Market On Open, Thursday 14 August

Help Please!

Before we get into it today - we’re in the middle of reviewing the services we publish and how we go about publishing them. We spend a lot of time in our own echo chamber. If you have a few moments to give us your thoughts (completely anonymously - we won’t ask for your personal details, and as we won’t have any such data we won’t be selling it to anyone), please do so using the link below. It would be much appreciated - we aim to get better by listening to our readers and subscribers.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Cryptomania II

by Alex King, CEO, Cestrian Capital Research, Inc

Bitcoin hit new all time highs overnight, and Ether is not very far behind. What this means is that crypto will be all over the news once more and it will suck in capital from all sorts of places that have no business investing in it and, indeed, will probably invest in the wrong kind of crypto, which is to say they probably won’t invest in Big Money Crypto.

The whole question in crypto right now - and no-one knows the answer - is:

- When this bull market rolls over, and stocks begin to sell off, will crypto also dump?

- And will there be any differentiation between the major coins during the next bear market?

I’m truly interested in this. I would assume that the long list of altcoins will mostly be crushed in the next bear, since they are largely used as gambling chips and when folks have less money, they gamble less money. I can see an argument that Ether may hold up better than the others, perhaps better than Bitcoin, because it is the chip used to pay the piper of tokenization - and tokenization has a shelf life way beyond this bull market in my view.

In investing, the right answers are never the easy ones. If you blindly assume that Ether will continue its meteoric rise because Tom Lee, you’ll be wrong. If you unthinkingly assume that Ether will be crushed alongside a bunch of other stuff on Pumpfun, you’ll be wrong.

Fortunately we have a way to know, and that way is price and volume. Price and volume will tell us what is happening in Ether, in Bitcoin, Solana and everything else. Since crypto is now a Wall Street project, it will start to behave more like Wall Street behaves. And that’s our wheelhouse. So stay tuned!

Now let’s get to work. Today’s Market On Open note is free, no-paywall, for all to read. If you like what you see, join up for our Inner Circle service - this. Any problems signing up, reach out to us by e-mailing minerva@cestriancapital.com .

Thanks all!

US 10-Year Yield

Continues to fall.

Equity Volatility

Everyone is asleep and not worried. The next potential wakeup call is Friday’s options expiry. You’ll know if people start worrying because IT WILL BE ALL OVER THE NEWS AND SOCIAL MEDIA THAT IT IS ALL OVER.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

No change. People are sleeping on bonds.

Hit resistance at the 8-day moving average yesterday. Eyes on the prize - it’s all about getting up and over that 200-day.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

As for TLT, so for TMF.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Ether

My guess is that this is in the later stages of a Wave 3 up on the timeframe shown. Could hit the low 5000s before reversing. People will think the next drop is a RUN FOR THE HILLS moment, but I believe it will just be a shakeout of levered longs before getting back to Ether’s main business right now, which is shaking out levered shorts.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at our Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

Oil (USO / WTI / UCO)

Consolidation continues.

An a-b-c down move is in progress I think.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Here’s that A, B, C in $UCO too.

Disclosure: No position in oil.

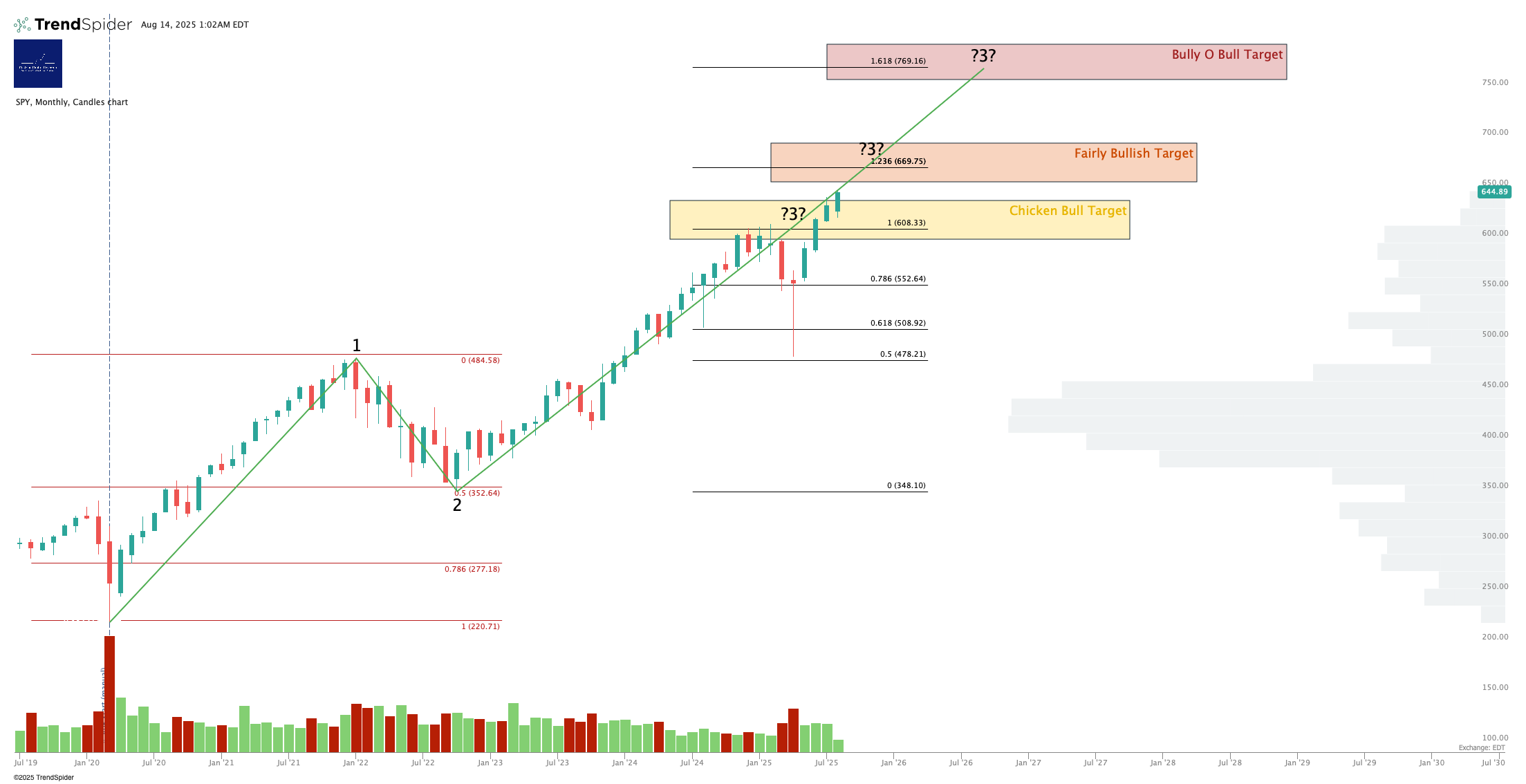

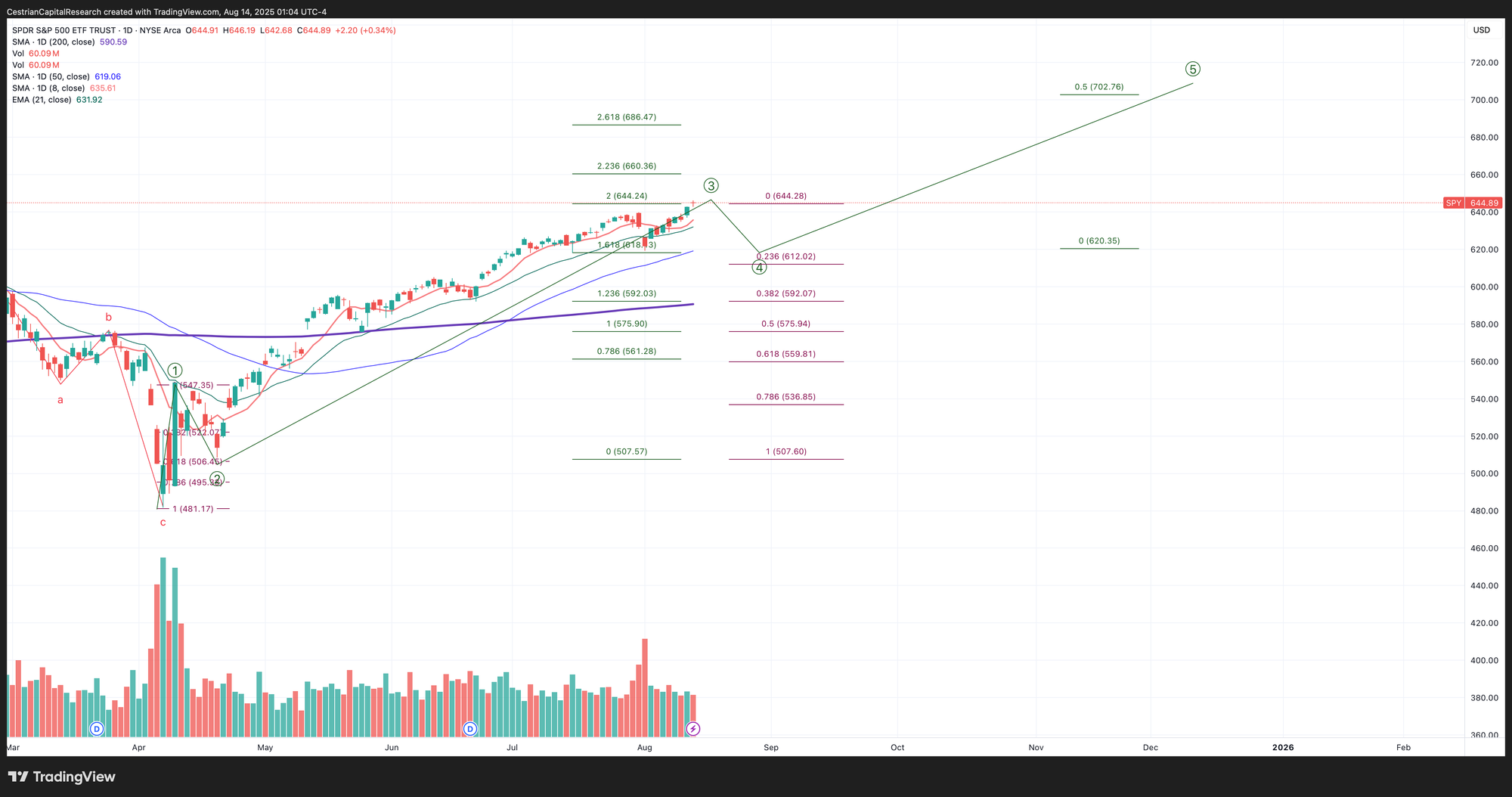

S&P500 / SPY / ES / UPRO

The wealthmaker that nonetheless makes everyone unhappy. Go figure.

So we hit that 200% Wave 3 extension right before August opex. This will prove to be (i) the OF COURSE WE SHOULD HAVE KNOWN moment or (ii) a nothingburger - no-one knows until opex hits. Be ready though, just in case!

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

All these levered-short ETFs - like $SPXU on the right hand side below - look the same. The breadcrumb trail of hedgooors who jumped in too soon. That’s a lot of accumulation though; usually in the pro instruments (you don’t see much of Chad on the levered-short-SPX side) these things pay off, so we shall see.

Disclosure: I am long $IUSA, and long SPY puts for September expiry. In aggregate net long the S&P.

Nasdaq-100 / QQQ / NQ / TQQQ

This chart alone says to me that this bull run is not finished if you zoom out and have months as your unit of time. We may or may not get a correction from now until end September - often the market does that in order to scare normal folks so that your friendly neighborhood Master of the Universe can scoop up your $VOO and whatnot at low low prices, the better to run them up into the religious festival known as Year End Bonus Season - but even if we do, I think it will be a modest one before another push higher. Look to the $650 zip code in the QQQ for year end, I think.

So let’s set our sights on that 2.618 extension at $600ish as the potential near term resistance for QQQ.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Here’s those premature hedgoors again over on the $SQQQ side.

Reader, I am one of them. Forgive me, Mammon, for I have sinned.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for September expiry. Slightly net short the Nasdaq ETFs (but for clarity I am bullish on the market - I am overhedged long via other pro-growth positions).

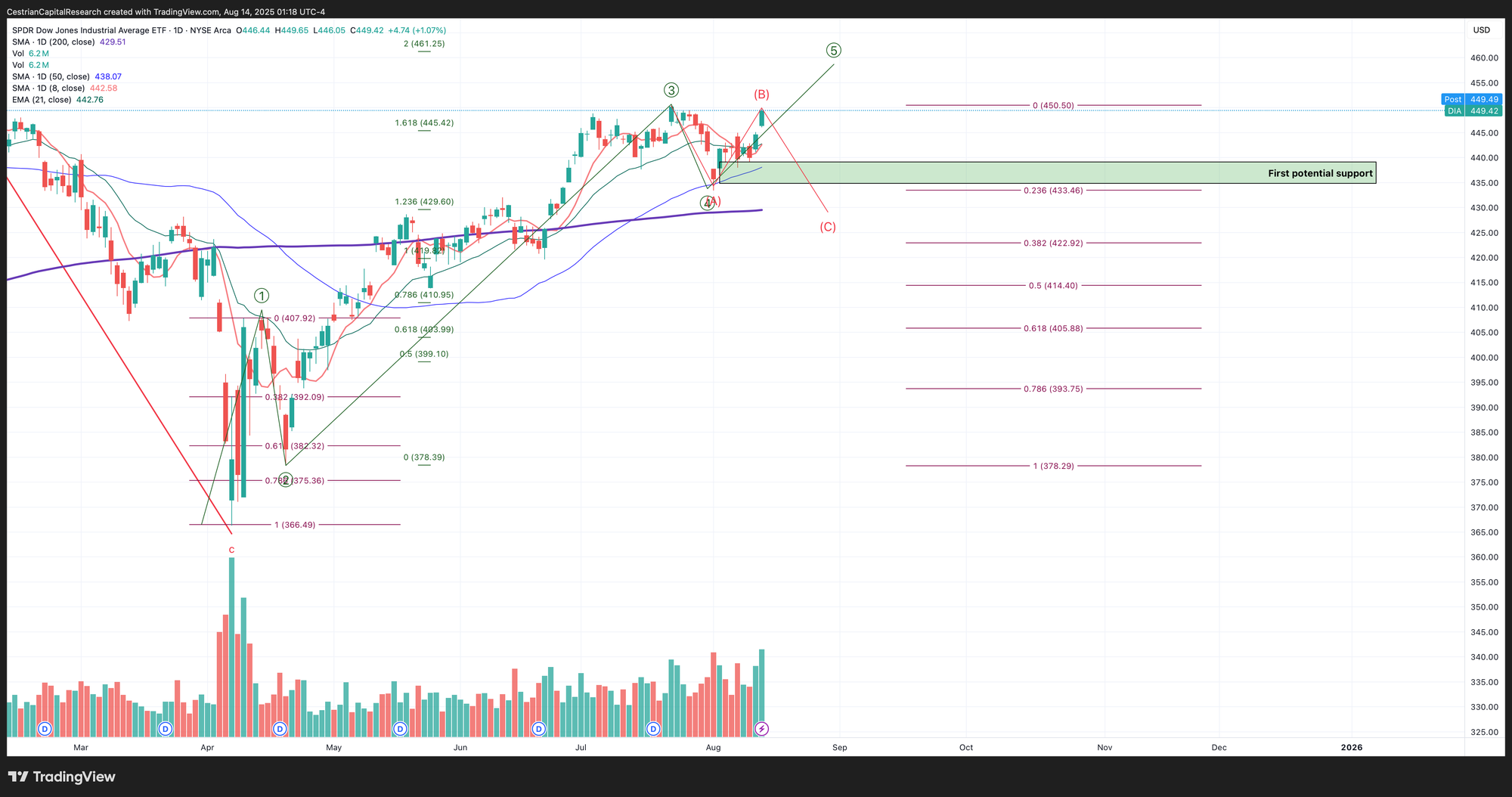

Dow Jones / DIA / YM / UDOW

Finally … Grandpa is thinking about joining the party!

If tomorrow’s opex is a rug pull, and everyone is bailing out just as the old folks arrive, this is what a corrective a-b-c move may look like in the Dow.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Dow shorts were served a dose of humble pie yesterday. $AAPL pie of course.

Disclosure: No position in the Dow.

Sector ETFs

if $XLK corrects near term, I would expect $240 to hold as support (because it held as resistance for a long time).

Disclosure: I am unhedged long $XLK.

3x Levered Long/Short Tech - TECL/TECS

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Oho! A step up in hopeful bears down here at the lows in $TECS.

Disclosure: No position in TECL or TECS

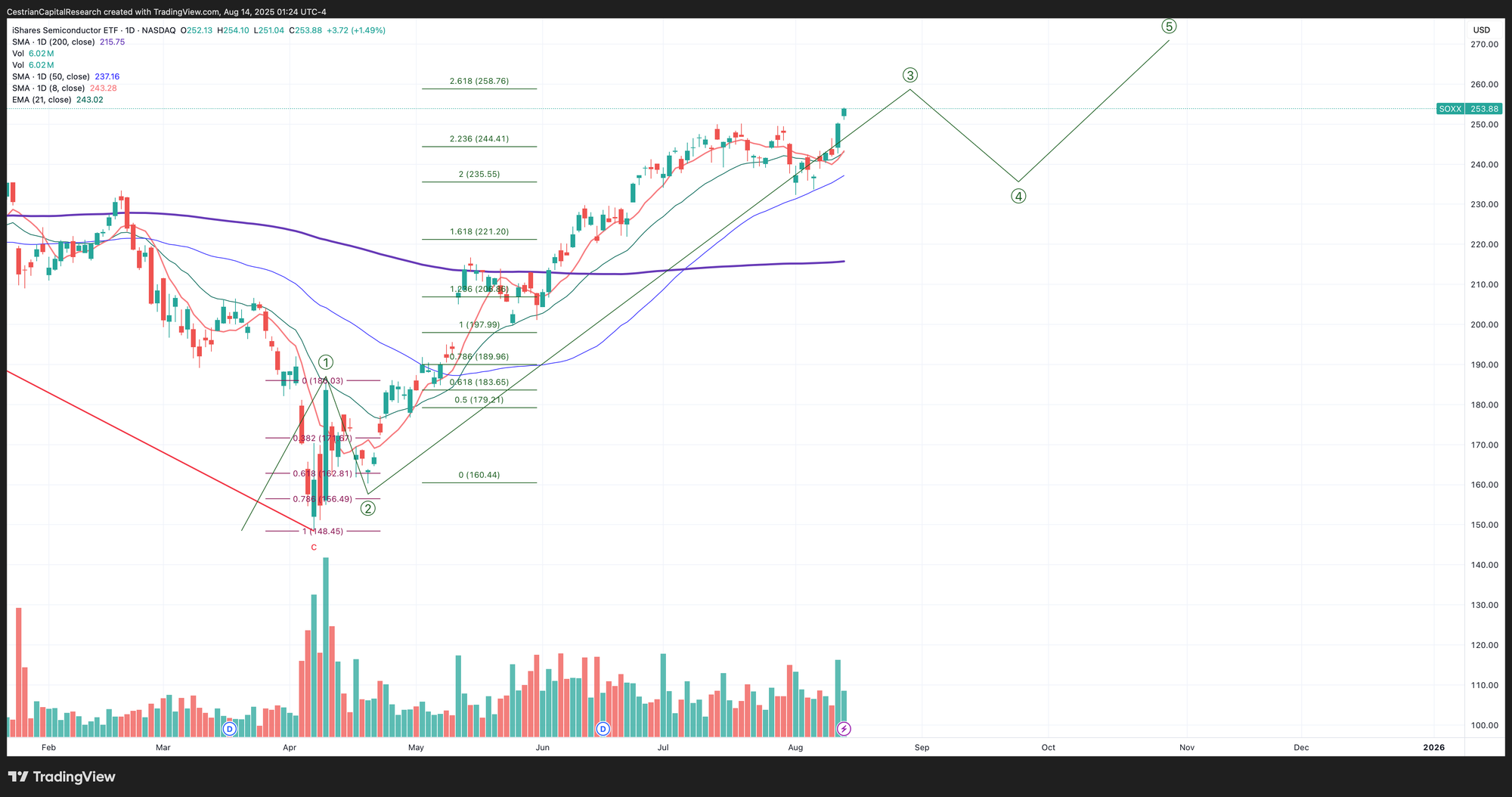

SOXX (Semiconductor)

$258 possible target for what I think must be an ongoing Wave 3. Semiconductor has been a beast since the April lows.

3x Levered Long / Short Semiconductor - SOXL / SOXS

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

If, big if, this is the final act of the semiconductor bull run from the April lows (again, I don’t mean the abyss comes next, I mean if a correction comes next) then here’s how SOXL may look. Certainly there is a bear club gathering in SOXS as you can see from the volume x price indicator there.

Disclosure: I am hedged 1:1 $SOXL:$SOXS, and long $SMH - overall net long semiconductor.

Alex King, Cestrian Capital Research, Inc - 14 August 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, SMH, TLT, DTLA, ETHE, ETHA, XLK; long September TQQQ, QQQ and SPY puts.