Market On Open, Thursday 16 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Hello Volatility, My Old Friend, It’s Good To Speak With You Again

by Alex King, CEO, Cestrian Capital Research, Inc

Oho! Look at this!

If since mid-April you have been (a) bored by the only-up market and/or (b) wrongfooted by the only-up market on account of your self-image as a demon trader being upended by teenage degenerates crushing your returns by just buying 0DTEs in quantum computing stocks &c and/or (c) unhappy because you like to see people in pain and suffering instead of getting rich by doing nothing? Then yippee-kay-ay, this time is for you, Buster.

Life just got a little tricky again. And the market is likely going to make a doofus of everyone that doesn’t have their wits about them. When the Vix starts to ramp, now you need to sharpen your skills. Oh, and most people choose to reduce risk too. Cut back on the leverage, cash up a few positions you feel a little queasy about, generally wind your neck in.

Now the good thing is that since there are a lot of people who started trading only in the last 2-3 years, most of them don’t know when to wind their neck in, because the market has been only-up since January 2023. (Yes, yes, Liberation Day and all that but if you actually look, April 2025 was a nothingburger on an open-to-close basis, the yo-yo tariff business was just psychodrama designed to scare people out of leveraged positions). So if you’re already thinking about the Vix, which by definition you are, because you’re reading this, and if you’re already thinking about controlling risk, which again you must be if you go to this paragraph, then I have news: you’re already ahead.

Time to concentrate now. Think about what you own, why you own it, what your price target is, what your stop-loss level is. Please don’t fall for that garbage about “time in the market beats timing the market”, that’s just a kind of neurolinguistic fentanyl handed out for free by asset managers everywhere so that you leave your hard-earned in your asset manager’s hands, there to be earning fees whether the world is burning or celebrating. Yes, of course if you don’t know how to time the market you will probably have your backside handed to you. But if you just leave your money and ignore it you will probably also have your backside handed to you at some point, but you will have been paying fees and deluding yourself the whole time.

Every day in this Market On Open note for our Inner Circle subscribers we lay out setups in the S&P500, Nasdaq-100, Dow Jones-30, US Government Bonds, the Vix, oil, tech, crypto and semiconductors. Every day. Then every week we run our live webinars to walk through how we see the key sectors and stocks and indices, talk live in real time with our members on topics they request and more. And not-quite-but-almost 24x7 we chat live in our Slack community about all the above and more besides. If you manage money, be it your own, your family’s, your clients’ or your limited partners - do you really not want to join us?

Let The Machine Take The Strain

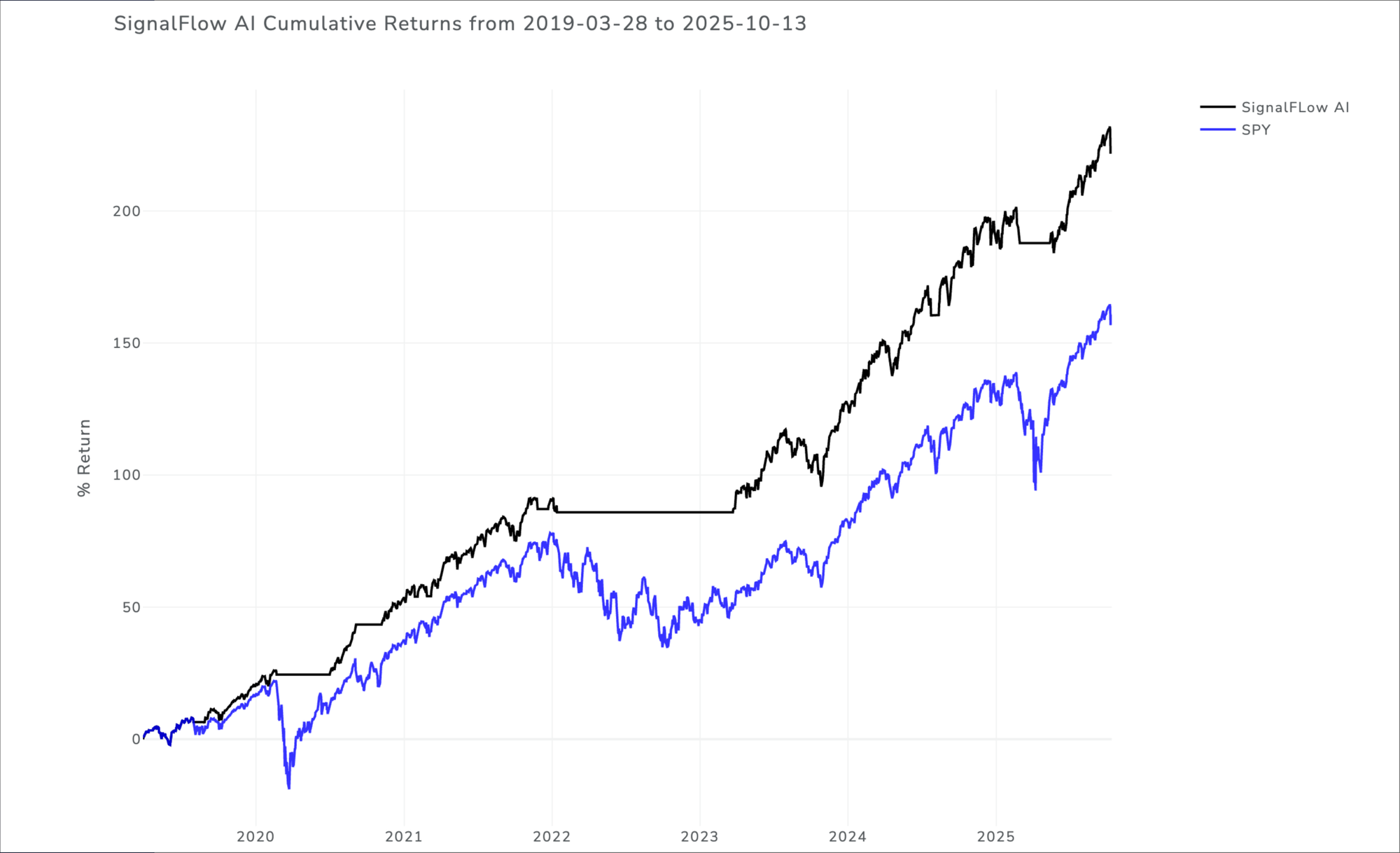

An update on how our simple long-only S&P500 algorithmic signal service is doing. As a reminder, this is about the easiest algorithmic service anyone could imagine. SignalFlow AI For $SPY prints a one or a zero right after the close each day. A one means the model thinks the market is likely flat or up the next day; a zero means the model thinks the market is likely down the next day. The model is designed to help investors avoid big drawdowns; in other words the intent is that the model flips to 0, risk off, before any big selloff in the S&P. And that if you traded according to model outputs, the idea is that you can step aside whilst the pain torments others, then get back in with your account relatively unharmed - thus preserving (1) capital and (2) emotional balance.

Here’s the cumulative performance of the algorithm vs. simply holding SPY over the same period. The service went live mid-2024; the data prior to that is backtested, the data after that is live trading ie. out in the wild, for real. You can see from a simple visual inspection the benefit of avoiding those material selloffs.

I myself run a pool of capital by following this algo. When it flips risk off, I take this pool of capital out of its S&P exposure. When it flips risk on, I put the capital back into the S&P. I like this a lot. It keeps my capital safe from material drawdowns and it takes the angst away from the decision to go to cash periodically.

You can learn more about this service here (if you’re an independent investor) and here (if you’re an investment professional). If you don’t know if you’re an investment professional or not, you can check our Ts & Cs here (look for section 1.5).

You can also read about the whole family of SignalFlow AI algorithm services here:

OK, let’s do it. Here’s our daily market note, covering yields, bonds, equities, volatility, oil, crypto, and key sectors. Join our Inner Circle service if you’d like this note in your inbox every trading day.