Initiating Coverage Of CoreWeave

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

RPO, The Yet-To-Be-Debased Metric

by Alex King, CEO, Cestrian Capital Research, Inc

In recent years it has been very helpful to any investment analyst to see more and more companies report on “RPO” or “Remaining Performance Obligation” or, in Normie, “orders we have received but have yet to fulfill”, or in Boomer, “backlog”. The rules around RPO recognition strike me as a little more analog than those around revenue recognition - that’s because we’ve yet to have a securities market crisis caused by, er, “ambitious” RPO recognition in the way that we have seen as regards revenue recognition. One day RPO will have its own SOP97-2 Moment; but not yet.

If you invest in companies with long-running contracts, it’s good to look beyond just recognized revenue so you can see just a little way down the track ahead of the here and now. And it’s great to flip through the SEC filings - the 10-Qs and 10-Ks - to find the RPO numbers because it means that when the CEO with the good hair comes out and tries to KAPOW you with ARR or Run-Rate or some squirrelly nonsense like that, you can ignore it and just Apple-F or CTRL-F your way to backlog nirvana at SEC.gov.

Core

CoreWeave, the newest Hot AI Stonk On The Block, has the fattest order book vs. revenue I have ever seen - and that includes every software company I can think of, every defense contractor I can think of, everything. There was some weavery from the CFO on the earnings call that I didn’t much care for, but the RPO? Jeez. $15bn reported as of 31 March 2025, with the CEO guiding to $29bn with orders placed after the quarter end including the latest OpenAI deal. Q1 revenue was a little shy of $1bn and the company is guiding to a little under $1.1bn for Q2. So if we said the company had a runrate in the $4bn zip code we could then say that the order book was around 7x runrate revenue. Which is, in international accounting standards language, Yuge.

Also impressive, given what the company does (sell compute time over the internet, basically - you can think of it as one giant Telnet session), is the degree to which much of that RPO is pre-paid and thus falls into the ‘deferred revenue’ category. As of Q1, approximately $4bn of that $15bn RPO has been invoiced to customers and those invoices either accepted or actually paid. So deferred revenue is about 1x runrate revenue. This tells you how differentiated the services are; if you go look at lower-octane hosting companies you’ll see much less in the way of prepaid revenue, and you won’t see such a flex of a working capital profile either. This being a recent IPO, cashflow data is a little thin on the ground still (it will get backfilled as the 10-Qs and 10-Ks are published over the next 12 months or so) but in the majority of quarters for which we have data, the company has collected cash a whole lot faster than it has paid it out. Which means that if you need to know who is the Daddy in CoreWeave’s supply chain? CoreWeave is the Daddy.

Our usual Very Boring Financial Fundamentals Table is a little pointless here until we have more trailing data from successive earnings calls (S-1s are surprisingly patchy on this front) but to sum up I think the company’s numbers look a little like this:

- Very large order book and prepaid revenues per the above

- >$4bn in annualized runrate revenue

- Gross margins in the 70% range (very good for the business model - tells you they have pricing power)

- EBITDA positive

- Probably cashflow negative on a TTM basis due to ginormous capex commitments

- Unusual new-IPO balance sheet insofar as it is stacked with debt already - net debt of $8.6bn on probably-negative unlevered pretax free cashflow is something that needs watching.

Valuation looks like around $80bn EV right now, or around 20x runrate revenue. That will scare Boomers but it’s par for the course for the Hot Stock Du Jour. Likely to cool off a little in due course - see comments on the stock chart, below.

Weave

Now, as regards the CFO commentary on the earnings call, I heard two things that I could describe as a Weave-type of speech. The phrases that alerted me from my usual recumbent position during Yet Another Sellside Analyst Earnings CAll Congratulations Fest (aka. “please can we have some M&A or capital raising business from the new hot company? pretty please?) were:

“Self amortizing debt” - this is a new one on me. It’s been a while since I worked in leveraged finance so perhaps this is a new kind of debt that evaporates through the power of Magickal Acts alone, I don’t know. But it sounds hokey to me. So I think watching the leverage in this thing is probably a good idea.

“We don’t know the accounting treatment of the OpenAI deal yet but it won’t affect revenue, earnings or cashflow”. I’ll just leave that out there for you to think about.

This kind of Accounting Word Salad doesn’t matter when the stock is in the What’s New / What’s Cool list and everyone wants a piece. It shouldn’t happen on an earnings call or even a board meeting and any grownup member of the board of directors will be having a quiet word with the CFO right now. But it’s not a problem today. Where it may become a problem one day is if the Word Salad doesn’t translate into Actual Meaty GAAP Numbers. Watch this space. The CFO may not survive the transition into public life - wouldn’t be the first time.

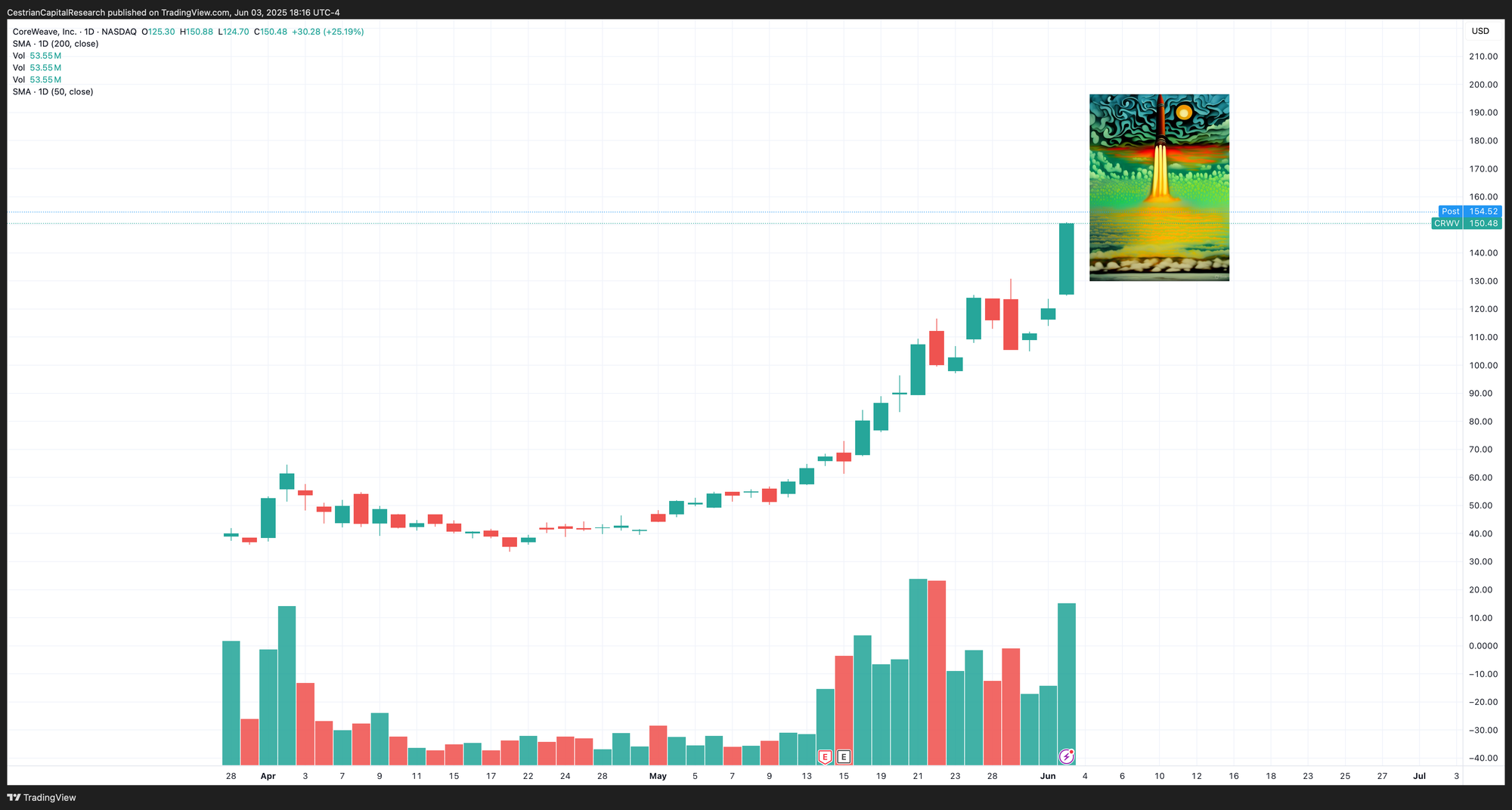

Stock Chart

The stock is in a state of Roid Rage at the moment which is usually a function of some kind of options Greek malarkey. It can continue its direct-ascent trajectory longer than shorts can hold down their bile. But at some point gravity will kick in and when that happens - in a month, a quarter, a year - there’s likely a very nice long-term entry point here. Assuming the self-amortizing debt doesn’t self-destruct that is. Full page chart, here.

Rating

I don’t own CRWV, but if I did, and I had a genuinely long-term perspective, I would hold it. I think that it will probably cool off some from here and again with a long-term view in mind there will be opportunities to accumulate a position over time here. Usually with hot IPOs there is a new post-IPO low base put in a year or two later, but since many investors can’t wait three minutes let alone a year, you can expect to see plenty of volatility in the name before that time.

We rate the stock at Hold.

Cestrian Capital Research, Inc - 3 June 2025.