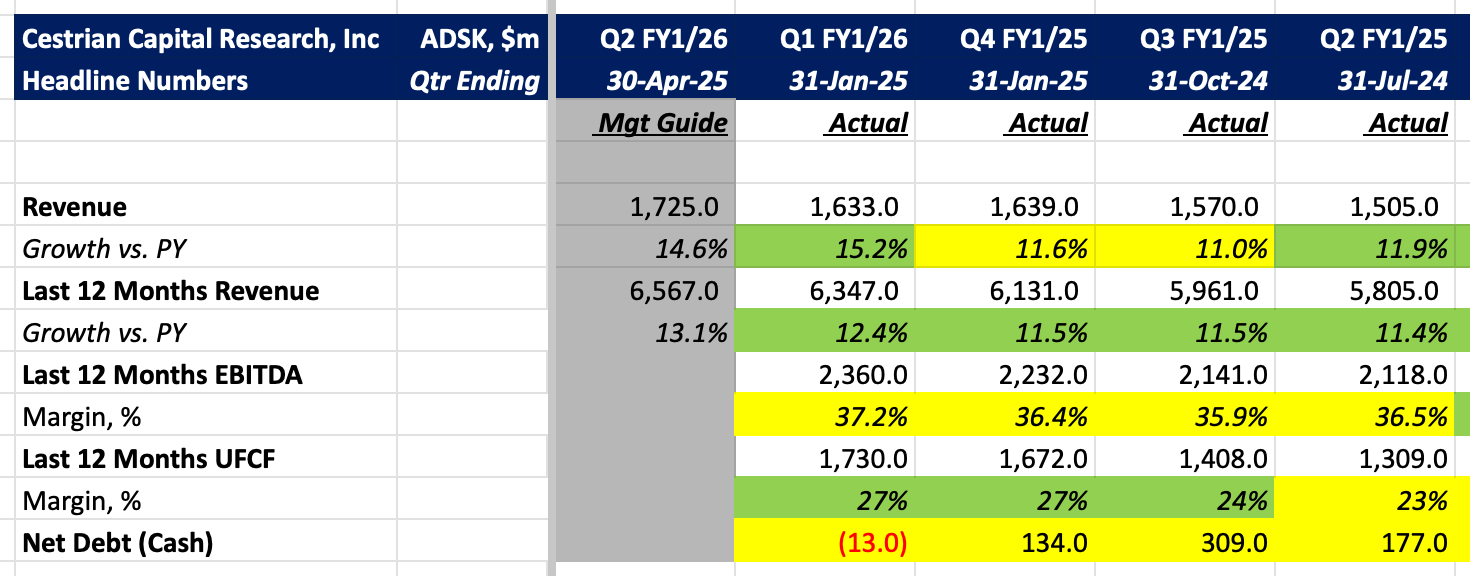

Headlines

Detailed Analysis