Fortinet Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Two Scoops of Plain Vanilla Please

By Hermit Warrior, a.k.a. Richard Iacuelli

Welcome to the new sleeker, easier to read format for our earnings reviews which we'll be using for selected names. The aim is to make the important points 'pop out', with an easier read - and we're dragging ourselves firmly into the AI-augmented (not replacement) age with a new 'AI Insights' section. All feedback - good, bad, or just meh - is always welcome!

House View

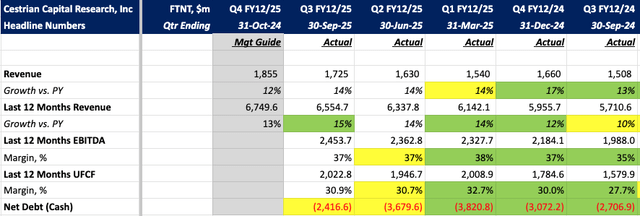

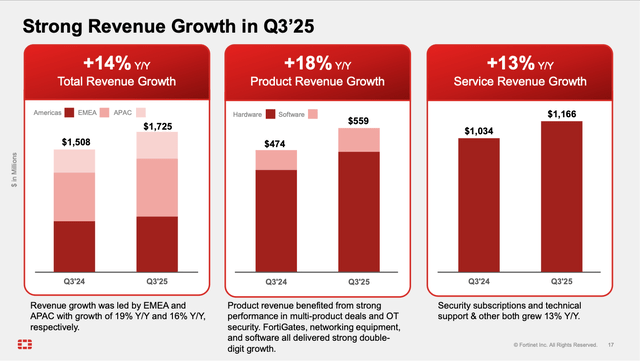

Another solid, if unexciting, print made up Fortinet's ($FTNT) Q3 earnings, with 14% year on year revenue growth coming in a little above the 13% guide - matching growth in the last two quarters. Margins remained steady all round (and at historically high levels) while costs went down both in absolute terms and as a percentage of revenue. A 12% guide for Q4 revenue growth - the first time in a while it wasn't 13% - no doubt disappointed the market, however is up against tough comps from the year ago quarter. Those looking for Watermelon and Mango flavors will want to look elsewhere; FTNT delivers two scoops of rich plain vanilla - and for some that's just the ticket.

Here are the headlines.

Analyst Insights -

Growth:

- Q3 revenue growth of 14% came in just above the 13% guide, and matched growth seen in Q1 and Q2.