Market On Open, Tuesday 18 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

It’s All Over, Time To Get A Real Job

by Alex King, CEO, Cestrian Capital Research, Inc

Want to know why the market is selling off? It’s Andrew Ross Sorkin’s fault. Everyone in finance is reading 1929 at night, spooking themselves silly, then going to work the next day and selling off some more stuff to de-risk a little bit more before the whole thing dives headfirst into the floor.

In the alternative, we have some repositioning by funds and some forced deleveraging by retail. I hope that if you read and use our work here at Cestrian, you have been able to insulate yourself from the worst of the selloff; by not owning the craziest stuff in size in the first place and/or by using our charts and/or by using our machine learning algorithms to help avoid periods of weakness.

Volatility is a normal part of any market; the oddity is when volatility is suppressed for long periods of time. The volatile times may make you feel queasy but if you learn to put feelings aside and follow numbers and numbers along, these are the times when the money is made. Not necessarily when the money is banked, but when the positions are opened that will in due course make the money.

If you’re not yet using machine learning algos in your trading and investing, you’re missing out. This is where the world is moving to and like everything else associated with the Internet, it is taking what was once esoteric and open only to elites, reducing the cost, and enabling distribution and use by most every investor.

Today at 6.15pm Eastern please join a FREE webinar in which Yimin Xu, Prof. Jay Urbain Ph.D and myself will be discussing how to use these algos. You can sign up here.

Join The Cestrian Inner Circle

As a member of our Inner Circle service you’ll receive a full market analysis note every day in your inbox, earnings reviews on 50-60 stocks through the year, you’ll join a real-time grownup, all-business chat community of investors and traders (it’s a Chad-free zone by the way), a weekly live open-mic webinar and of course trade alerts whenever Cestrian staff personal accounts place trades in covered stocks & ETFs. Doubt me? Check our reviews.

OK. Let’s get to work - our daily Market On Open note below covers yields, bonds, equity indices, sectors, oil, gold, Ether, Bitcoin and more, as always.

US 10-Year Yield

Little bit sideways-rangebound right now. We “should” see bonds benefit as the notion of equity risk rises in investors’ minds, but “should” doesn’t pay the bills so let’s see.

Equity Volatility

At Vix 23 we can now start to think about the possibility of a vol crush. The Vix can go much higher but we are now at least in “spike” territory.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

No change. Bullish.

Apologies for the messy chart. The A-B-C is intended to show a potential bear path if that current “support” line gives way, and the green up & red down wave is intended to show a possible start to a new bull cycle if support holds.

I myself think support is going to hold and TLT is going to move up, but that’s just my opinion!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Holding at the 200-day.

Disclosure: I am unhedged long $TLT and $DLTA (an EU UCITS TLT proxy).

Gold

A-B-C potential bear path; the 50-day SMA (blue line) may hold as support in which case gold is in a new bull pattern which started on 28 October.

Disclosure: Positioned in gold according to our Commodities Algo Service.

Bitcoin

There is a lot of liquidation going on amongst native Bitcoin holders right now, and sentiment is on the floor. That can be the start of a bottoming process.

Disclosure: I am long $IBIT.

Ether

I amended that A-B-C path a little … for now this continues to look like a low is being found around this level.

Disclosure - Long $ETHA and others in the Ether complex.

Oil (USO / WTI / UCO)

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UCO continuing to look constructive.

Disclosure: I am positioned in oil per our Commodities Algo Service.

S&P500 / SPY / UPRO

November continues to look like a no-big-deal regular pullback in the S&P at this level of zoom.

Lost the 50-day at the close yesterday; below it in premarket still. In the event of more downside I would be very suprised if the 200-day at $613 gave way.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am long $IUSA, long $SPY, and long SPY puts for December expiry ie. net long the S&P.

Nasdaq-100 / QQQ / TQQQ

I remain of the view that QQQ is going to hit $650 before any real bear market kicks in.

Trapped under the 50-day for now. Nvidia earnings will determine direction.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for December expiry. Overall (slightly) net short the Nasdaq.

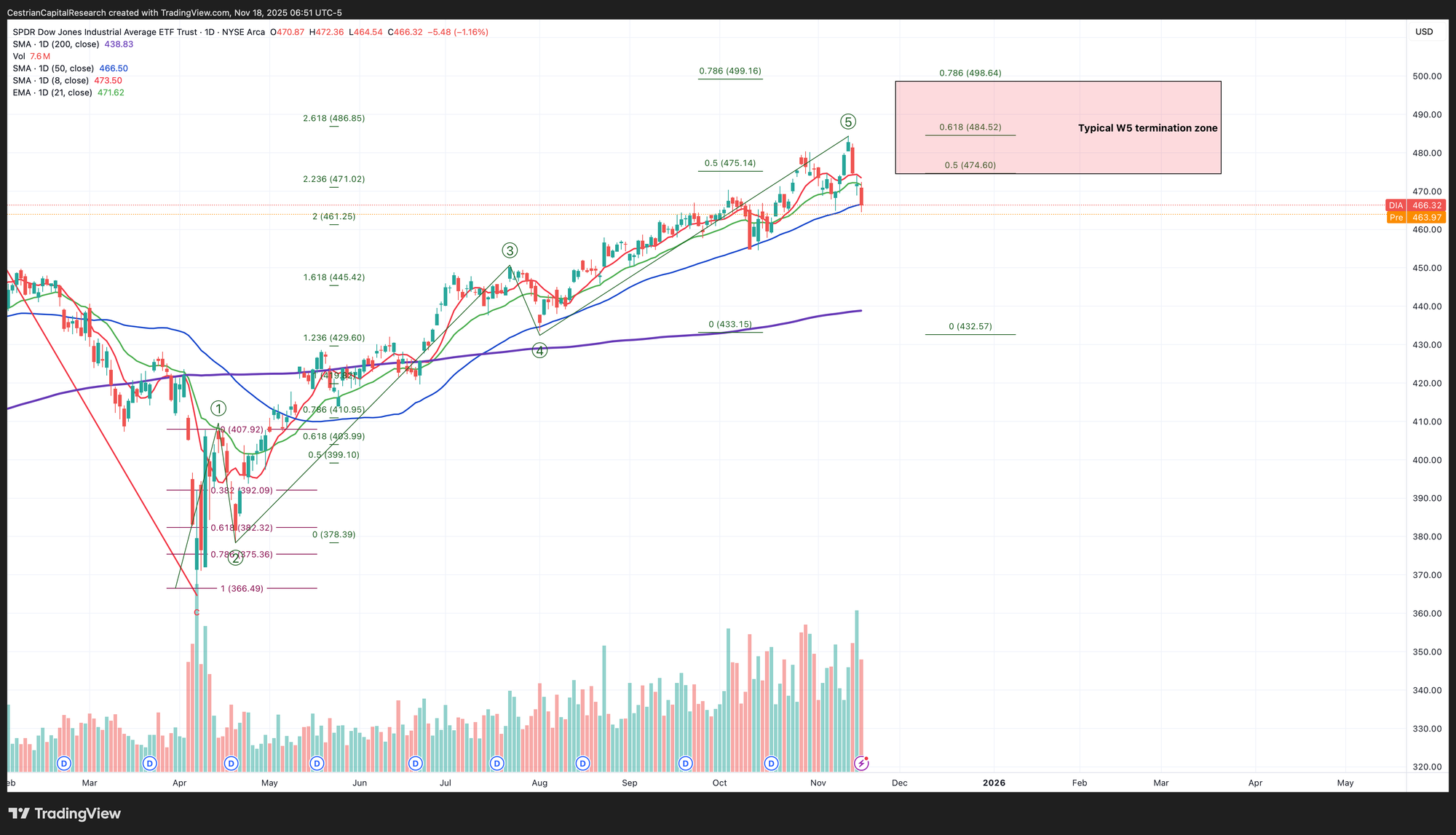

Dow Jones / DIA / UDOW

If there are bears on the edge of town - nobody told Grandpa yet.

Held over the 50-day SMA at the close yesterday - below in premarket trading today but as always, closing prices are what matter most (not least because they are influenced by the day’s 0DTE trading and hedging, which is increasingly material).

3x Levered Dow - UDOW Long / SDOW Short

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in the Dow.

Sector ETFs

No change - bearish below $296, bullish above.

Disclosure: No position in $XLK.

3x Levered Long/Short Tech - TECL/TECS

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in TECL or TECS

SOXX (Semiconductor)

To state the blindingly obvious … NVDA will be determinative.

3x Levered Long / Short Semiconductor - SOXL / SOXS

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged 1:1 $SOXL:$SOXS.

Alex King, Cestrian Capital Research, Inc - 18 November 2025.

DISCLOSURES: See each line item in the note above.