Dell Q1 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Recession? What Recession?

by Alex King, CEO, Cestrian Capital Research, Inc

Dell is yet another company whose fundamentals indicate that, in fact, all is functioning well on Main Street, USA. The company is guiding for a Q2 (ending July) growth rate of +16% vs prior year, and an FY1/26 full year growth rate of +8%, a little up on the current TTM growth rate. If the economy was in trouble you would think that Dell would get hit. That it isn’t is another data point to suggest Main St is in good shape. As for the stock, well, there are more exciting names in town but on a very simple technical measure the name is just up and over its 200-day moving average, meaning the simplest long strategy here would be to buy it and have a stop-loss a little below the 200 day in case it falls back. Sometimes you don’t have to over-think things.

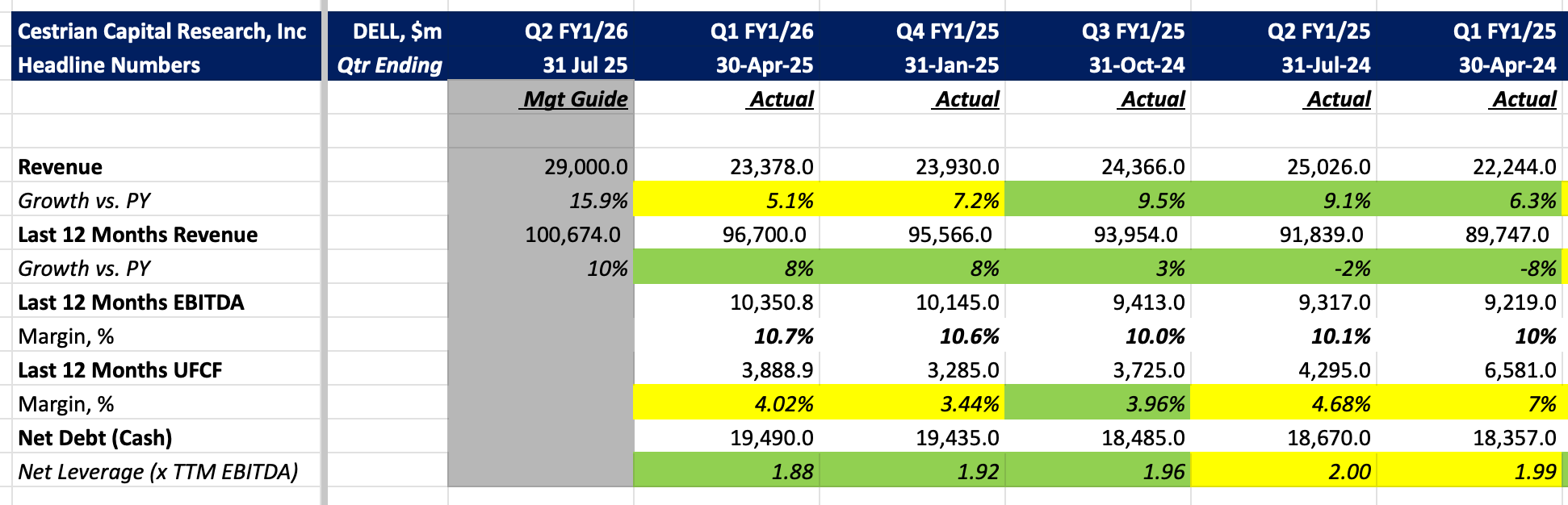

Headline numbers then let’s take a look at some details.

Financial Summary