Market Before The Open, Monday 21 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The GENIUS Is Out Of The Bottle

by Alex King, CEO, Cestrian Capital Research, Inc

I think the impact of the GENIUS Act is likely under-appreciated by most investors. Ostensibly focused on legitimizing stablecoins (which are intended as a way to transform U.S. dollars into a currency capable of trading cryptocurrencies more easily), to me the major impact of the Act will be to (i) increase demand for US Treasuries & the US dollar - because in theory stablecoins are collateralized by US dollar or US Treasury holdings and (ii) to lighten the regulatory burden on the asset management industry by anointing the creation of tokenized assets - digital representations of real-world assets with the Ethereum blockchain as the primary database of record.

I believe we will see a move to classify many of these tokens as not-securities and therefore not subject to the protective laws offered by a century or more of securities law. The primary beneficiary of any such move will be the asset management industry. Less protections for investors would mean greater profits for managers, all other things being equal.

As always with new regulatory environments, new opportunities will nevertheless abound. Today, a handful of companies are engaged in an arms race to acquire large positions in Ether, the cryptocurrency used to pay for transaction (“gas”) fees on the Ethereum blockchain (which will be the basis of all these newly tokenized assets). This is creating significant price moves in Ether, and since these companies’ sole meaningful activity is to lever up and acquire Ether, then for as long as the merry-go-round continues, there are likely gains to be had in Ether itself as well as the stocks of the treasury companies.

We posted a note on this earlier today. This is an important market development right now.

Let's get to work.

HEADS UP - we launch the premium version of our Big Money Crypto service very soon. Look out for the announcement. We’ll be running deeply discounted launch pricing until end July. If you want to pre-register for this service just drop us a line using this contact form.

US 10-Year Yield

Still within this 5-wave down move.

Equity Volatility

The Vix remains on the floor, meaning very little demand for >30DTE S&P500 puts at present.

Disclosure: No position in any Vix-based securities.

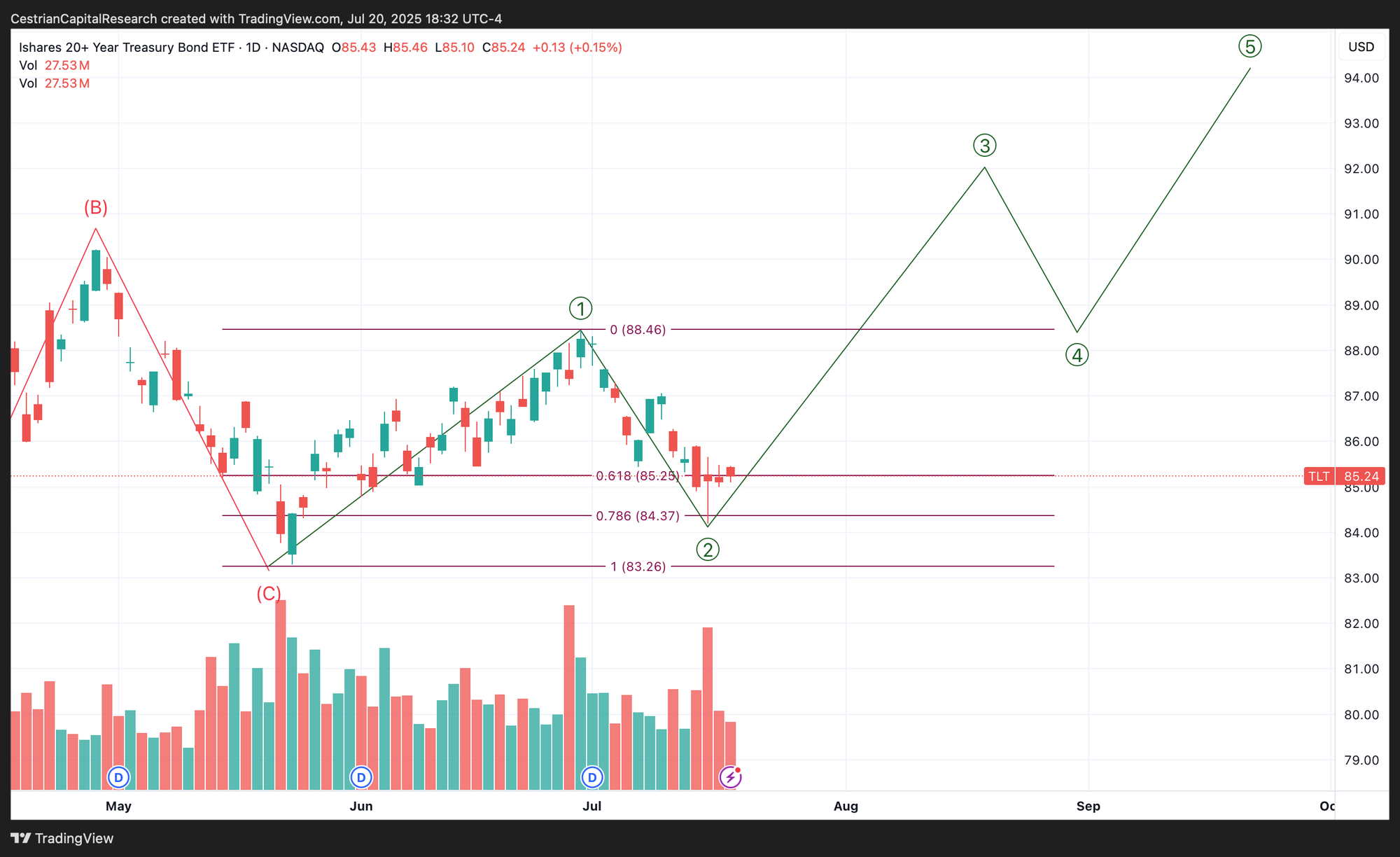

Longer-Term Treasury Bonds (TLT / TMF)

No change on this timeframe.

That continues to look a righteous Wave 2 low, if so, a Wave 3 is next - bullish!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Again, holding over the Wave 2 low nicely.

Disclosure: I am unhedged long $TLT, $TMF and similar EU UCITS ETFs.

Ether

Ether remains the best risk/reward opportunity in crypto in my view. It is earlier in its bull move than is Bitcoin, it has real fundamental demand (from the levered Ether Treasury Companies - BitMine, SharpLink etc), and real-world applications (paying transaction processing fees to the Ethereum blockchain to host tokenized asset representations).

Read why I think that, here.

Ether itself is in a powerful move up at the moment, a result of competitive accumulation by the above. This Wave 3 up may reach somewhere between $3950-4500 before taking a breath.

Disclosure - Long $ETHE and various other members of the Ether complex.

Oil (USO / WTI / UCO)

The wedge pattern continues to consolidate on the monthly.

Holding the lows; looks bullish to me.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Also looks like it is getting ready to move up.

Disclosure: No position in oil.

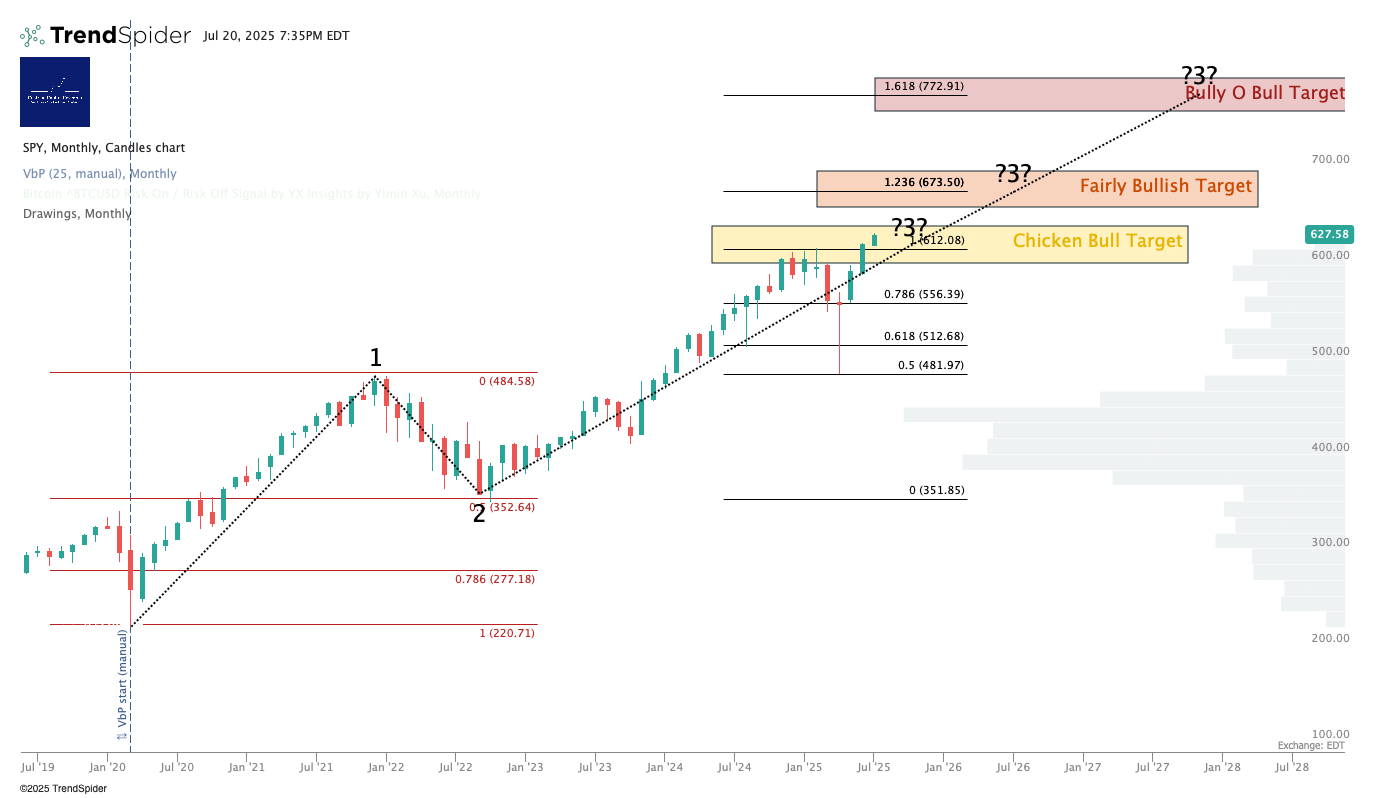

S&P500 / SPY / ES / UPRO

Nothing bearish in sight on this longer term chart.

Obviously this “should” be a distribution pattern - high volume x price at the highs, momentum divergence etc etc. So the price, short-term, of SPY, should be going down soon. Right? Well, maybe but it has threatened to drop for a long time and not done so - I would be wary of short positions until such time as price actually starts falling.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

The same story as SPY.

Disclosure: I am long $IUSA, long $UPRO, and long SPY puts for September expiry. In aggregate net long the S&P.

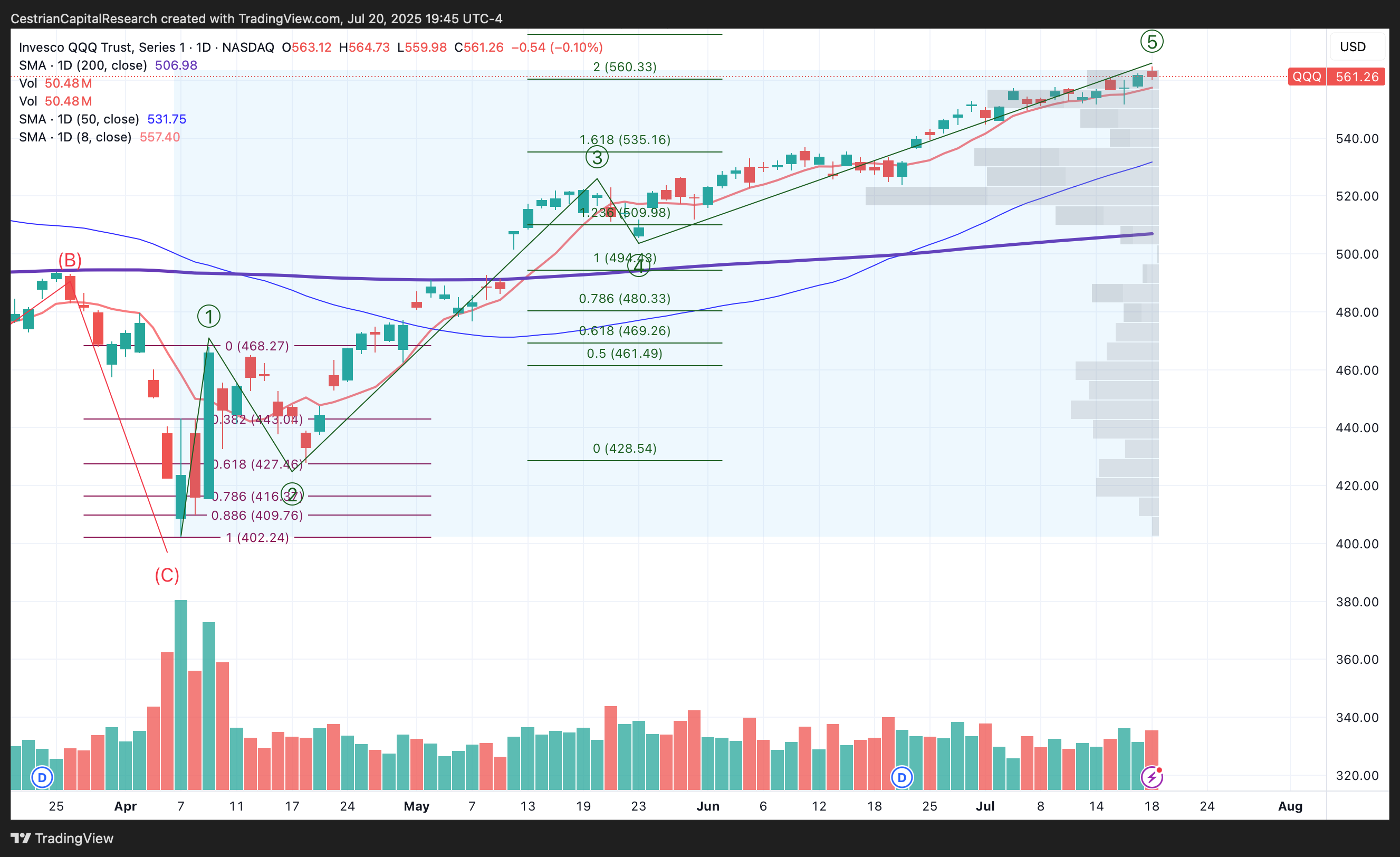

Nasdaq-100 / QQQ / NQ / TQQQ

Bullish through year end.

Continuing up for now.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Continues to look like a topping pattern in TQQQ and an accumulation-at-the-lows channel in SQQQ. Suggests a downturn on the way.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, long $QQQ, and have $TQQQ and $QQQ puts for September expiry. Overall broadly neutral the Nasdaq but significantly net long growth equities.

The full morning note, available to Inner Circle members, also includes coverage of: DIA, UDOW, XLK, TECL, SOXX, and SOXL.

Alex King, Cestrian Capital Research, Inc - 21 July 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, QQQ, UPRO, IUSA, SOXL, SOXS, SMH, XLK, TLT, TMF, DTLA, SDOW, ETHE; also long SOXS calls and September TQQQ, QQQ and SPY puts.