ExxonMobil Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Wen Breakout?

by Alex King, CEO, Cestrian Capital Research, Inc

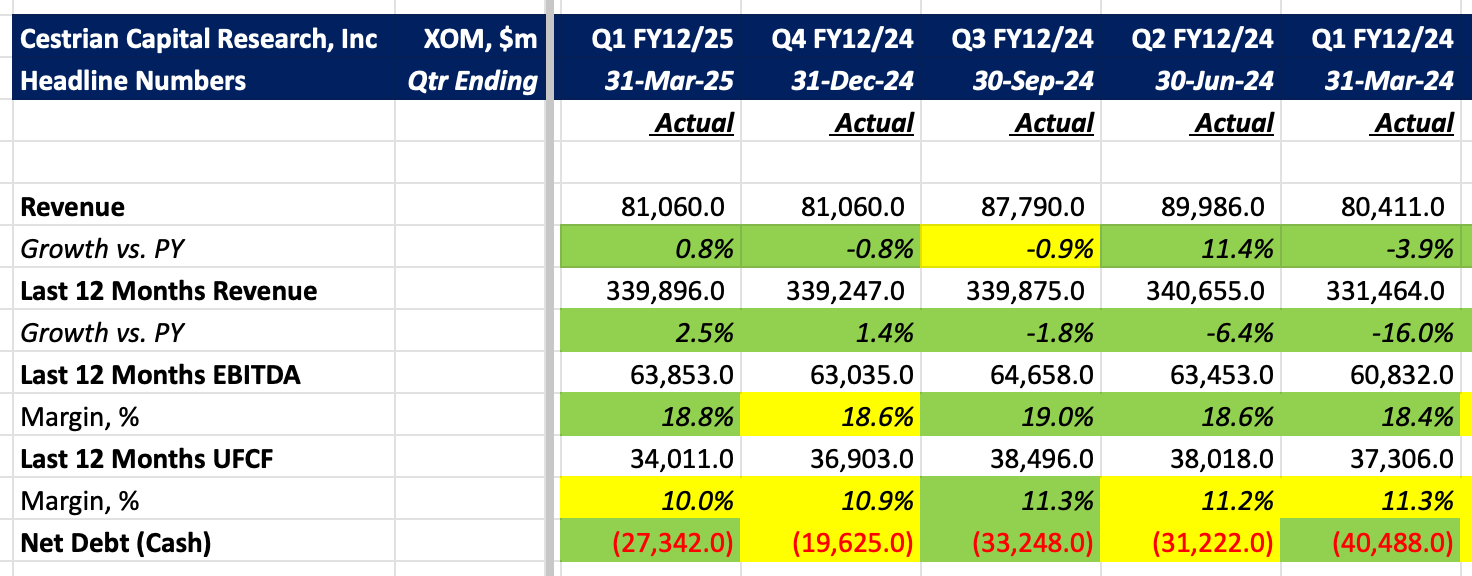

Energy names have been trending sideways in rangebound fashion for a couple years now. Usually this kind of slow accumulation is a precursor to a sectoral move up; this has threatened to happen in recent months but the breakout has yet to come. Exxon continues to generate perfectly solid financials and dividend yield whilst waiting to see if rotation into the energy sector does take place.

Let's get into the detailed financials, valuation analysis and stock chart.

Stock Charts

In the larger degree I think XOM continues to be under accumulation - bids arrive when the name appears to be falling out of the range, and sales happen when the name is thinking about a topside breakout. You can open a full page version of this chart, here.

Zooming in, it’s possible that we have seen a Wave 2 low of the retracement that followed the post-Liberation Day rebound. This may portend a new local high in Wave 3 up; we’ll see. Oil prices are rising in the wake of the successful Ukrainian attacks on Russian military assets; this may flow through to energy sector corporate stocks.

Full page version of this chart, here.

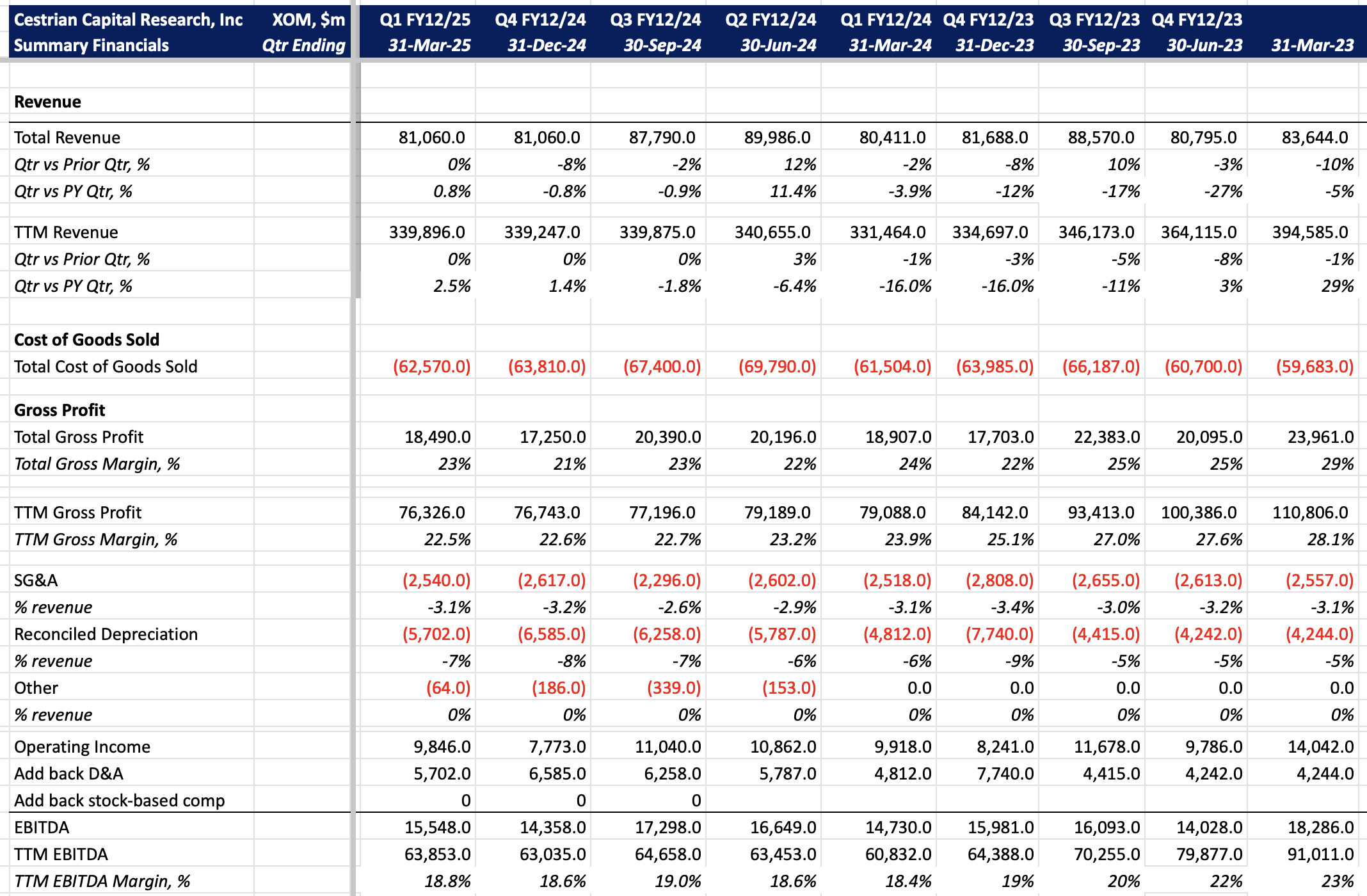

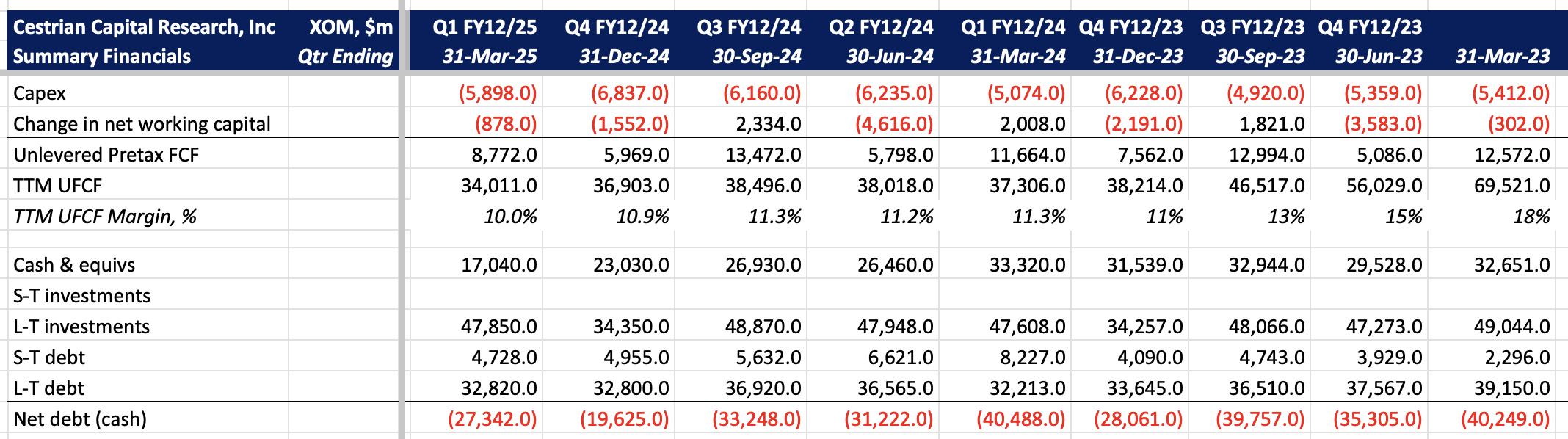

Financial Fundamentals

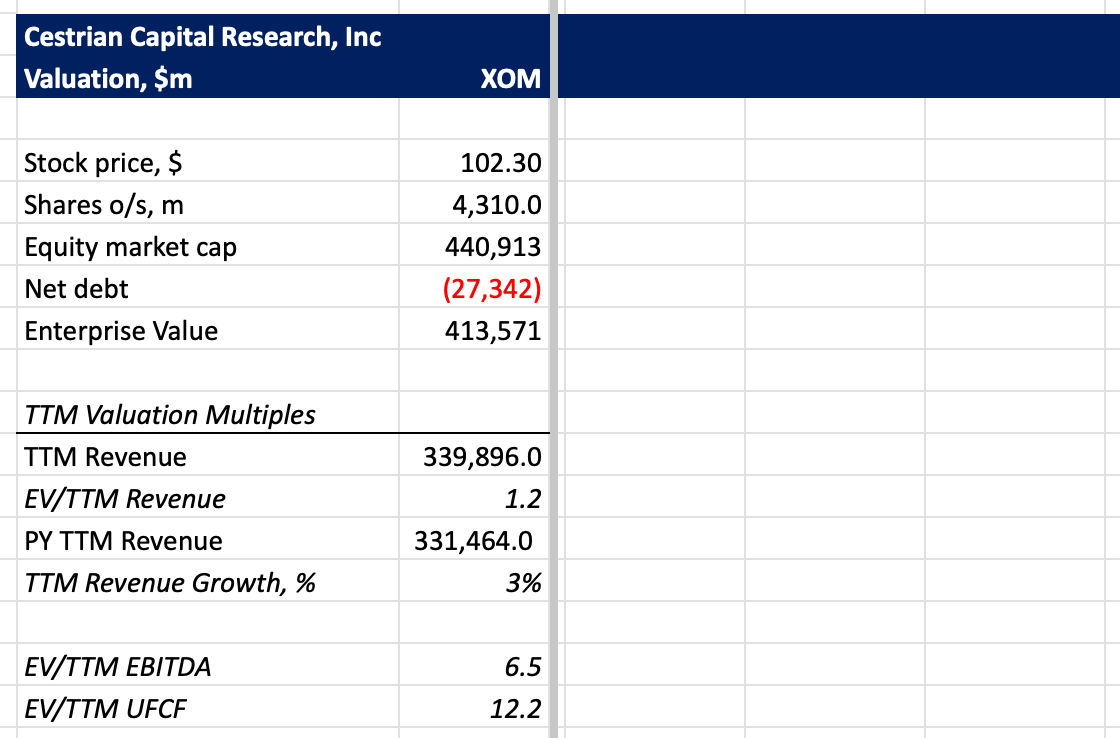

Valuation Multiples

Rating

We rate XOM at Accumulate per the longer-term chart above.

Cestrian Capital Research, Inc - 2 June 2025.