CrowdStrike Q1 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A Lot Of Fish In The Sea

Personally I have a pretty low risk tolerance for any actual or perceived accounting malarkey in companies whose securities I own, or am thinking of owning. There are a lot of companies and a lot of stocks in this world and so I find that avoiding anything with a genuine risk of accounting problems is a pretty easy decision to take.

CrowdStrike ($CRWD) has some unwelcome attention from the SEC and the DOJ at present. Here’s how Computerworld put it in February this year.

Now, I have no idea of course whether there are accounting problems at CRWD or not. The company explained on its recent earnings call that it had received some questions from the authorities and that of course it was responding to those questions. Plenty of companies with no problems whatsoever deal with the SEC and the DOJ on issues like this all the time. The insinuation of the article seems to be that the company may have mis-recognized a $32m sale to a reseller.

When revenue recognition problems arise at a company it usually takes the form of sales being translated into revenue too quickly. SOP97-2 and other US GAAP rules require that companies recognize the revenue from sales at the rate that customers obtain value from the purchase. So if you sell someone a small bottle of lemonade at the roadside you can assume they will drink it right away. You make the sale, collect the cash, and recognize the revenue all on the same day. If you sell someone a 12-month software contract that involves the software monitoring their network for intrusion over that 12 months, then you make the sale on day 1, you (probably) commence revenue recognition once the customer has accepted the product installation (in Dinosoaur-Speak, the product “passed UAT / user acceptance testing”), and you recognize the revenue 1/12th each month for the 12 months of the contract. When you collect the cash is a completely separate question and has to do with whatever agreement your sales function reached with the customer. Could be on day 1 before revenue begins to be recognized, could be monthly, could be (unlikely but could be) after 12 months.

Companies that accelerate revenue recognition normally do so in order to hit quarterly numbers to avoid getting analyst downgrades, investor complaints and so forth. The assumption being that a revenue and/or earnings miss will see their stock drop and a hit or beat will not. So revenue recognition errors or mis-statements can fetch accusation of securities fraud. It’s a serious matter - not just an accounting issue.

So does Crowdstrike look like it has these kinds of problems?

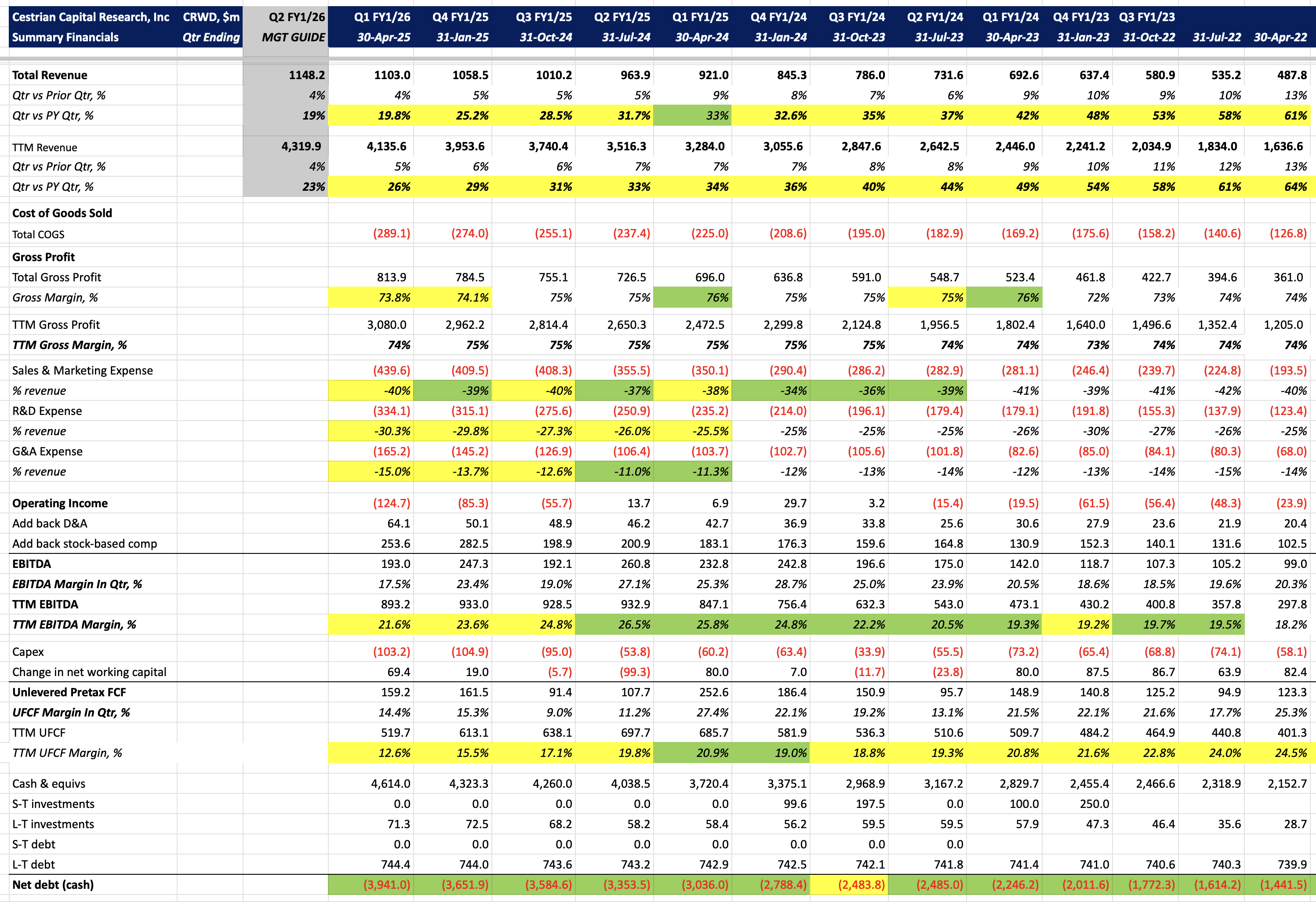

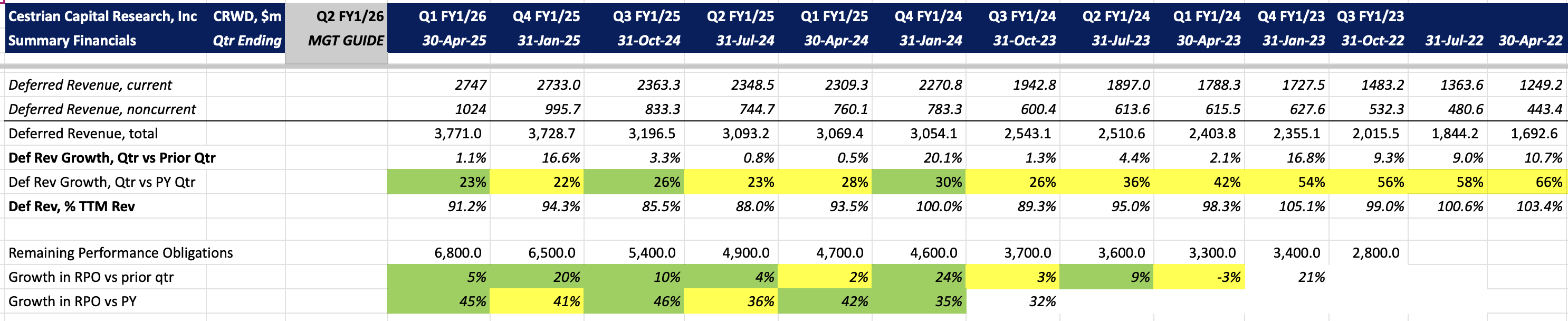

If you take a cold look at Crowdstrike numbers the first reason you might think there’s nothing to see here is that the cash balances keep climbing. Typically, companies seeking to inflate their revenue and earnings (both accounting concepts, not real things) show up because their cash-at-bank balances are dwindling faster than they “should” be according to the revenue and earnings performance. The other reason that CRWD looks like this may not be an issue is because the deferred revenue (prepaid orders yet to be recognized as revenue) is also climbing, and so too is the total order book (remaining performance obligation). If you compare this to some of the storied earnings mis-statement players over the years - your MCI WorldComs, Enrons and so forth? This doesn’t look like that. At all.

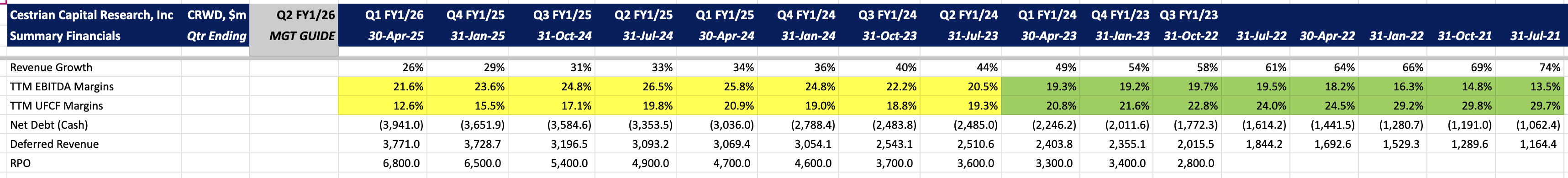

Where I suspect Crowdstrike has begun recognizing revenue more aggressively - which to be absolutely clear does not mean improperly, it means where there is the legitimate option to do so I suspect it chooses more-revenue-sooner not more-revenue-later - is that in recent quarters the clear trend is for TTM EBITDA margins to exceed TTM UFCF margins - in other words earnings are running ahead of cashflow. Whereas earlier in its life as a public companies, cashflow margins exceeded earnings margins. The latter usually indicates that a company is getting paid upfront for a lot of things and, further, that its accounting is on the conservative side.

The green quarters are TTM UFCF margins > TTM EBITDA margins; yellow, the reverse.

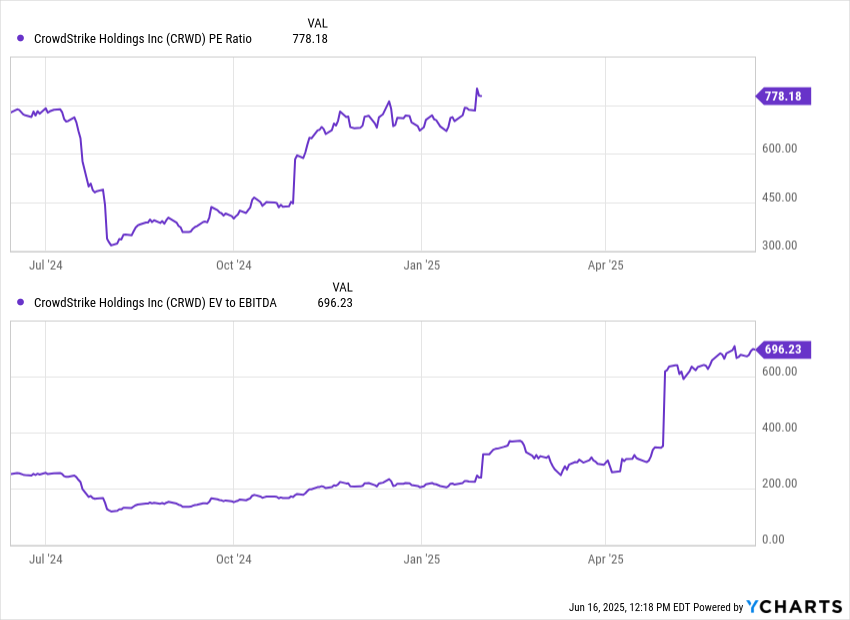

So I don’t know if there are grounds for the enquiries being made of the company or not, but I do think that accounting has gotten more aggressive - again not improper, just more aggressive - as growth has slowed. The earnings multiple on which the stock trades has risen a good deal in recent months.

This keeps me out of the stock personally - price has run up, multiples are up, growth and margins are falling, and the company has the distraction of the SEC / DOJ to deal with - doesn’t matter if their books are a lesson in GAAP compliance, it is distracting for management.

The stock chart by the way says that the price is approaching what may be a Wave 5 high in the multi-year cycle up off of the 2022/3 bear market lows.

So taking all this together we move to Distribute rating.

Numbers, valuation and charts follow.

Financial Fundamentals

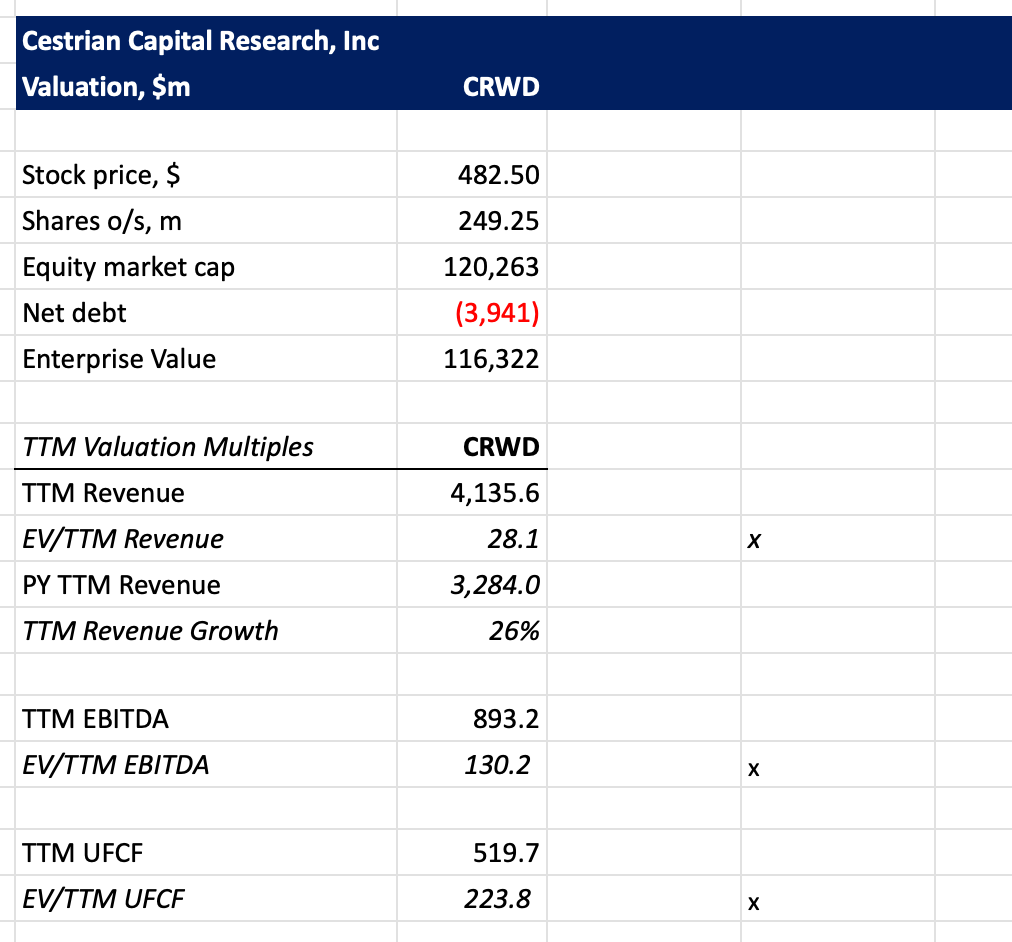

Valuation Metrics

You don’t have much room for error at 223x TTM unlevered pretax FCF!

Stock Chart

Perhaps some more upside from here but the risk/reward balance to me says that taking profits may be prudent - hence our Distribute rating.

Full page chart, here.

Cestrian Capital Research, Inc - 16 June 2025