Cloudflare Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Look Under the Hood

By Hermit Warrior, aka Richard Iacuelli

You could be forgiven for stifling a yawn when going through Cloudflare's ($NET) Q1 Investor presentation - and then checking it wasn't in fact the previous quarter's. Nothing new - or very interesting - to see here.

The March 12th Investor Day Presentation on the other hand is a different story (at least the second half). Here we get to see what's really going on under the hood, with interesting insights on all sorts of areas of the business. More on that later.

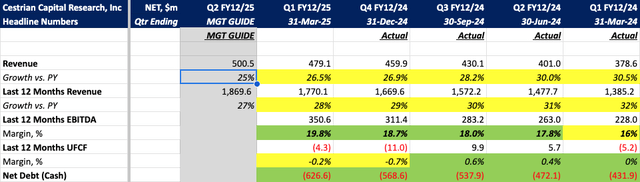

The headlines paint a picture of consistent revenue growth, at around 27% year on year (beating the guide which was for just under 24%) and guiding for 25% growth in Q3 which, if they beat by the same margin as this quarter, would in fact mean growth accelerates a touch (something that hasn't happened since Q4 '21).

EBITDA margins ticked up, as did net cash. For the full year, the guide is for 25% revenue growth. All in all, pretty much what we've come to expect.

Dig a little deeper, and peruse the Investor Day presentation, and things get a little more interesting. Let's take a look.