Market On Open, Tuesday 16 September

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Rug Pull Or No?

by Alex King, CEO, Cestrian Capital Research, Inc

At the moment the strength of the equity market rally since the April lows is disbelieved by everyone, including those who have participated in the gains. For a time it means the less you think, the more money you make.

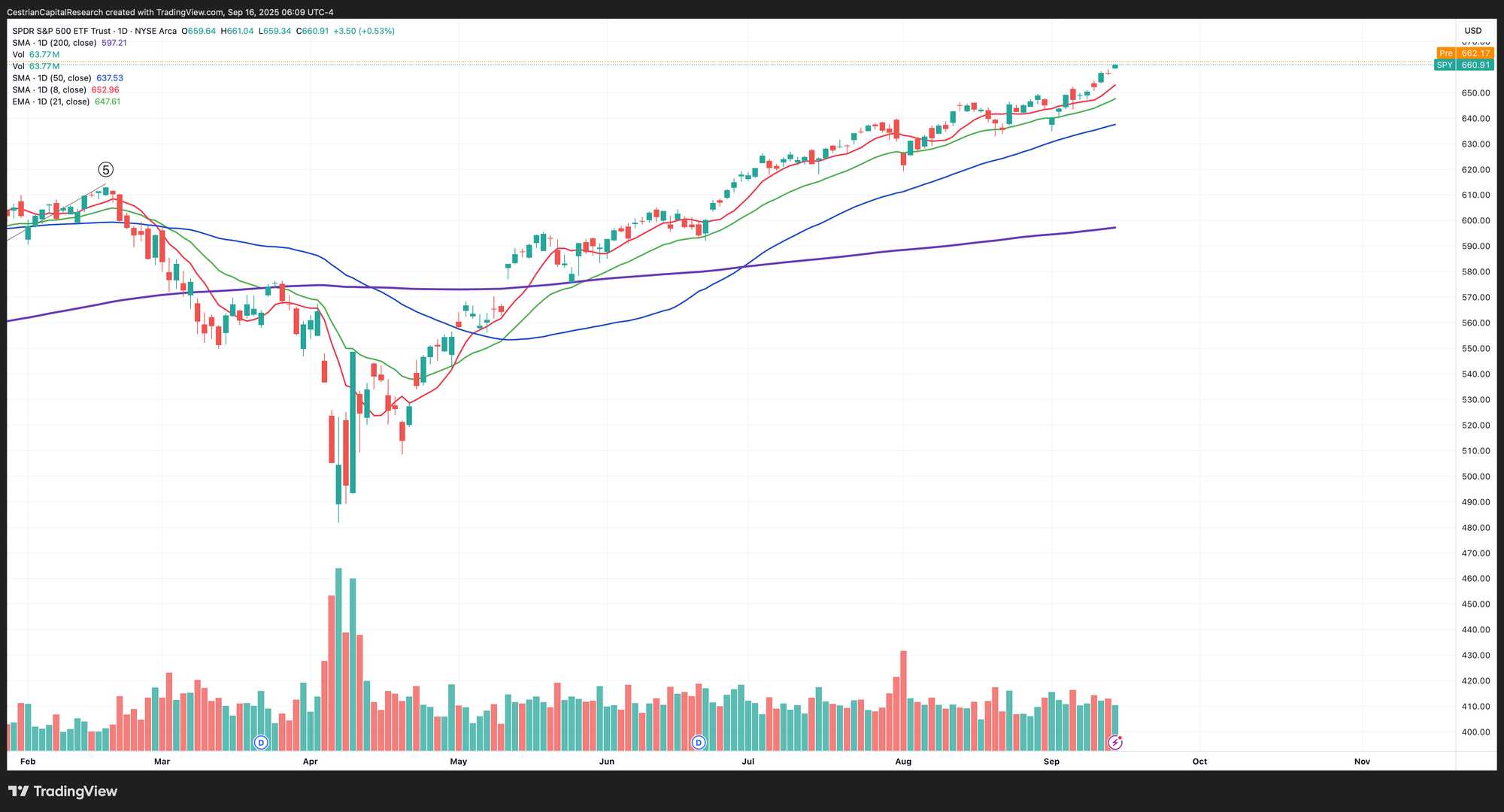

Here’s $SPY since the post-Liberation Day bottom. You can open a full page version of this chart, here.

SPY has seen daily closes below the 21-day exponential moving average (the green line) only three times since 24 April. That is remarkable insofar as it has been just a relentless bid with low volatility. If you have exercised caution or restraint since the April lows, all you have achieved is to cost yourself money (with the psychological benefit of easier sleeping, depending on your hedging ratio!).

This phenomenon is causing much grief amongs professional market participants, most of whom are not accustomed to a simple buy-the-dip-and-HODL strategy. And the more the grind-up continues, the more restraint will be tossed out the window and the more capital deployed long. This, of course, contains the seed of the next top, because in the end there must be no more buyers.

All year, our machine-learning signal services have been on the money. I think this is due to a combination of (1) machines don’t read the news, don’t look out the window and don’t have feelings and (2) the creators of our algorithmic services are each as close to machine-like as the wetware gets, so there is no inadvertent IF X THEN YIKES subroutine built into the code.

If you’ve yet to include AI in your investing and trading process, you are falling behind. It’s as simple as that. Machines aren’t perfect and I wouldn’t turn all my capital over to one, but I myself use our algorithmic services each and every day - that’s the best analysis I can give you.

Take a look at the SignalFlow AI family of algos, here, and at the YX Insights family of algos, here.

Now let’s get to work with our daily market analysis. Available every day to our Inner Circle members.