Market On Open, Thursday 20 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Bright And Sunny Uplands Ahead Once More!

by Alex King, CEO, Cestrian Capital Research, Inc

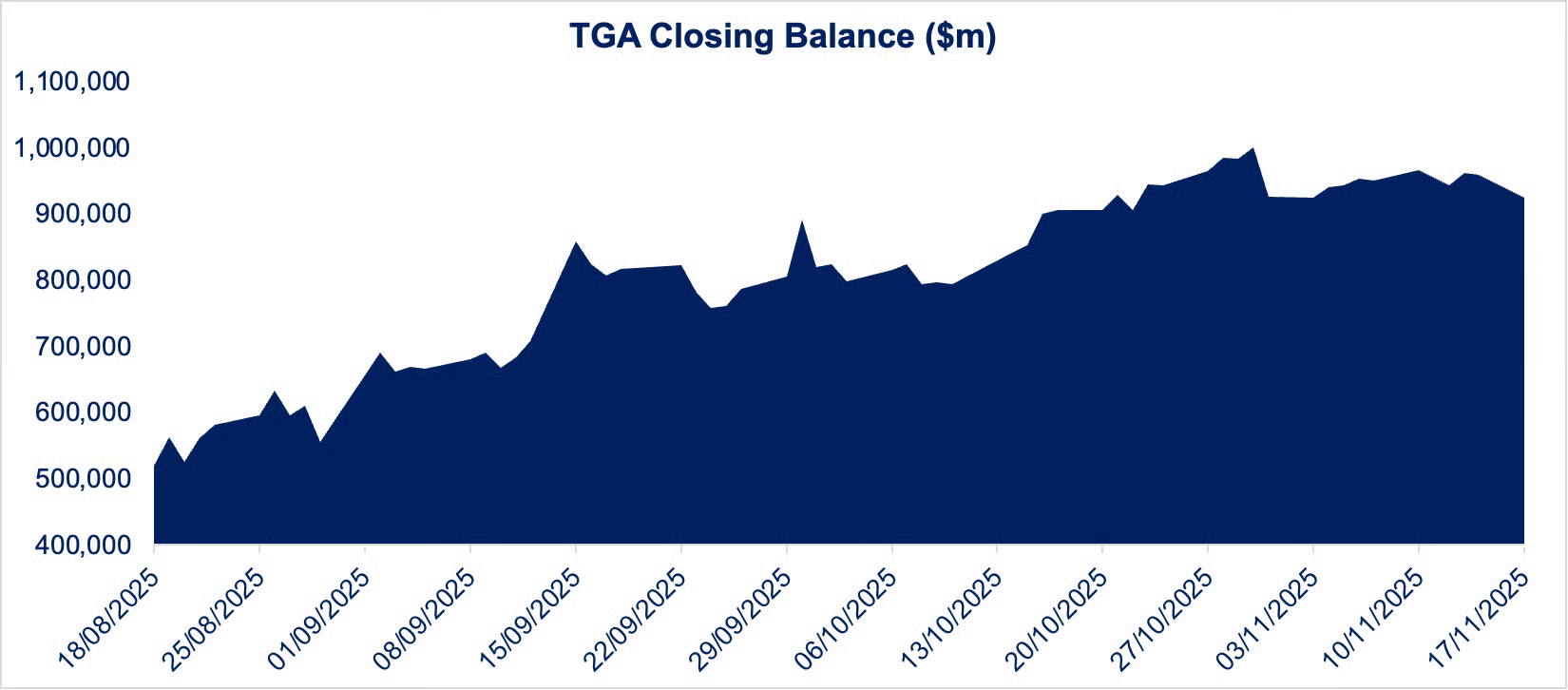

Either Jensen saved capitalism, or the Treasury General Account is unloading into bank reserves, then downstream into brokerage margin accounts and from there into the capillaries that feed thirsty traders with the nectar to YOLO once more. The coincidence of Nvidia earnings and the beginnings of a flood of liquidity into the system is too hard to pick apart but personally I favor the latter as the dominant theme. As Yimin noted yesterday:

“The good news is that TGA is now starting to move lower, meaning the government is spending cash on its reopening.On Monday, TGA moved from $959 billion to $925 billion, a notable one-day spend. If continued, which it should, we could see liquidity flowing back into the markets soon.”

If this thesis proves correct, we’re likely to see a runup in risk asset prices into year end.

Here’s another take on this macro picture, from Alan Longbon, who is low-key one of the best macro commentators around.

After the deluge? Who knows. Anything can happen. But for now? Up, I think.

Join The Cestrian Inner Circle

As a member of our Inner Circle service you’ll receive a full market analysis note every day in your inbox, earnings reviews on 50-60 stocks through the year, you’ll join a real-time grownup, all-business chat community of investors and traders (it’s a Chad-free zone by the way), a weekly live open-mic webinar and of course trade alerts whenever Cestrian staff personal accounts place trades in covered stocks & ETFs. Doubt me? Check our reviews.

OK. Let’s get to work - our daily Market On Open note below covers yields, bonds, equity indices, sectors, oil, gold, Ether, Bitcoin and more, as always.