Market On Open, Tuesday 21 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Bugged Out

by Alex King, CEO, Cestrian Capital Research, Inc

As everyone knows - and I mean literally everyone knows - gold is on a tear. Moonshot. Parabolic. Better than the S&P. Better than Bitcoin. Better than AI. The best! And this common knowledge naturally leads to the typical human deciding that they too must join the trend. No matter that they had no interest in buying gold earlier this year for 30%-40% less. Still less at the 2022 bear market lows when you could buy the $GDX ETF for a touch over $20 (currently $76).

The human instinct is to run with the herd, presumably for primeval reasons of safety from predators, the weather, &c. The successful investor however should do something slightly different; which is to say take note when the herd starts to run, to then join the pack at the rear and tag along, and then hop off out of the swarm right before it careens right off a cliff or just tramples its own members, as stampedes are wont to do.

Investing and trading has many elements to it; numeracy, some understanding of business and finance for sure. But right up there with having some notion of what GAAP is and why it exists is - control your emotions and learn to recognize when others are not controlling theirs. The herd is incurably depressed even though prices are trending sideways at the lows at high volume? Buy. The herd is buying due to euphoria or fear (the present goldbug trend is a fear-buy; a fear of inflation, a fear of systemic collapse, a fear of the dollar being relegated to non-reserve status, all that kind of thing)? Hold for a time - remember, other folks’ emotional buying is your profit if you bought when you should have - and then sell.

We can all train ourselves to run colder than we naturally do. But nothing is as cold as a machine. Personally, gold has been good to me this year; I’ve clocked in nice gains in $GDX and $GLD. I’m now short gold via a long $GLL and a short $IAU position. How did I make these gains and jump off before the cliff? Some special qualities I have? Deep gold domain expertise? A relative in a senior position at a miner?

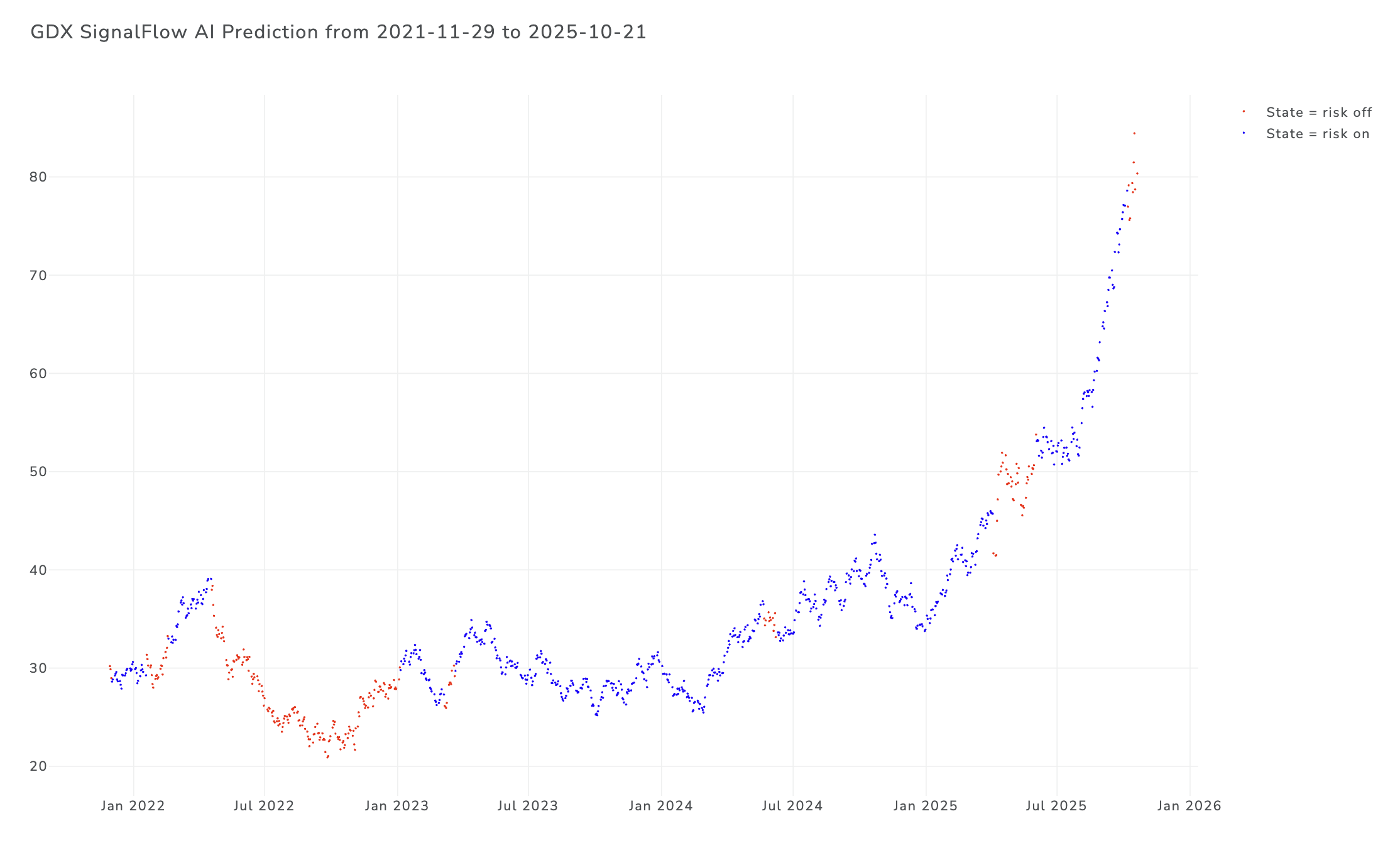

Nope. I have a machine. A really neat machine. Our SignalFlow AI machine. This machine is a statistics beast; it doesn’t know what gold is, it just knows how to predict a y-axis value for tomorrow’s x-axis value based on a whole lot of previous x- and y-values. The machine can learn any liquid stock or ETF price pattern and, over time, improve its ability to predict that stock or ETF’s next move. It’s not infallible of course, but it’s pretty good, and I can tell you I use this machine a lot in my investing and trading. Here’s how the machine called $GDX. I’m sorry-not-sorry for the compsci dot-matrix type presentation. If it looked like a nice clean Robinhood print, you would do well to be sceptical.

Note, the pattern is based on backtesting until the middle of May this year; thereafter it’s live trading data ie. predictions not backtests, which is to say the algo out in the wild dealing with reality as it happens.

A blue dot means risk-on or “hold GDX”.

A red dot means risk-off or “don’t hold GDX”.

This is very easy to trade by the way. This is how I do it: when the signal flips from risk-off to risk-on, I buy the instrument in question - GDX in this case. When it flips from risk-on to risk-off, I sell it. For as long as the signal remains risk-off, I do nothing. Flips back to risk-on? Buy. Back to risk-off? Sell. And so on.

You can see the results. The algo held GDX long all the way up this parabolic run, and lately has flipped risk-off, right around the time those queues are forming outside physical bullion dealers that sell to retail. I don’t know if the machine has become sentient nor whether it can Google stuff to see whether folks are queuing up outside stores to buy gold. Maybe it does that when we’re not looking, I don’t know. But the results? Man. It’s good.

These days, algorithms are infused into my daily investing and trading decisions, either direct-drive like the above, or others that I use as a factor in my discretionary choices. You can prise them out of my cold dead hand - I am never going back to just fundamentals and technicals. There are some things that machines are bad at, like empathy, and there are some things that machines are great at, which is ice-cold pattern recognition.

You can read about the whole family of SignalFlow AI algorithm services here.

The GDX example above comes from the sector-rotation service, SignalFlow AI Growth, which you can find here:

SignalFlow AI Growth - Independent Investors

SignalFlow AI Growth - Investment Professionals

If you have any questions at all about SignaFlow AI, reach out using this contact form, or email us at minerva@cestriancapital.com .

OK, let’s do it. Here’s our daily market note, covering yields, bonds, equities, volatility, oil, crypto, and key sectors. Join our Inner Circle service if you’d like this note in your inbox every trading day.