Is Vertiv Stock A Buy After Q2 Earnings?

It dawned on me recently that one of the reasons I often prefer to invest in and trade ETFs rather than single-name stocks is that when considering single name stocks, I can’t help but consider the fundamentals. And since, as we all know, fundamentals only matter in edge cases (eg. when the stock has mooned and the business is castles in the sand, or the stock is in the basement and the company is generating cash like it’s going out of fashion), there is no point thinking about fundamentals if the market is not in an edge case.

Let’s consider $VRT in that light. Who wins - the numbers or the chart?

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Vertiv sells stuff to people who build and operate datacenters. It was put together from a rollup of smaller “we sell stuff to datacenters” companies like Cyclades, which sold IP KVM devices. The stuff that $VRT sells is generally fairly low-tech and/or depends on buying in tech from other people to assemble it. This is why the company clocks in only mid-30s gross margins. (Remember, gross margin = revenue minus variable costs). In the good times, it has reasonable cashflow margins, achieved through demand creating itself rather than requiring much effort; in the bad times it has poor cashflow margins, because the sales and marketing effort required to shift those 30% gross margin items really climbs. Vertiv is not, in short, a very good quality business - it would not pass the Buffett sniff test.

In a bull market - that matters not a jot. Here’s how $VRT has performed since the Covid lows. (Full page version, click here).

Absolutely spectacular run! And then you see a much deeper-than-market correction when stocks weakened this year (VRT started falling before the indices, and it fell further than the indices).

This is the essence of a high beta stock. Fantastic in the good times, brutal in the bad times.

So where now? Let’s look at the fundamentals, valuation, and the shorter term stock chart to see if we can work out where the stock is heading next.

Financial Fundamentals

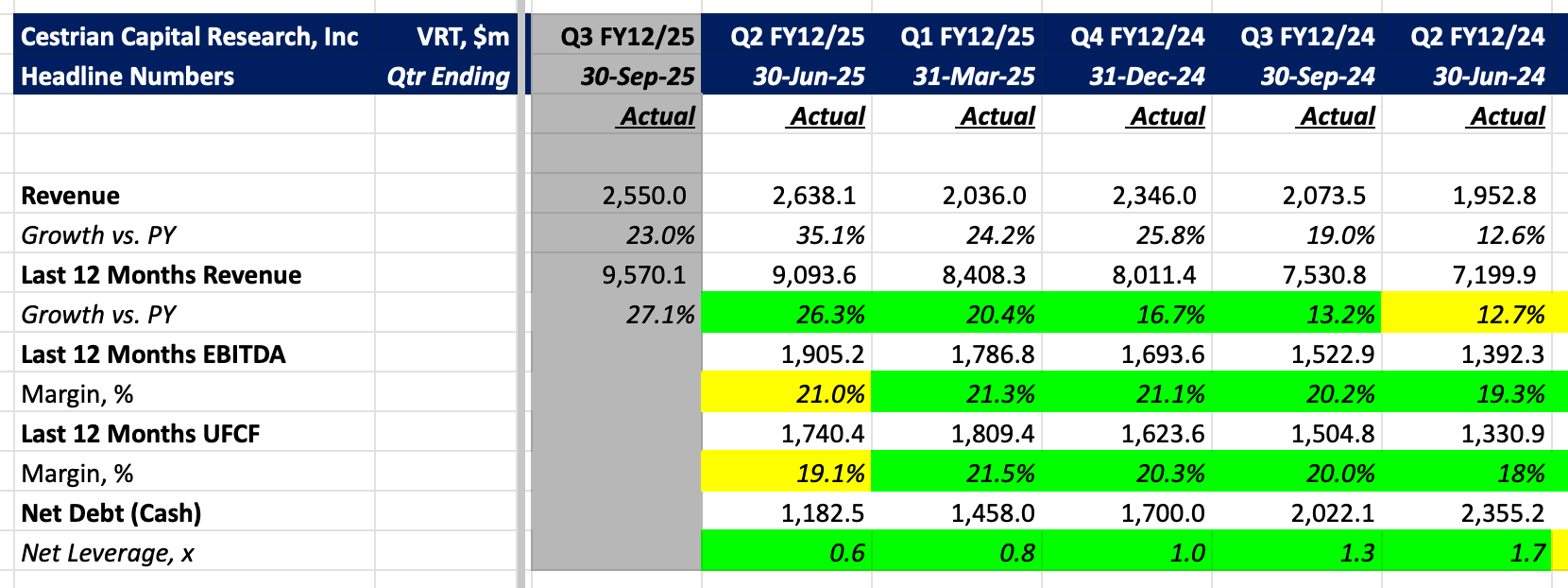

Here’s the headlines.

As you can see, a superb performance in the last year. The question is whether margin decline this quarter - those are TTM margins by the way so the change in % is material, it’s not a fast-twitch number - is telling a story or not. Bear argument? More sales and marketing and R&D costs required to shift any given dollar of gross profit. Bull argument? “Investing for growth” - justified by the raised guidance just issued.

Neither is conclusive right now but if you own $VRT stock, or are thinking of doing so, I think you have to have that margin drop in mind, together with the at least short-term-looking-toppy chart.

Full page version, here.

That 5-wave cycle isn’t a hill I would die on but it might be correct, in which case we may see a material drop about to come along. But rather than panic-sell, even nervous holders might watch how $VRT performs against the moving averages. Friday it closed above the 8-day SMA (red line) and that was on a grim day for markets. A drop below that and in particular a drop below the (green line) 21-day EMA is probably meaningful.

Stock Rating

So, a Hold rating from us for now but below the 21-day EMA we would switch to Distribute pending support.

If you have any questions or comments on our take on $VRT, we welcome them. Nothing we like more than talking stocks. If you’re an Inner Circle member you can hit us up in Slack chat (here); if not, you can use the comments field to this note as long as you are logged into our site (you don’t have to pay to become a member, just choose the Free option here).

Appendix: Detailed Fundamentals And Valuation

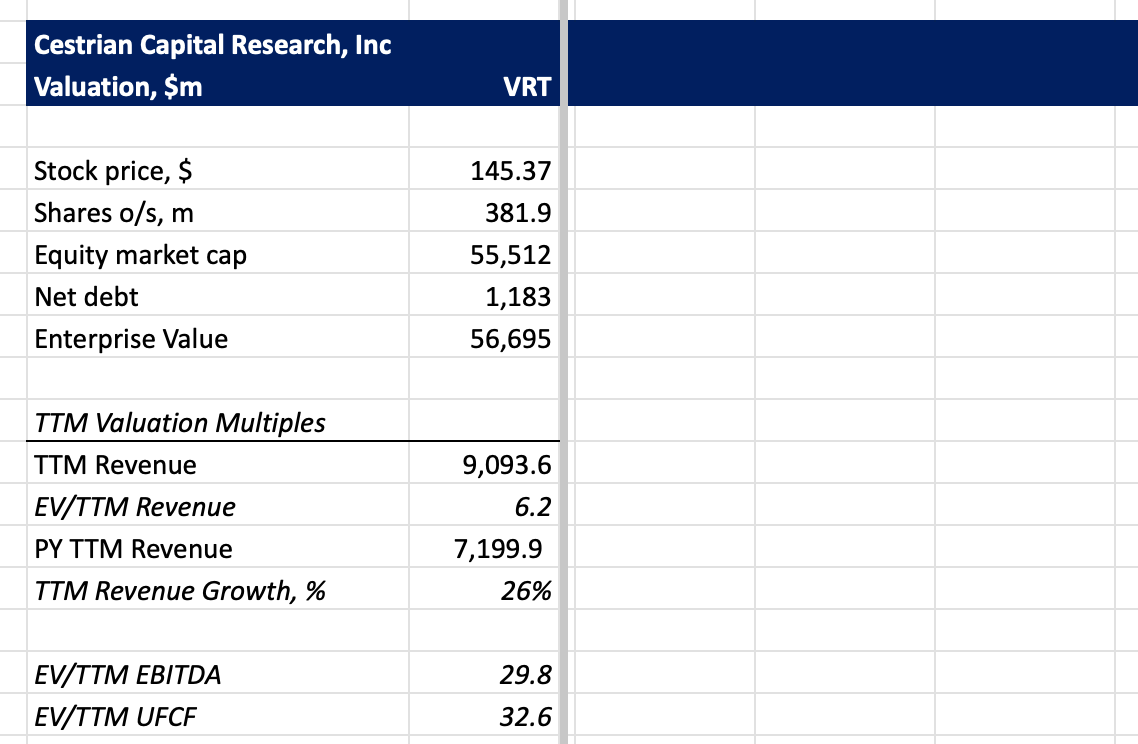

Valuation Analysis

I think 33x TTM UFCF for a 26% growth, 30% gross margin business is toppy. Much of the time, $NVDA can be had for around 50x TTM UFCF or less and that is a way better quality company.

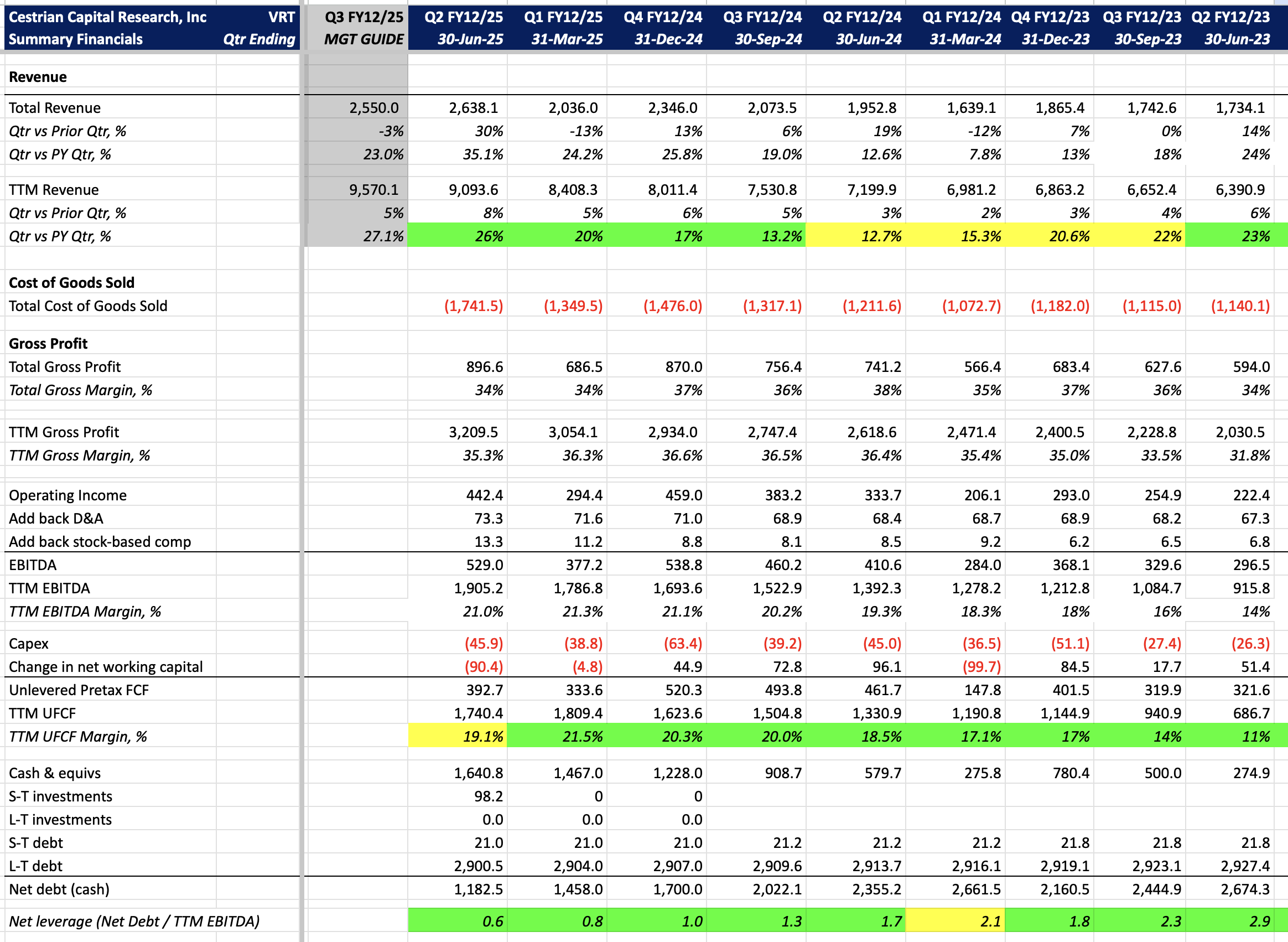

Fundamentals

Cestrian Capital Research, Inc - 4 August 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $VRT.