Iridium Communications Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

On The Block?

by Alex King, CEO, Cestrian Capital Research, Inc

Iridium is a perfectly sensible business doing perfectly sensible things (low bit rate satcomm) which offends nobody and excites nobody. It’s not going to be the next Starlink or Kuiper because it doesn’t have the right fleet and it can’t raise enough money or put enough satellites on orbit fast enough to get close to the high bit rate players. So it has two fates I think. Option one, it fades into the background over a very long time; in ten years the stock continues to bumble around at the lows. Or two, the company gets sold to a consolidator in the satcomm sector. I myself think the latter is more likely. And I think institutions think that too. Because look at the volume profile on the stock chart:

You can open a full page version of this chart, here.

Time = 0 on that volume chart at the all time highs back in April 2023. (A top we called nicely, I will say). The stock looks to me like it is under accumulation, and we rate the stock at Accumulate accordingly.

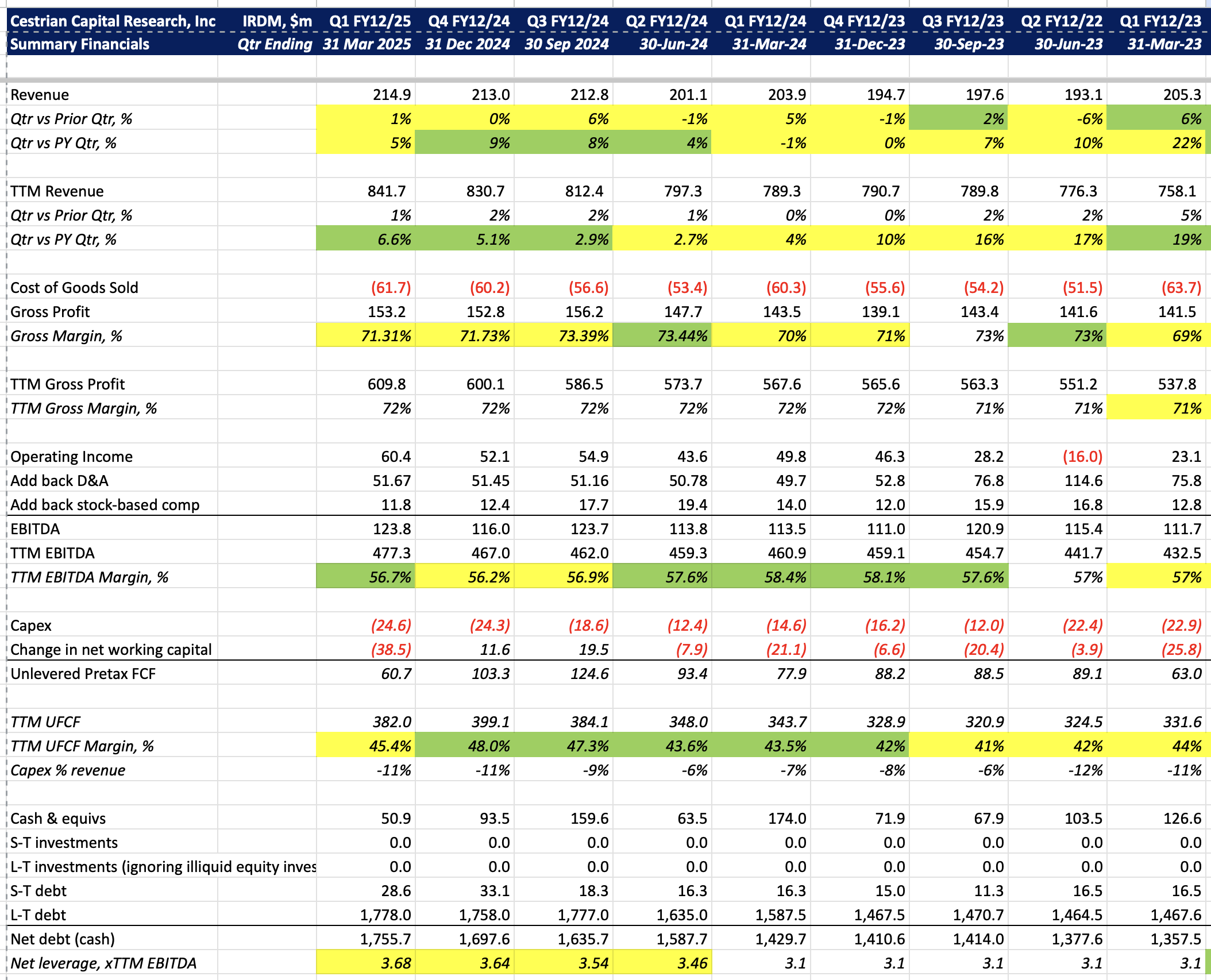

Numbers

Note the leverage is climbing - that’s because they are playing the levered-buyback game which is fun for a while but has a time limit on it. Revenue growth is fine, margins are kind of topped out, there is only so much you can do with this thing as a standalone company.

I would guess that if the company is sold it will be in the $30-35 range, maybe $40 tops. The stock is at $27 right now so I would say that’s 10%-50% upside from here and I think the chance of a $40 takeout is modest. A stop below $24 looks sensible to me.

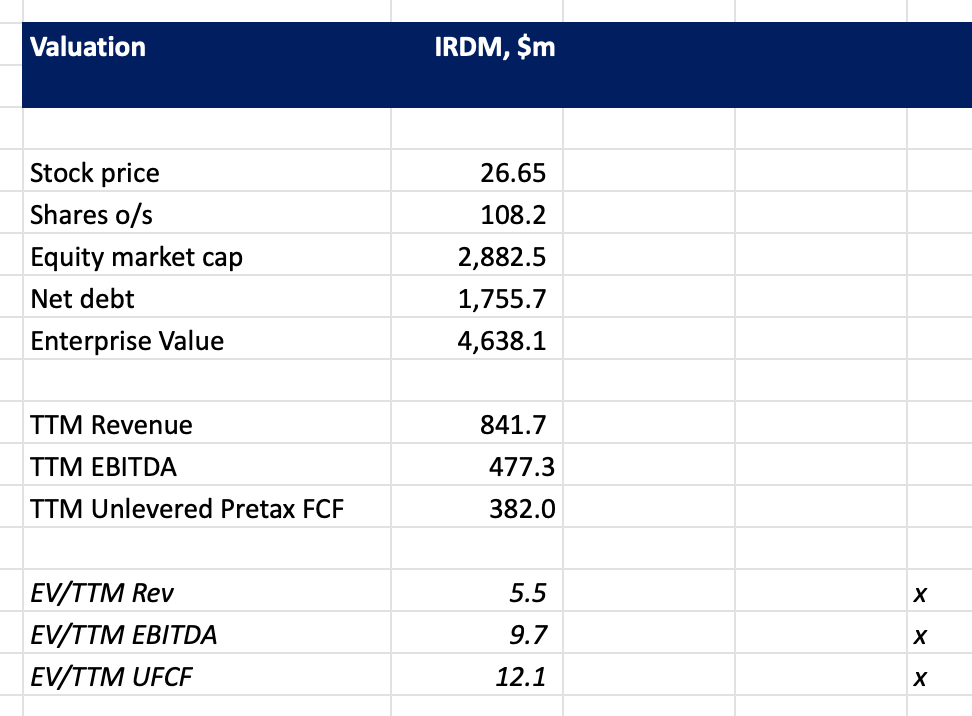

Valuation

It's not expensive, but that reflects the excitement level or lack of it!

Cestrian Capital Research, Inc - 6 June 2025.