Fortinet Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A Well Oiled Machine

By Hermit Warrior, aka Richard Iacuelli

Look, we can make this earnings summary short and sweet: Fortinet ($FTNT) delivered the kind of Q1 results expected from a well oiled machine settling into a low to mid-teens annual growth rate (expected to keep up for the foreseeable future) while keeping a lid on expenses and throwing out prodigious amounts of cash. There, that's it. You can skip to the chart now.

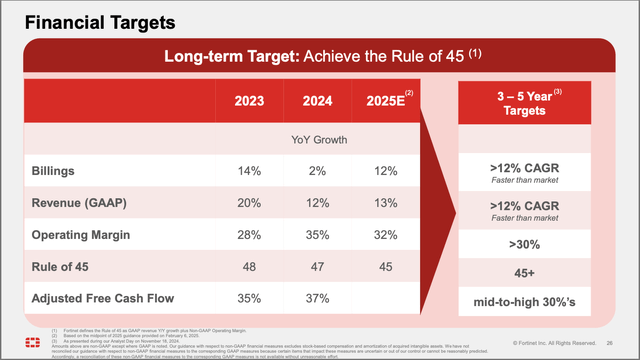

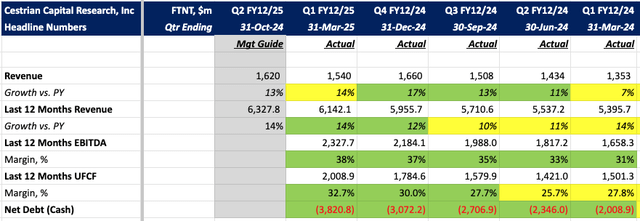

For those preferring to get their money's worth, here's the detail: Revenue growth of 14% (13.8% to be precise) came in less than a percentage point above guidance with management guiding to a similar 13% growth rate for Q2. Full year 2025 growth is also expected to be around - yes - 13%, with a similar trajectory expected over the next few years.

Amid the smooth humming, however, it's possible I think to detect a few wobbles that might point to some metal shavings hidden in the machine. We'll explore those later. For now, here are the headlines.

The stand-out story, even as revenue growth flatlines, is the continued improvement in EBITDA and unlevered free cashflow (UFCF) margins, which grew to 38% and 32.7% respectively (up from 31% and 27.8% in Q1 '24), almost exactly matching those of AAPL (also at 38% and 32.7% in the latest quarter) - with UCFC margins within shouting distance of those of MSFT and META (both at around 37%). Net cash grew 90% year on year and now represents more than half of annual revenues.