NO PAYWALL: CoreWeave, Capex And The AI Belief System

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

CRWV Q2 Earnings Analysis, Eventually

by Alex King, CEO, Cestrian Capital Research, Inc

The current basis of AI cannot survive. It is just too expensive.

Now, to be clear, the current generation of AI output is extremely impressive. Right now, AI systems - you know, the ones deemed to have “no real use case” by naysayers - can, inter alia, (i) pattern-recognize somewhat better than humans ie. out-trade most all humans (ii) search the web somewhat better than humans (iii) draw faster than humans (iv) invent proteins faster than humans … and so on and so on.

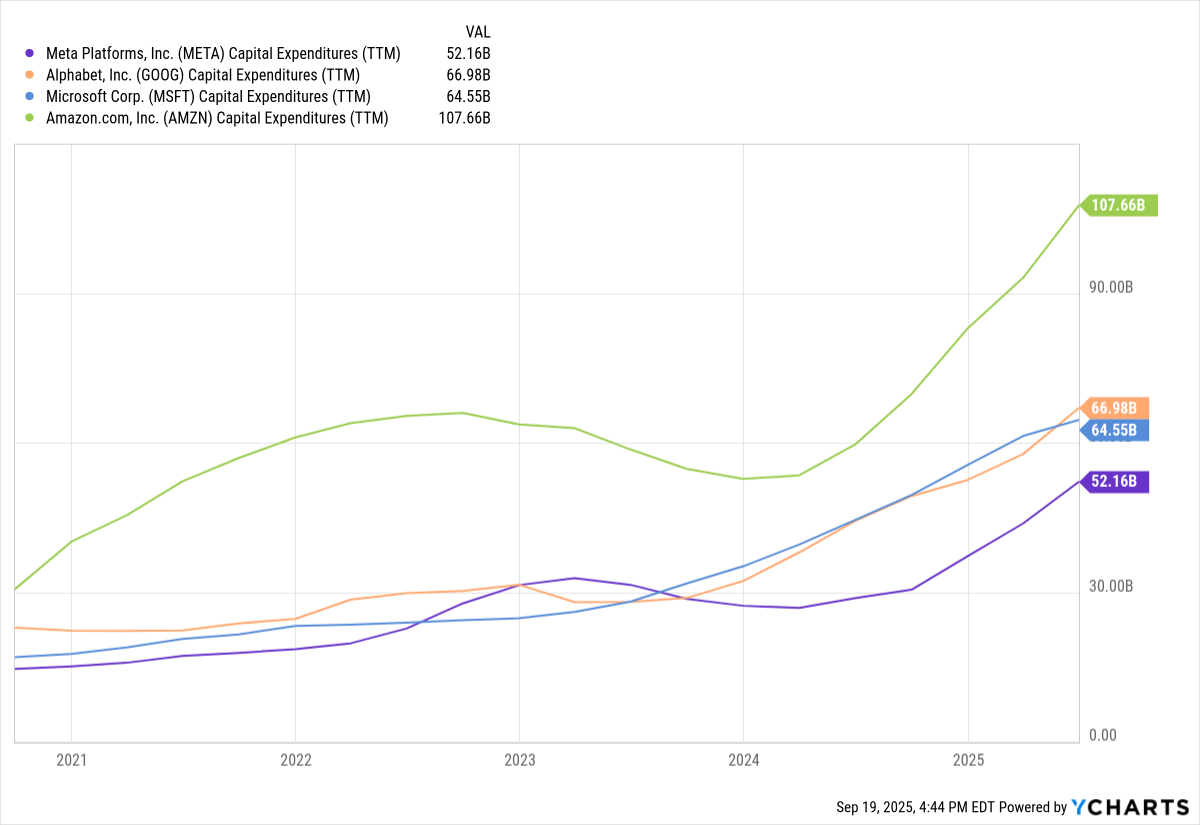

But the input cost. The cost! Here’s the evolution of last-twelve-months’-capital-expenditures from four big hyperscalers, going back to Q3 2020. Yikes!

Where is all the money going? Well, chips and datacenters, that’s where.

Not shown: the colossal spend on electricity provision.

Not shown: the colossal spend on cooling systems and coolant.

Not shown: the massive project by utility providers to provision enough power to the right places at the right time.

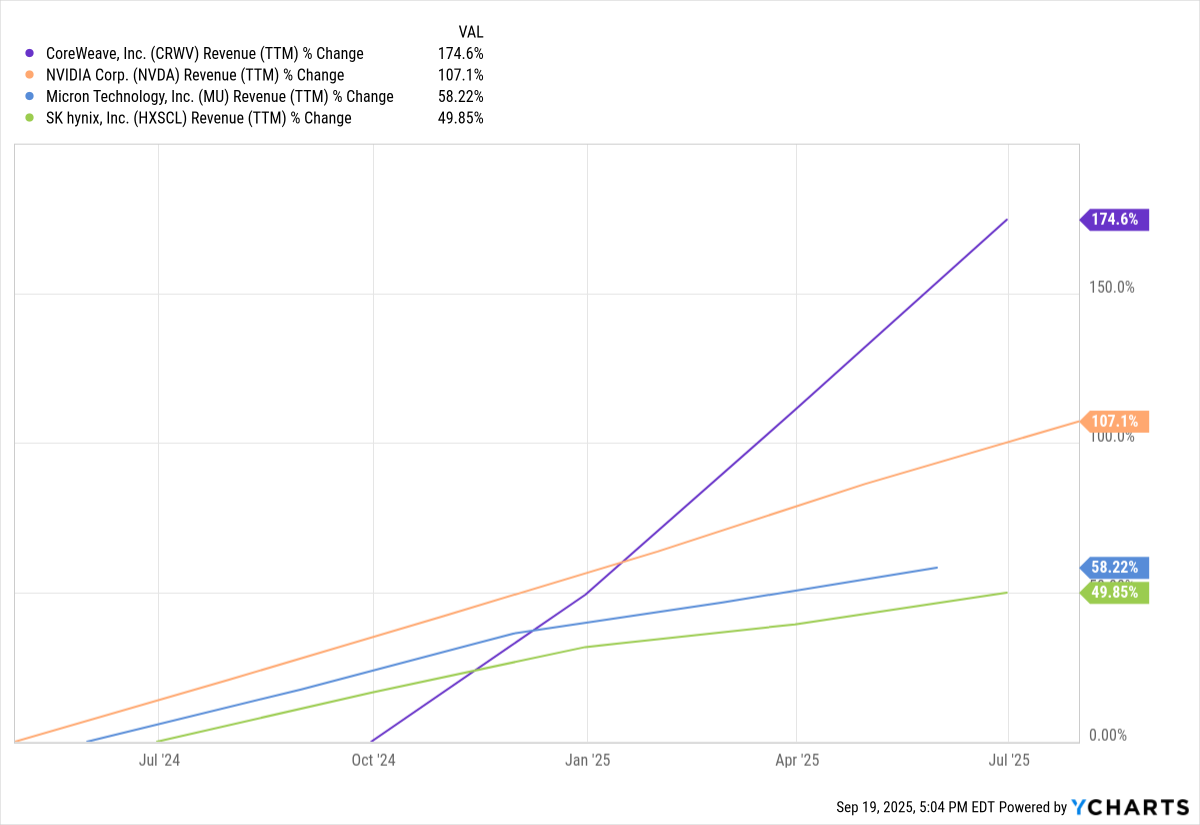

AI is eating the world, one dollar at a time. So far, one beneficiary, seen in the revenue chart above, is CoreWeave ($CRWV), which builds and operates high-end datacenters that have the hyperscalers themselves as customers. The financials operate on a belief-system basis, which is to say they make sense only if you believe that AI spending can continue to suck in capex dollars from around the world for the next X years until such time as cashflow black holes like $CRWV can maybe perhaps one day turn cashflow positive.

I don’t think this can last - there isn’t enough money, electricity or coolant in the world to keep running AI systems in this way. Something has to give, and what I think gives is (1) GPU architecture - I think a much more efficient calculation method has to come into play, and I believe $ARM will be a key piece of that puzzle due to its low-power-by-design nature (2) LLM structure - you just can’t keep building software that requires infinite power and compute cycles to problem-solve, somehow efficiency has to be brought to bear and (3) application coding - “vibe coding” and outsourcing the task to bloated LLMs likely means that anything coded by an LLM is, right now, also likely bloated.

None of this will change whilst the money is flowing freely. But when the market turns and money is no longer free or available, that will create the conditions in which a more efficient method of generating digital cat videos is created. Oh, also drug discover and all that other good stuff. From the next trough of disillusionment will the AI moonshot be built.

For now though, when money is free and flows like water to these companies, let’s take a look at CoreWeave.

Financial Fundamentals

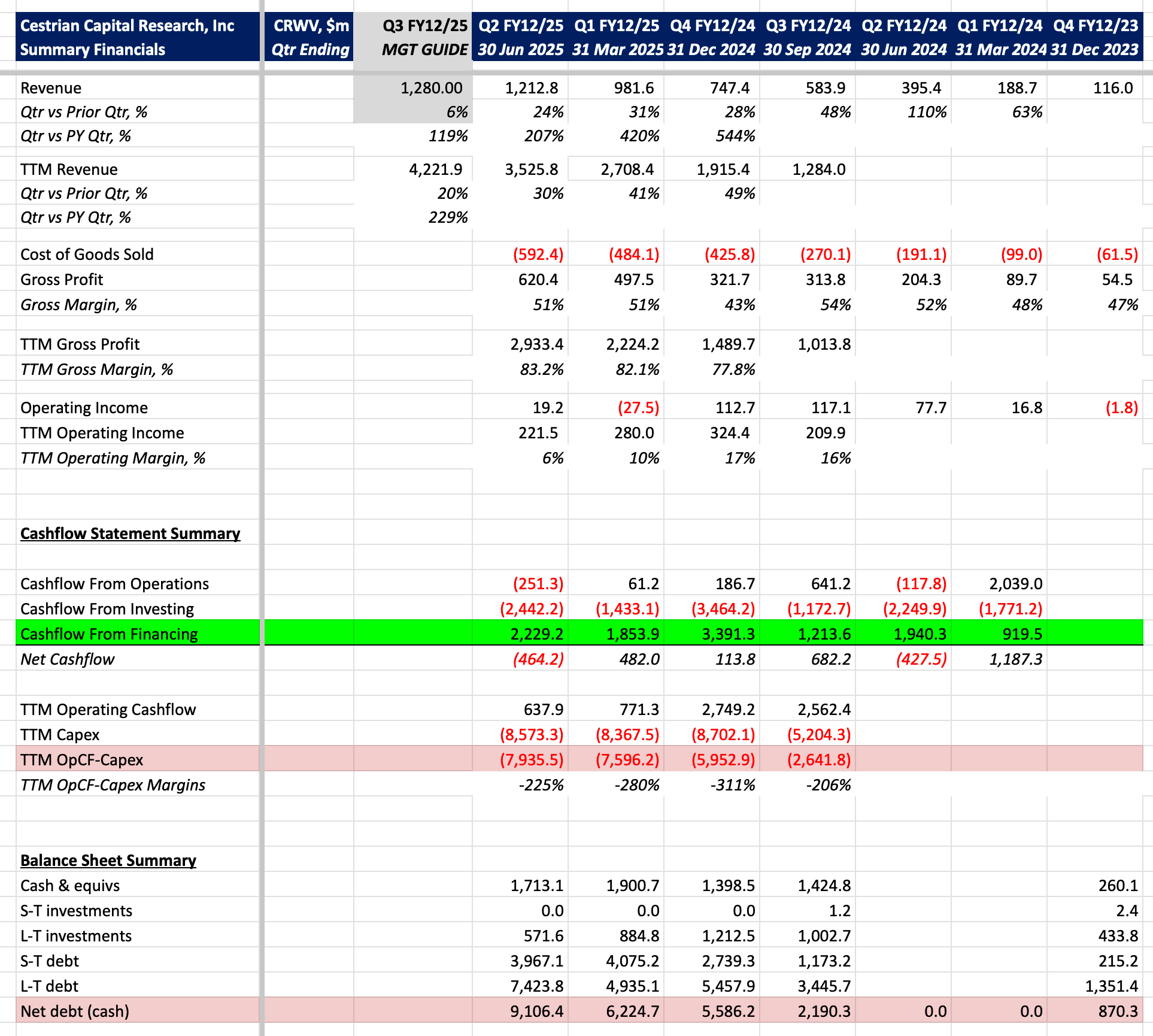

Firstly, mind the gaps. This is what happens with a new listing. As time goes by, more data is dripped out and we can fill in the blanks.

Secondly, if you’re new to accounting, for the avoidance of doubt, cashflow is not supposed to be something that shareholders and bondholders give to you to spend. It is supposed to be the other way around. The only positive cashflow contribution at CRWV is from financing ie. the raising of debt and equity to pay the electricity bills. Operating cashflow minus capex (basically, cash receipts from sales, minus the money the company spends to run the company) is massively negative and getting worse not better. Oh also, revenue growth is slowing, quickly.

As a result, net debt is piling up. A year ago, net debt was $2.2bn; it’s now $9.1bn.

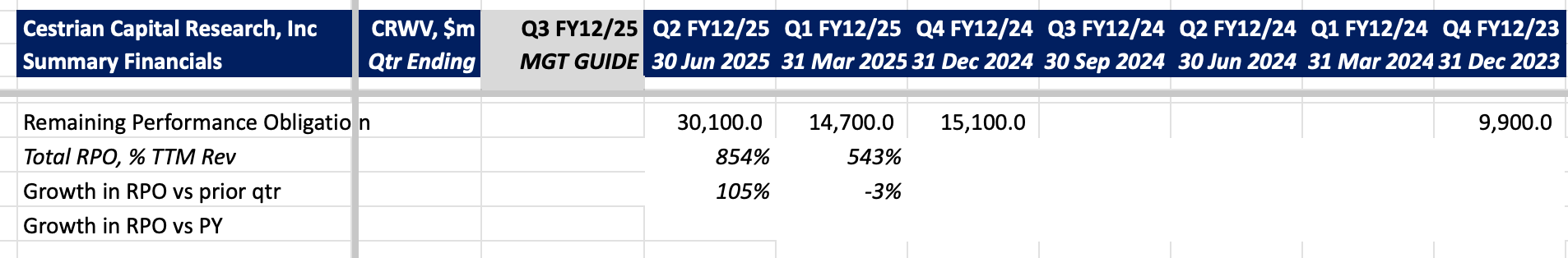

All of this may end up being justified if the company can convert its doublewide extra-fat order book into revenue and cash receipts.

$30.1bn of orders at present and growing fast.

Valuation

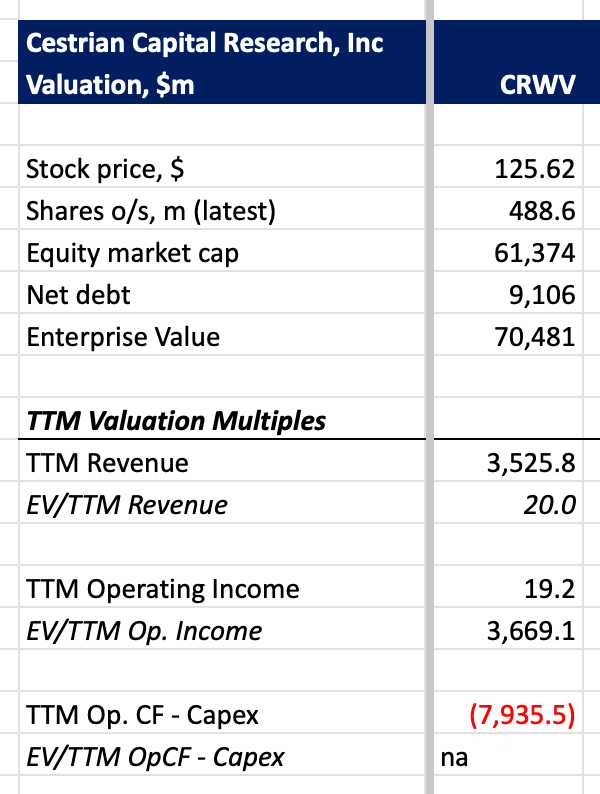

CRWV stock is yours for a mere 20x TTM revenue or 3,700x TTM operating income.

Stock Chart

Despite, or rather because of, all the nonsense above, CRWV stock looks in a bullish setup to me. You can open a full page version of this chart, here.

I think the stock can reach $230+ with a supportive market. A break below the 21-day EMA (green line) for more than a couple daily closes would invalidate the setup. Personally I have exactly that trade in place - long the stock with a stop placed some way below the 21-day. We rate the stock at Hold on the basis of this chart logic.

Cestrian Capital Research, Inc - 19 September 2025

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, CRWV.