Lam Research Q1 F6/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

by JamsODonnell

Summary:

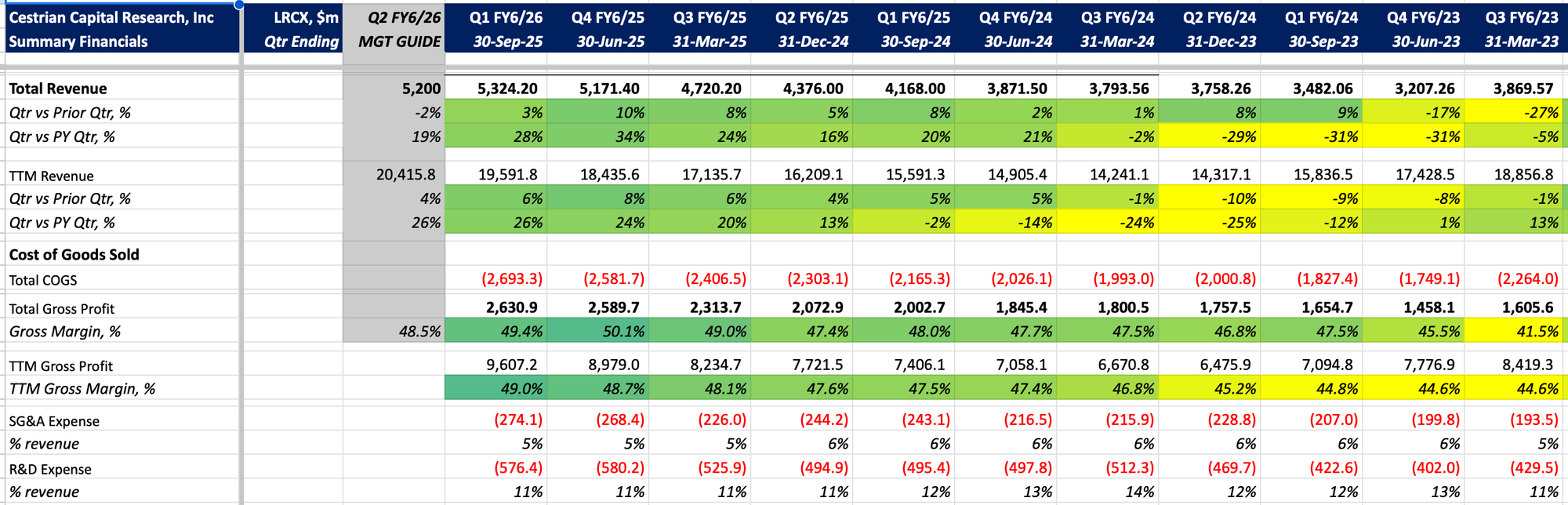

- Lam Research reported record Q1 revenue of $5.3 billion and record gross margins.

- AI-driven demand is a key tailwind, quantified as $8B in WFE for every $100B in data center spend.

- 2026 China revenue decline is expected to be "more than offset" by growth from global multinationals.

- Charts and options look favorable at least for the near future. Rating: Hold.

Fundamentals

Lam Research ($LRCX) reported record financial results for the September 2025 quarter (Q1). Revenue was $5.3 billion for the quarter, +3% vs. previous quarter and +28% YoY. TTM revenue was $19.6 billion. They reported record gross margin, but note we expect a bit of a slowdown next quarter, see below.