Market On Open, Friday 8 August

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Seasonality Bros Are Cooked. So Far.

by Alex King, CEO, Cestrian Capital Research, Inc

Normally in August, the grownups head for the Hamptons having degrossed and hedged the book somewhat, leaving some unholy admixture of junior MDs, interns and algos to manage the shop. This has many benefits if you are a member of the Master Of The Universe cohort. Firstly, whilst technically speaking anything that goes wrong is your fault, you can at least in the first instance blame it on the junior MD, the intern or the algos. Meaning that before you yourself are fired at least you get to exact revenge on the guy who thinks he’s smarter than you, also on the wide-eyed naiif who thinks he’s investing to help people’s retirements, and on the algo that you know is going to go rogue one day and lock everyone out of the building. And secondly…. maybe just maybe you don’t get fired because you convince your boss, at least for now, that the drop in your book has at least enabled you to refresh the team. Finally, if you actually did it right, your short hedges are in the green and you can cash in those fat juicy puts to buy the Mag7 at the Q3 lows in order that you look a hero into year end. And it doesn’t matter about the junior, the intern or the algo because I’M A MASTER OF THE UNIVERSE AND THEY HAD BETTER BELIEVE IT. Phew! Made it through one more year. (You think this life is easy? It’s not easy).

Seasonality bros right now are hurting. At this point if you are following the standard Q3 playbook, it’s looking like - the horror! - you may have to summer in Montauk next year with all the proles. Ew. Those long puts are burrowing into your new yacht budget and as for your hedges, well, pretty sure they were the junior guy’s idea anyway.

All of this is just another way of saying - yes, we “should” have had a seasonal pullback by around now, but no we haven’t, so be prepared for the market to just keep grinding upwards. If you have hedges of any kind - short ETFs, puts, whatever - have a plan to deal with them if they just keep grinding lower. Remember there is no shame in eating crow now in order to eat like a king later. Quitting out your shorts, or over-hedging them long to take advantage of the bull that keeps running, is fine. You can always re-hedge later on at a higher level. In markets as in life, nobody likes trapped shorts. So … as I always say … trade the market in front of you, not the market in your head or the one on the seasonality chart.

Now where’s that champagne dammit?

Whilst we’re waiting for the bar guy to bring it over - lol he was a junior MD last year but he traded the market he thought was going to happen, so now he mainly mixes drinks in between putting charcoal on the grill - let’s get to work. Hurry up, jeez.

Don't Get Left Behind.

If you didn’t read it already, read this, now. And I mean now.

Next up - a shortened version of our subscriber-only daily take on markets.

If you’d like to sign up for this every day - you want the Inner Circle subscription, here.

US 10-Year Yield

I remain of the view that the yield will continue to drop on this timeframe.

Equity Volatility

Zzzz. Nobody is worried about anything.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

Also zzzzz. Good zzzzz I think. Everyone is sleeping on bonds. Suits me fine.

Price is congested right now by which I mean you have two moving averages (the 8-day SMA and the 21-day EMA) and spot price all tripping over one another. Another green close or two and we’ll see the 8-day up and over the 21-day once more, which would be bullish.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same logic for TMF.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Ether

A renewed attempt at a real Wave 3 high.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

Oil (USO / WTI / UCO)

I have to say this chart spooks me a little. Oil consolidating within that wedge pattern for such a long time - that’s a monthly chart! - means that when it breaks out of the wedge it’s going to break hard one way or the other. To the upside likely means some major geopolitical crisis, and to the downside likely means some major economic crisis. The benefits of sideways are underappreciated.

Continues to hold over $64 - a break to the downside would have me getting out if I was long oil, which I am not.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same logic as CL_F.

Disclosure: No position in oil.

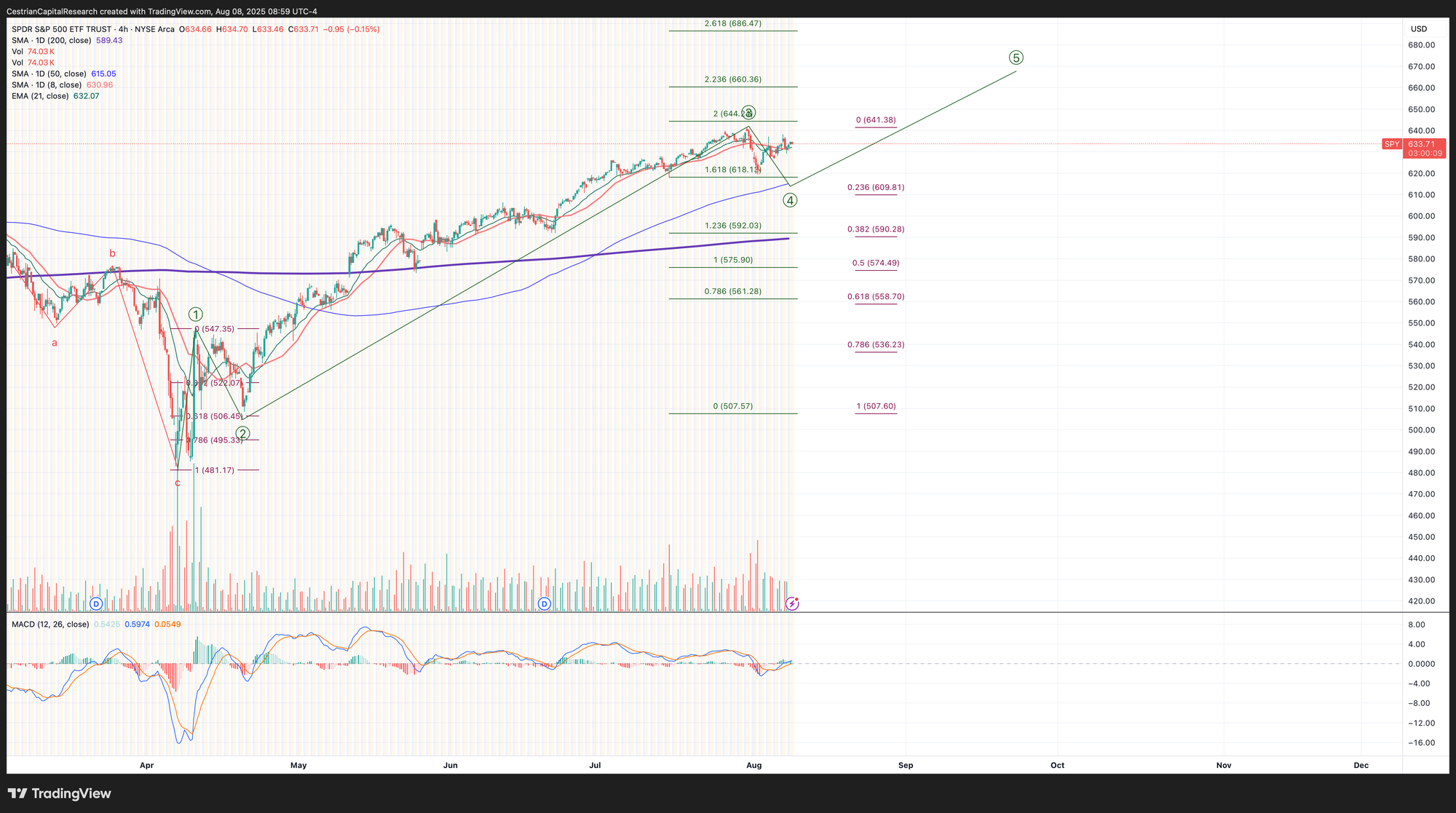

S&P500 / SPY / ES / UPRO

Local tops happen when indices cannot make new highs. If no new high in August, the chance of a selloff in September rises.

Again, has to make a new high or we likely see a correction. The longer stocks stay elevated, the more folks rush in with levered longs, the more money there is to take off of them with a selldown. Leverage is very much your friend if you learn how to make your own work for you - and other people’s work for you!

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Someone has been hoovering up SPXU down here at the lows, and I don’t think it’s Chad. I think it’s that guy at the Hamptons. And I think he means to get paid too.

Disclosure: I am long $IUSA, and long SPY puts for September expiry. In aggregate net long the S&P.

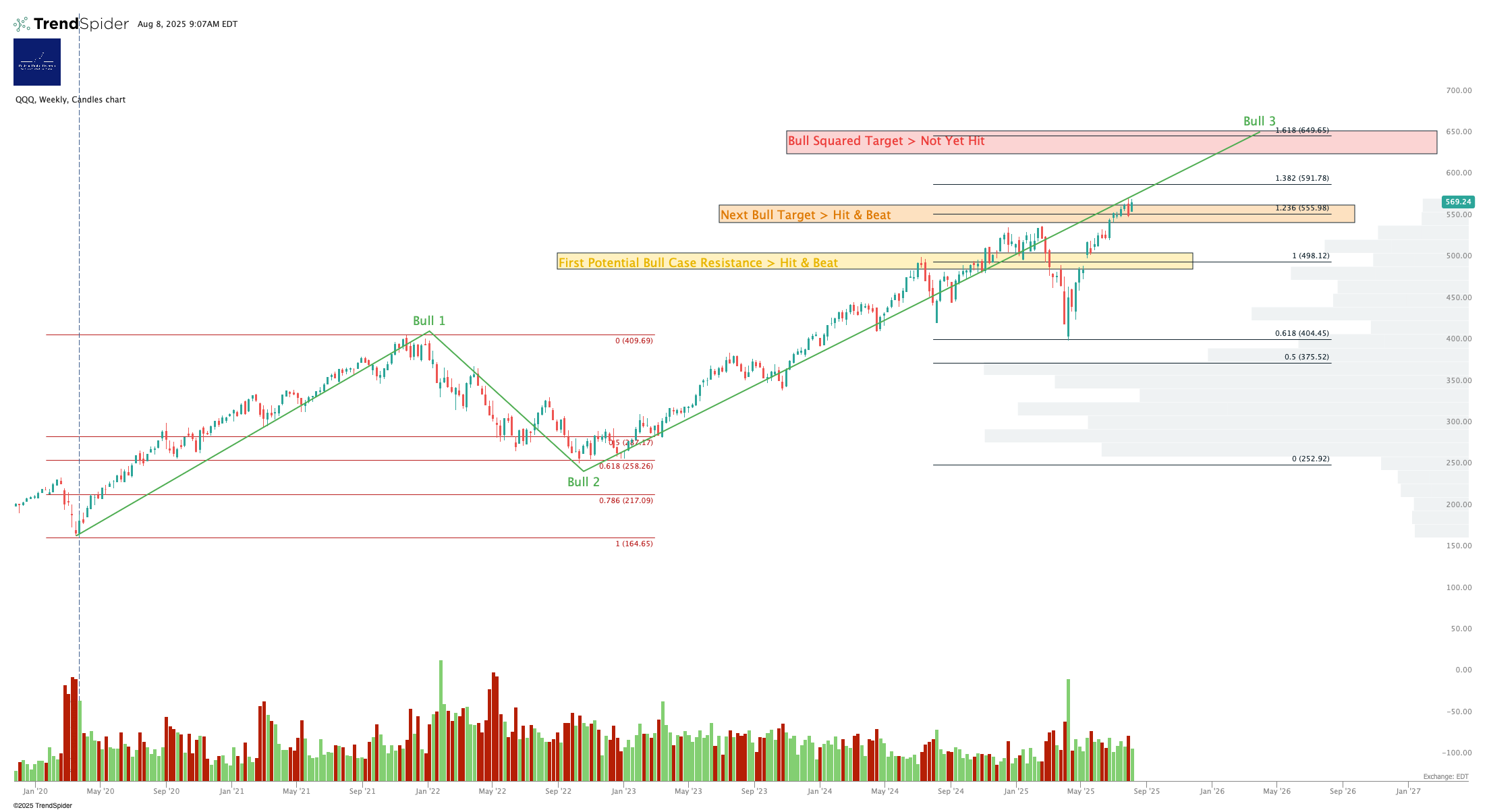

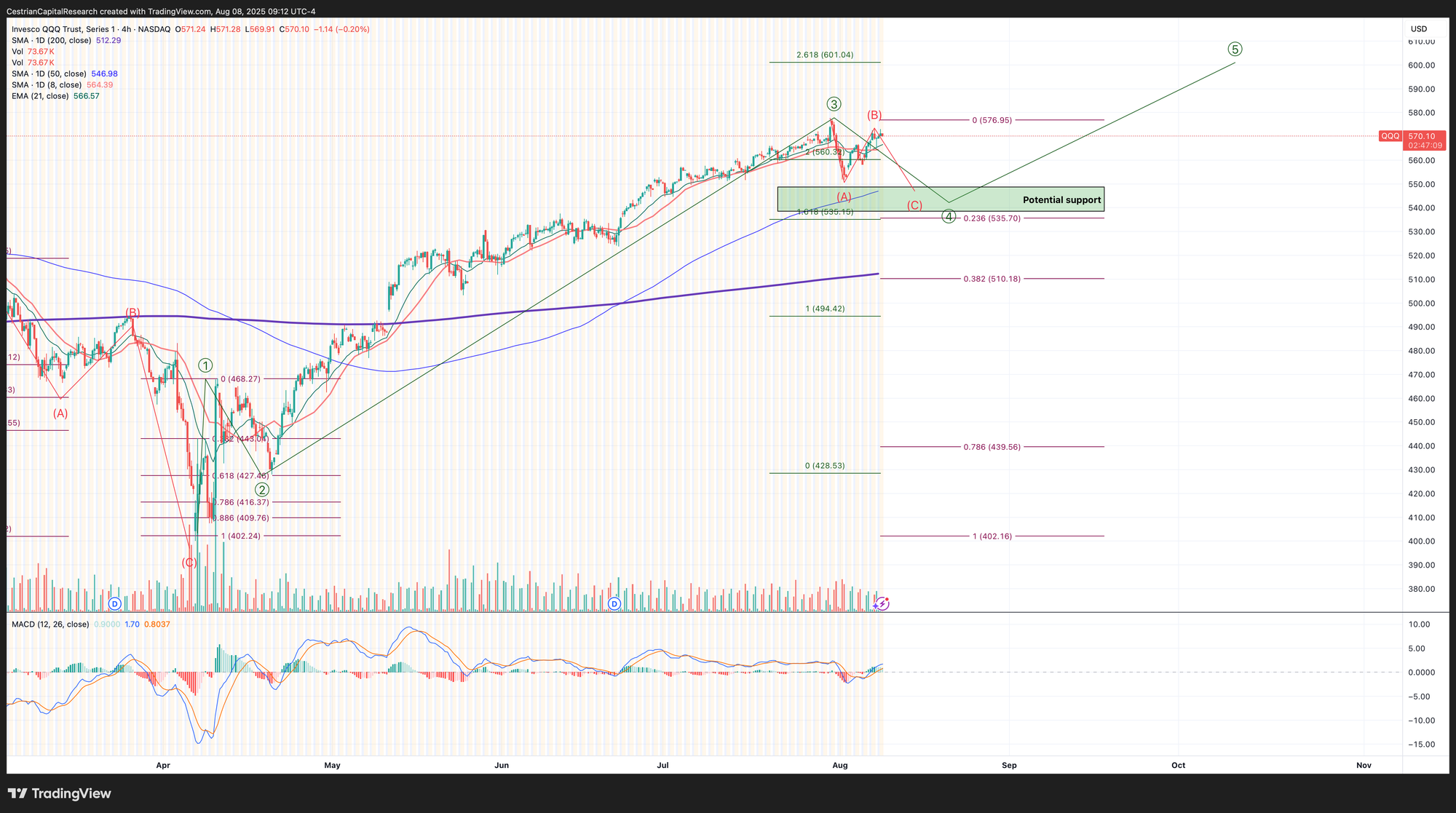

Nasdaq-100 / QQQ / NQ / TQQQ

Same as for SPY - must make a new high in August or risk a selldown in September.

Potential path of a correction show, should any such correction ever happen!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

There’s that guy again hoovering up the $SQQQ.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for September expiry. Slightly net short the Nasdaq ETFs (but for clarity I am bullish on the market - I am overhedged long via other pro-growth positions).

Want coverage of the semiconductor and tech sectors plus the Dow and more? Sign up to join our Inner Circle, here.

Alex King, Cestrian Capital Research, Inc - 8 August 2025.