Cloudflare Q2 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Flywheel Spinning Faster

By Hermit Warrior

It seems superfluous to state that Cloudflare's ($NET) Q2 earnings were solid; the market reaction post-earnings, and a slow but steady climb since (at least until yesterday) has made that quite clear.

The simple explanation is that NET's business is humming. Investments in new products, expanding network presence and capacity - and keeping prices low - are complemented by a sharp focus on improving and refining their go-to-market strategy, which is paying off with larger deals, larger customers and accelerating revenue growth. In short, their flywheel is spinning faster.

This from Matthew Prince, their CEO, on the Q2 earnings call:

Cloudflare keeps innovating faster than ever, and customers are voting with their wallets... it's real investments that drove record ACV bookings in the quarter. Beyond innovation... we also delivered significant operational and strategic progress along multiple go-to-market areas in the second quarter.

Let's take a look at the headlines, then we can dive in and dig around the weeds.

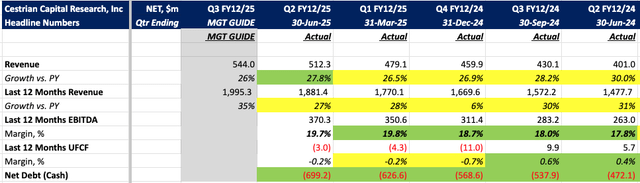

Revenue growth of 27.8% accelerated in Q2, coming in almost 3% higher than the 25% guide, something which has been getting rarer these days as most peers print results either in line, or barely a point above guidance. The Q3 guide for revenue growth of 26% seems a little light and I think sets them up for another beat.