Market On Open, Friday 20 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

All For Themselves, After All

by Alex King, CEO, Cestrian Capital Research, Inc

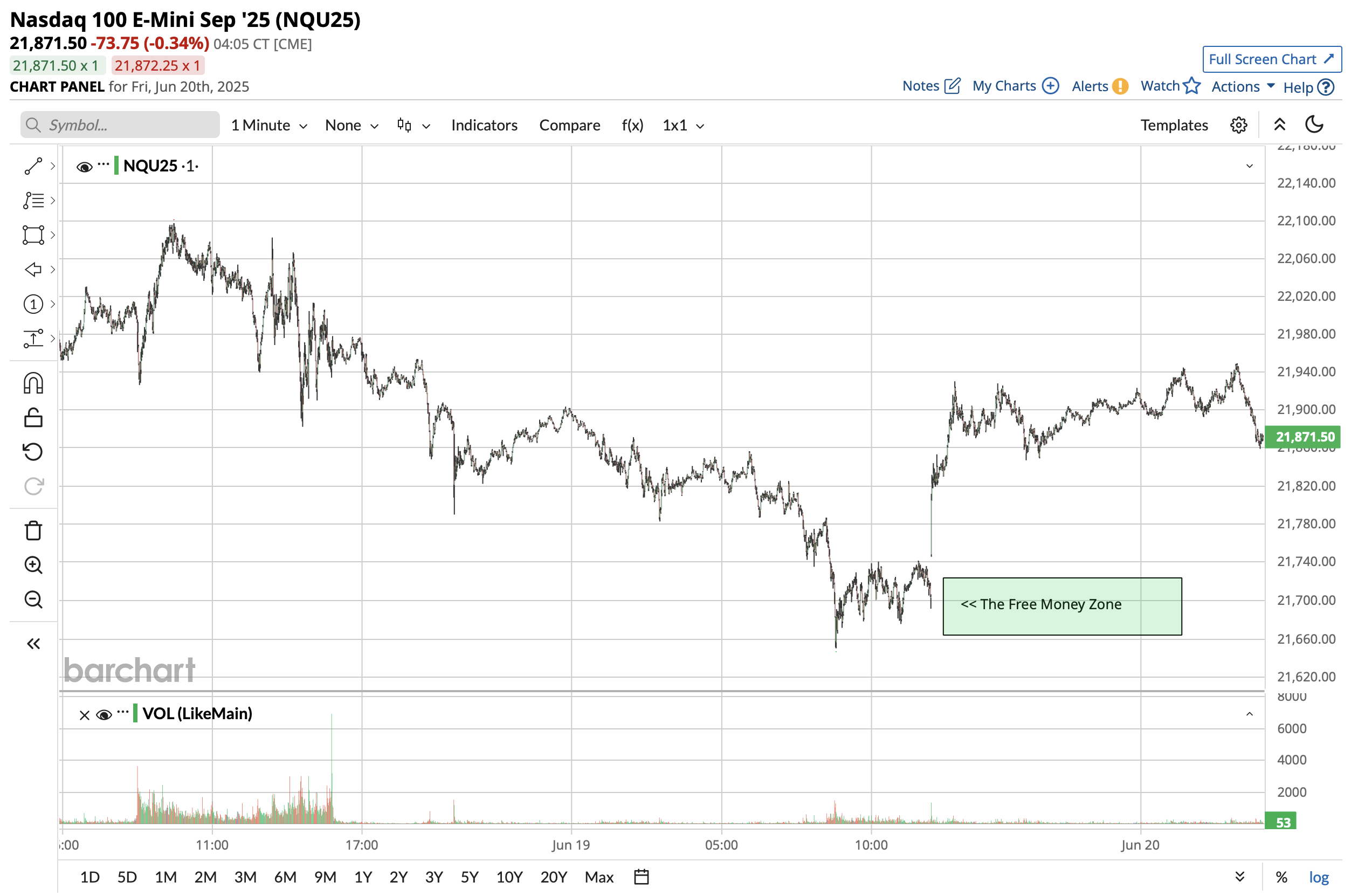

Market-makers had a wonderful time yesterday. Futures were trading but equities were not. A not-small selloff in S&P500 and Nasdaq-100 futures provided opportunities to both (i) get out of short hedges and also (ii) add to long positions at local lows. This Free Money Zone was not, of course, available to mere mortals who dare not risk becoming Turbo Bankrupt by playing with futures fire.

Zooming out, markets continue to be somewhat directionless in the short term; in the last two weeks, $SPY has moved between $591 and $605, less than a +/-2% move from the midpoint of the range.

Markets don’t trend sideways forever - normally this kind of rangebound sideways price action is indicative of price-setting investors engaging in either accumulation at local lows, or distribution at local highs; soon we will find out which of those it was, I think. The point of the sideways action is to bore the unsuspecting into not expecting the big move that follows. And the job of the investor is simply to be ready for that move, whether it be a break to the upside or a breakdown to the downside.

Let’s get ready by studying where markets stand right now.