Lumen Technologies Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

“Because AI Won’t Run On Yesterday’s Internet"

by Alex King, CEO, Cestrian Capital Research, Inc.

I have to tell you I am prone to a little reductionist telecom. Most telcos get all bent out of shape doing something other than moving photons, electrons and radiowaves from point A to point B as quickly and reliably as possible. Data transport is an exceptionally profitable and cash generative business if you do it right. Pretending to be a “solutions provider” aka. a consulting firm, or a consumer brand, isn’t exceptionally profitable or cash generative when it’s being done by telecom people. Different skillset.

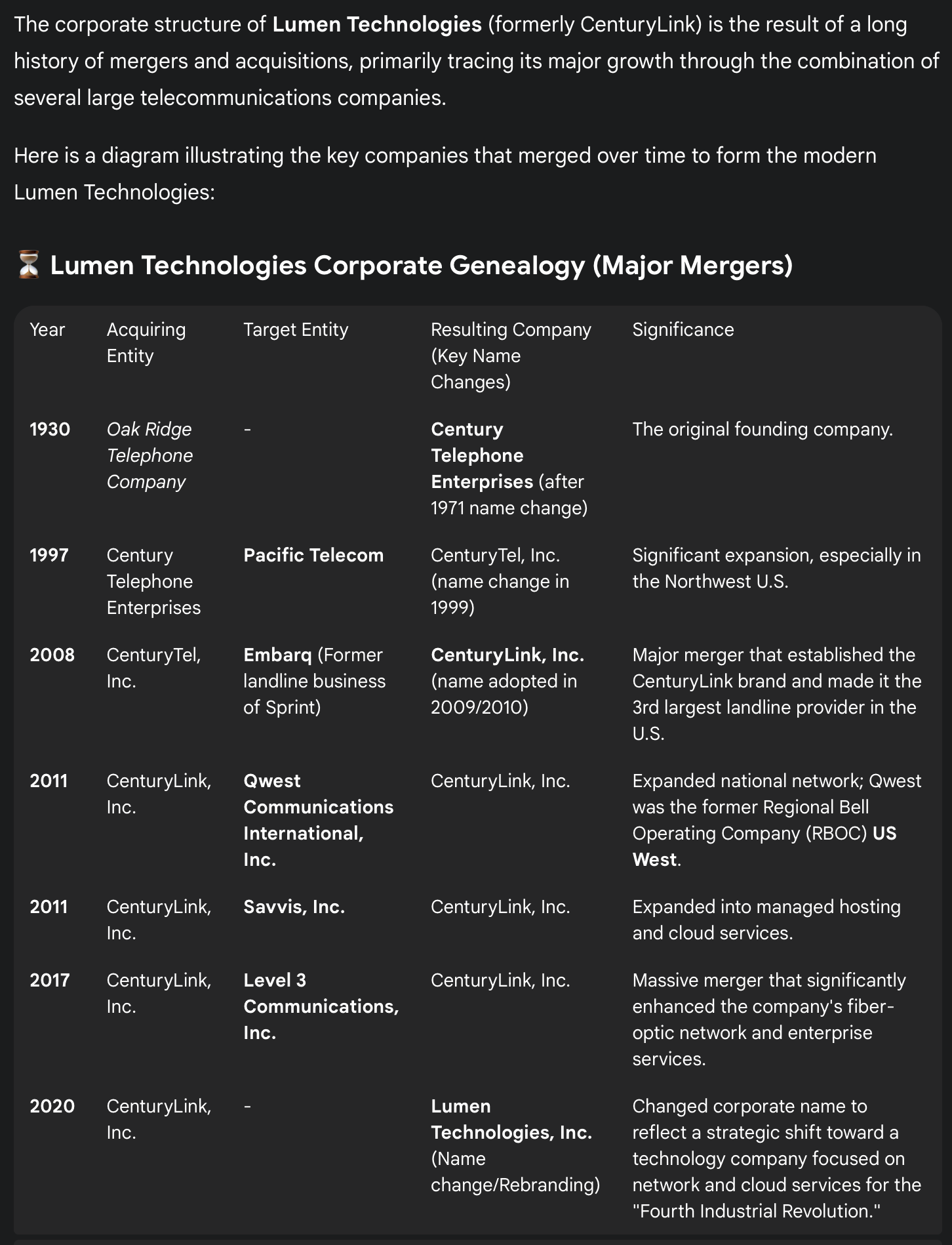

Lumen Technologies ($LUMN) was born a grab-bag of pieces of the US telecom landscape that were detonated by the 1984 breakup of ATT, then had endless capital flung at them during the 1990s fiber boom, were then restructured, sold, re-restructured, and then finally all fell back to Earth in new configurations under new ownership.

Rather than actually do the work myself, I asked Google Gemini to prep the slide.

Now, there is more restructuring yet. Right now there is a $3.8bn “assets held for sale” line item on the Lumen balance sheet, which pertains to this planned sale of consumer fiber assets to AT&T.

What’s left behind is a fairly clean enterprise-focused telecom business that is building a large order book of datacenter interconnect services. The value proposition is fairly simple which is, if you want your datacenter to have a high bandwidth connection to what old people call the Internet backbone, and you want it delivered by a pureplay provider that can connect in cities across the US, you call Lumen. (I note that I think I was writing similar sentences in about 1998 about companies like Qwest and Level 3. It didn’t work out so well for them, but this time around the customers have actual money and are actually spending it on Lumen services, so maybe this time is different, we shall see).

The stock is on the ups, closing today at $10.28, having been under quiet and steady institutional accumulation between $3-5/share. I think there’s more to come. We rate the stock at Hold.

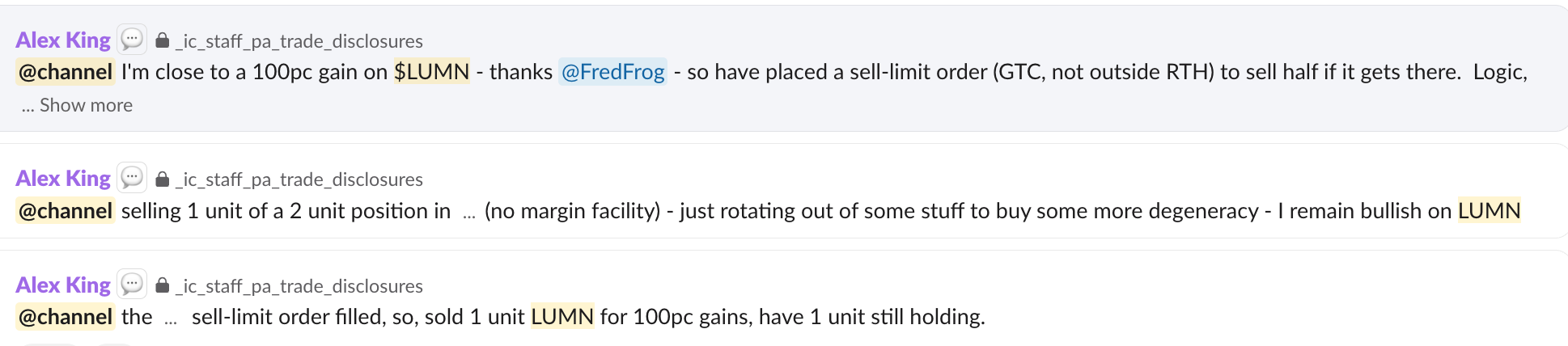

Those of our Inner Circle members who have followed this name have had the opportunity to bank gains of over 100% so far. The original idea for this stock came from one of our esteemed community members, a certain FredFrog (probably not his real name).

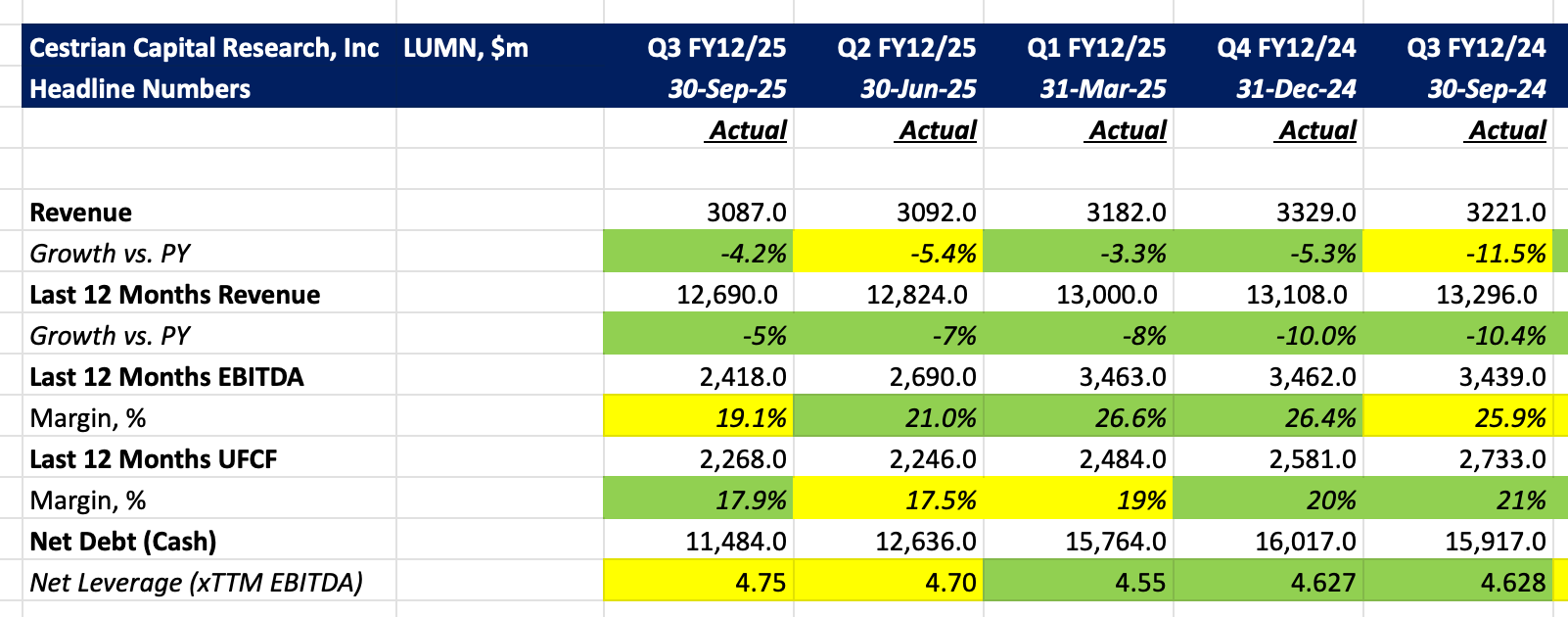

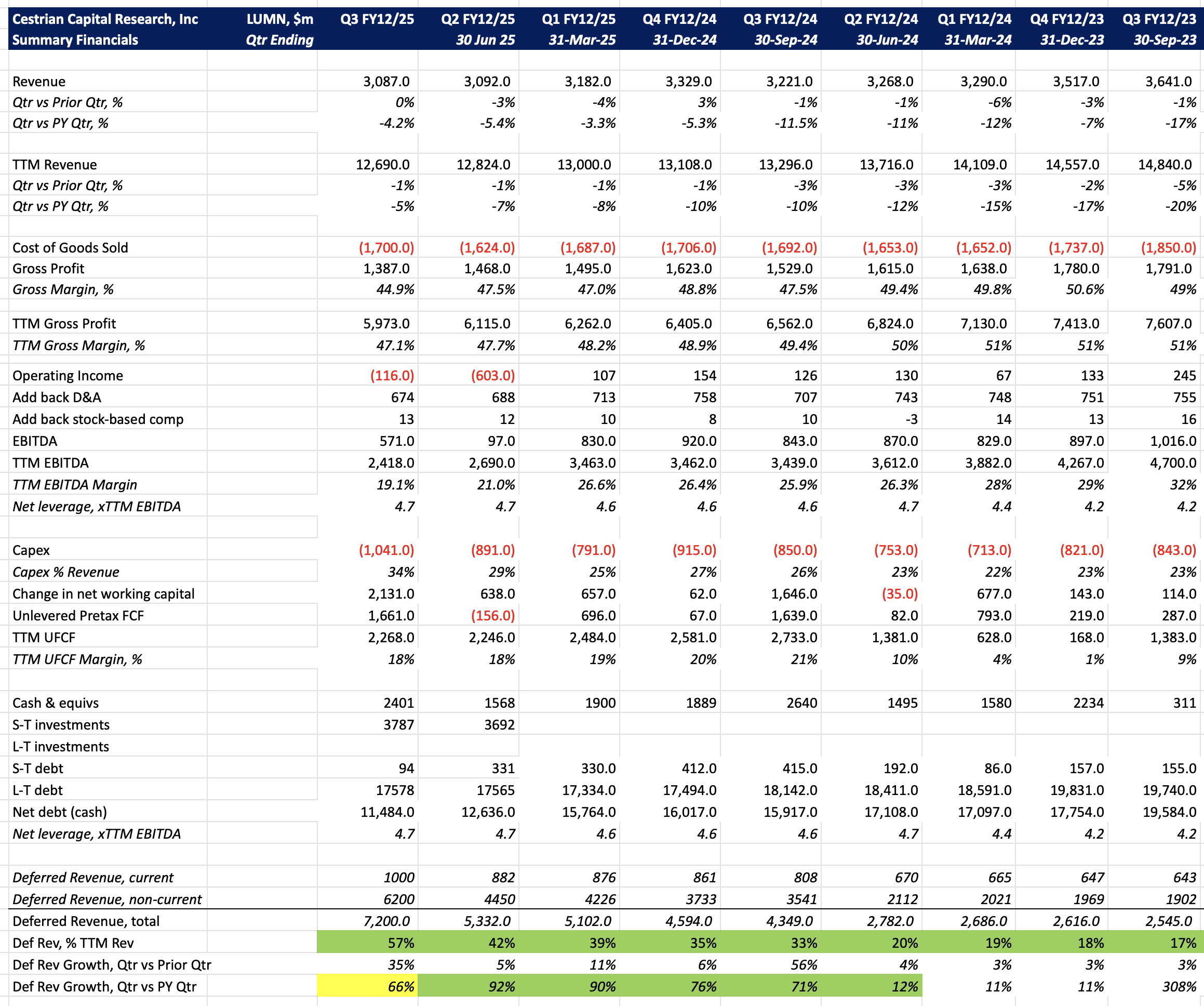

Summary Fundamentals

In complex merger / demerger situations like this one you can’t see reality through the GAAP numbers. And since the CFO probably isn’t going to be able to explain it all without going to jail, I find that if you watch net debt, net leverage, and the general direction of cashflows during the period of flux, you can at least see if things are going south fast. LUMN looks fine.

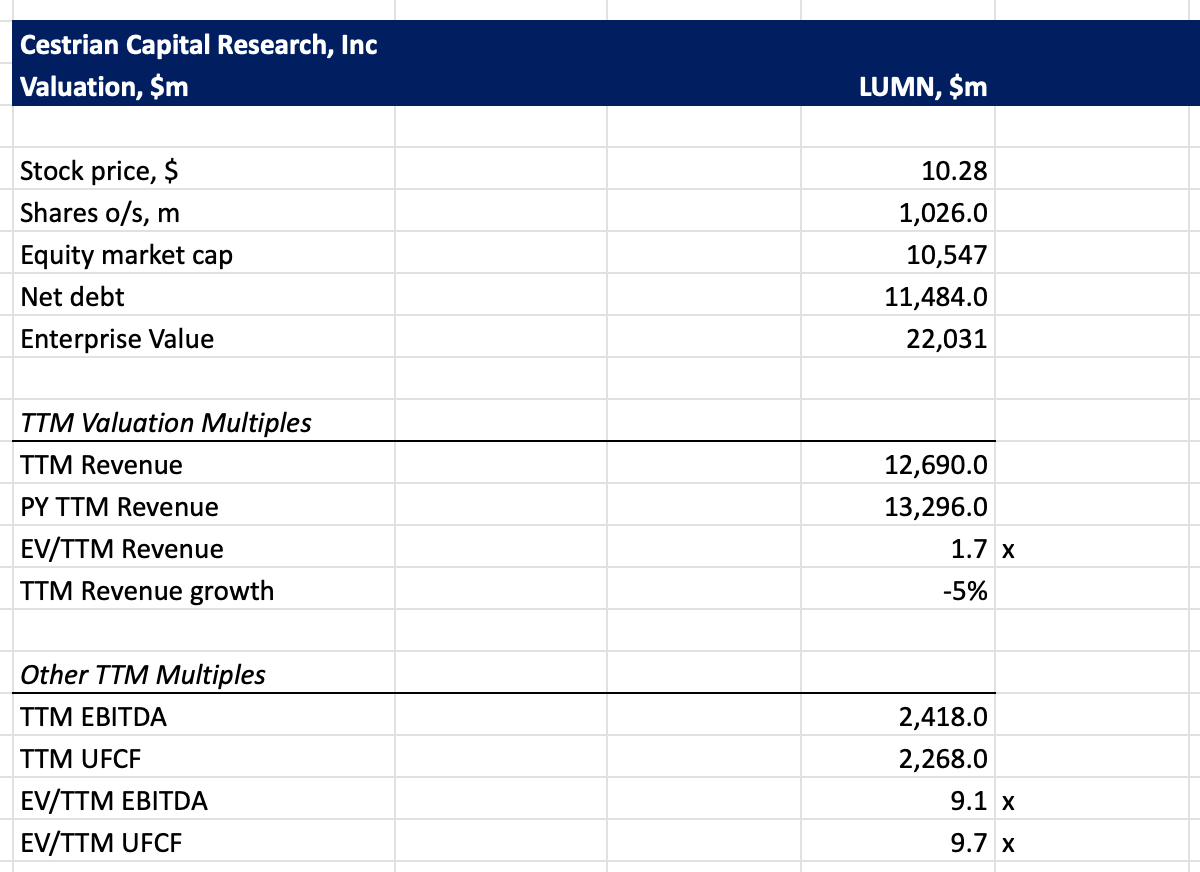

Valuation

Sub 10x TTM unlevered pretax FCF isn’t expensive for this stock.

Stock Chart And Price Outlook

First the bigger picture. You can open a full page version of this chart, here.

The stock is in the markup phase ie. large accounts are done buying and now it’s time for the good news stories to make their way around the market, to encourage the poors to buy too. After a period of time, bigs will dump their holdings on the poors in the ordinary course. I think that may start to happen around $12.60, the 100% Fib extension of that Wave 1 placed at the Wave 2 low; the stock could make it to $18 (the 1.618 Fib extension) in time but at that point I myself would definitely be selling.

Zooming in - today the stock opened down on the earnings print, sold off, touched the 21-day exponential moving average and then made like a scalded cat to close the day nicely after all. I’ve noted the gain above from our Inner Circle entry price. Full page version, here.

Rating

We rate the stock at Hold. Wiser heads already loaded up, time to ride the wave up a little longer and then sell once price starts to level off and volume pick up once more.

Appendix: Detailed Fundamentals

Cestrian Capital Research, Inc - 31 October 2025.

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long position(s) in $LUMN.