Initiating Coverage of Figma

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The New Desktop Publishing

by Alex King, CEO, Cestrian Capital Research, Inc.

As you hear me say a lot and often, the Internet ruins everything. Any industry it touches is deflated and destroyed. Initially, online tools are basic, slow, clunky and no match for the wetware in whatever guild we may be talking about. But over time, in the end, the machine can do things as well as most of the guild members, and for much less money too. And most every guild decides that, well, we don’t really need those high end services that only Boomer Bob on the fourth floor can do, not least because we are going to retire him soon.

In the 1990s, people like me with few outside interests thought that desktop publishing software, brought to you by the likes of Quark XPress , was tremendous, because it meant you could do stuff without having to pay commercial designers and printers a wall of money. Commercial printers and designers, their lives deflated by this funny little widget, felt otherwise.

Today’s equivalent of desktop publishing is digital product creation, which can now be handled to a large degree by products from Figma, Inc. (FIG). If you’re not familiar with the company, take a look at its easy-to-understand website, and be blown away.

The company was slated to be acquired by Adobe in 2022 for $20bn, a ginormo multiple of Figma revenue but a price worth paying to stave off deflation of Adobe profits by an independent Figma. The deal was nixed by antitrust regulators, which led to the Figma IPO earlier this year. A much-hyped event, the stock opened trading at $85, peaked at $142 the next day and promptly dumped to a current price of $54. Your regular “IPO As Exit Liquidity” story.

I opened a position in Figma recently - just before the earnings drop sadly! - because I think the company has a bright future and that the stock has plenty of time to fill out its post-IPO base before trending up once more.

Rating

We rate the stock at Accumulate between $50-60/share. Our Stop Zone starts at $45.

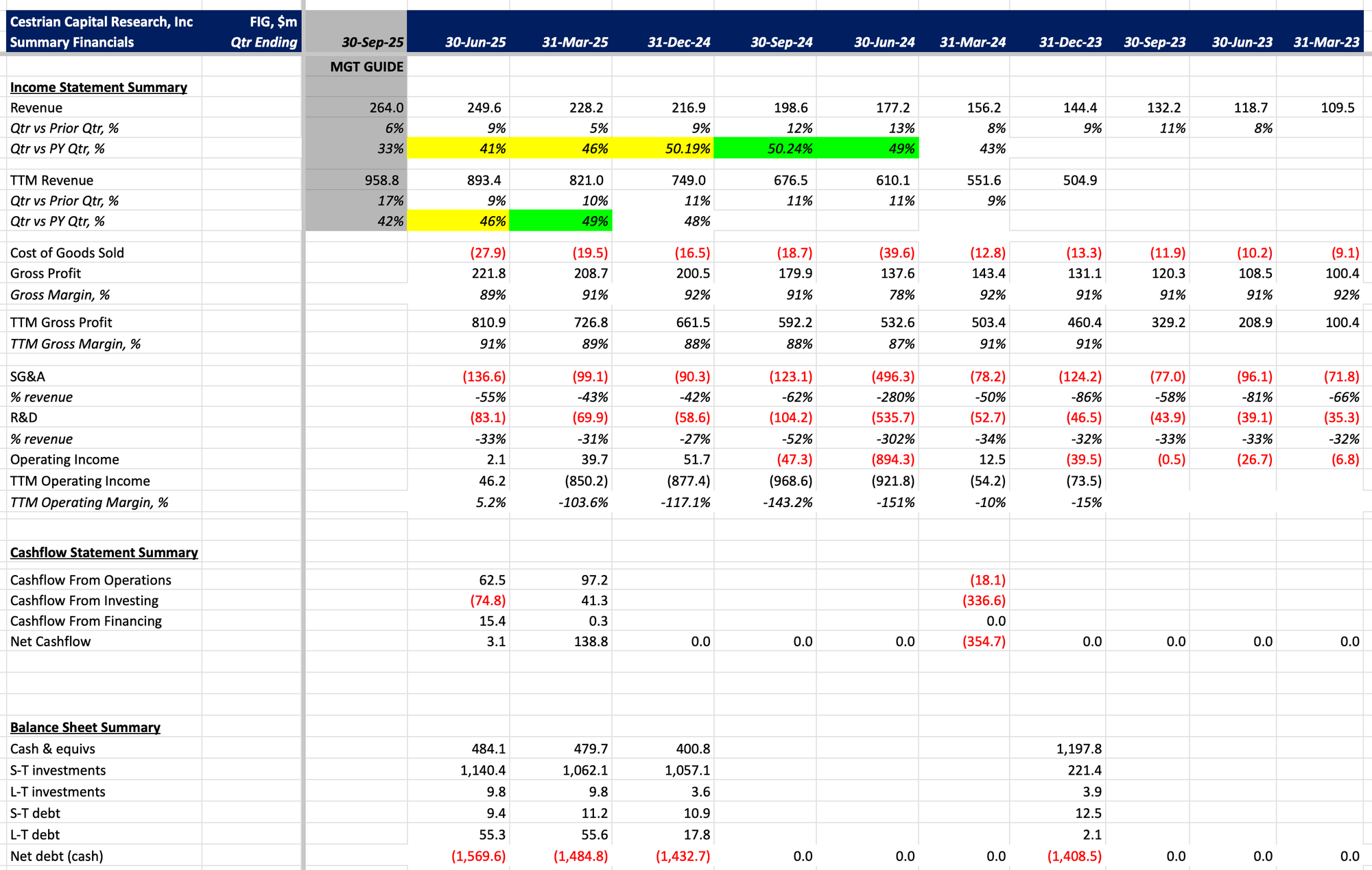

Financials

New IPOs are always spotty in terms of easily available financials, and this one is no different.

We can say that revenue this quarter grew at +41% vs. prior year, that TTM revenue was $893m, growing at +46% vs prior year, and we can say that growth is slowing. We can also say that the company has $1.6bn of net cash on the balance sheet. Earnings and cashflow are more opaque but will become clearer as each new quarter is printed.

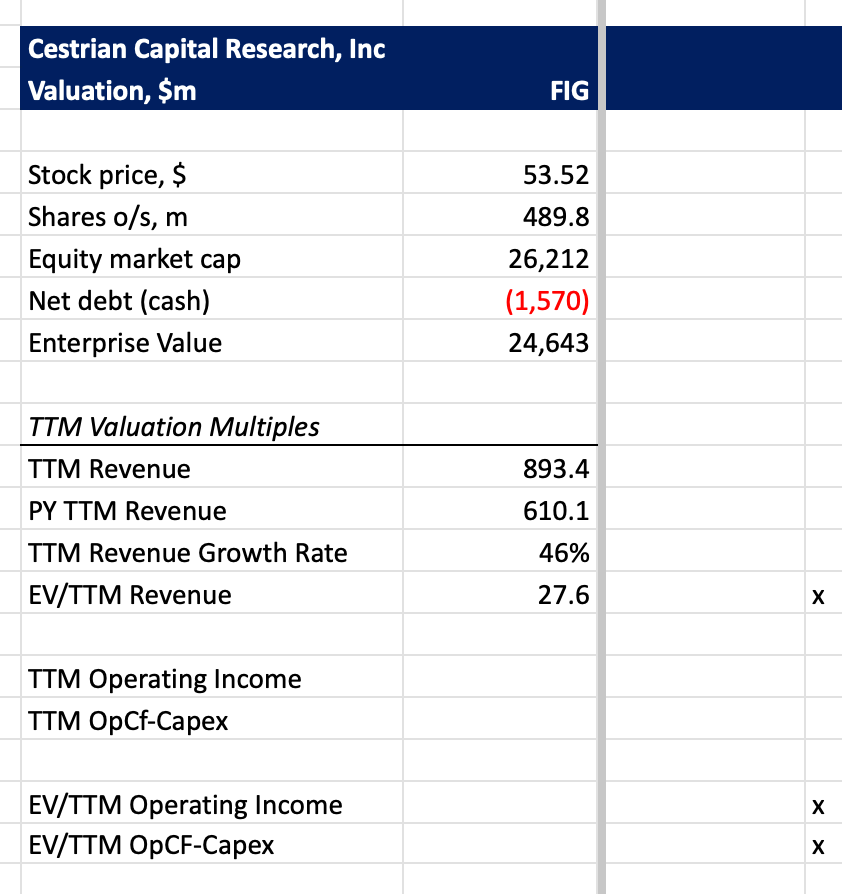

Valuation

28x TTM revenue for mid-40s growth is expensive by any measure.

Stock Chart

You can open a full page version of this chart, here.

Cestrian Capital Research, Inc - 16 September 2025

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $FIG.