Fortinet Q2 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Something Missing

By Richard Iacuelli, a.k.a. Hermit Warrior

Three things stood out when Fortinet ($FTNT) reported Q2 earnings on August 6th. Firstly, the confident tone of management on the call. This from the prepared remarks delivered by Ken Xie, their CEO:

We are pleased with our strong second quarter performance, beating both our billings and operating margin guidance. Building on this business momentum, we are raising our full year billings outlook.

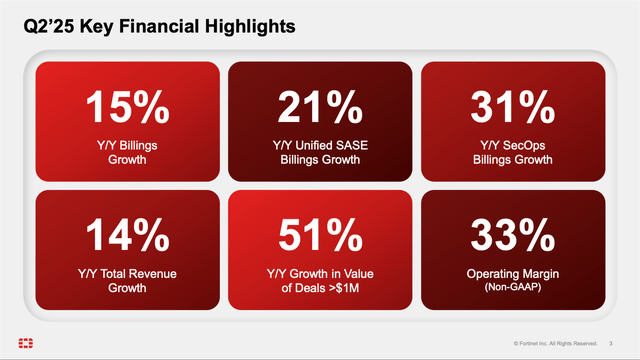

Secondly, and somewhat jarringly, every meaningful growth statistic highlighted by management was significantly higher than the actual revenue growth achieved.

And finally - hard to miss of course - was the market not buying this supposedly strong performance as the share price closed down 22% the following day (management can at least console themselves that it wasn't as bad as TTD's post-earnings tumble).

What to make of these contradictions; what are we missing? Let's take a look at the headlines, then we'll dig down some more.

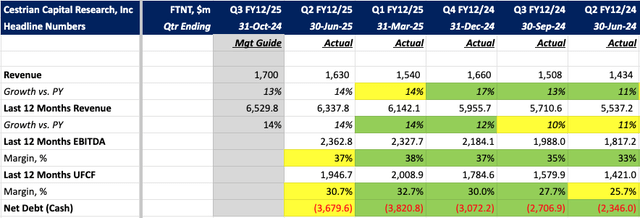

Running our eye over the numbers, it's clear these were actually pretty decent results. Q2 revenue grew 14% year on year, a touch above the 13% guide (Q1's guide/result were exactly the same). EBITDA and unlevered free cashflow (UFCF) margins ticked down a bit, as did net cash, but were still near historic highs. It seems de rigueur for FTNT to guide for growth of 13% (highlighted in last quarter's earnings review) and Q3 revenue growth was set at - yes - 13%.

So, management achieved what it said it would on revenue, maintained very healthy margins - and a rock solid balance sheet - and the stock promptly tanked. Let's dig in to figure out why.