Market On Open, Tuesday 28 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Can The Center Hold?

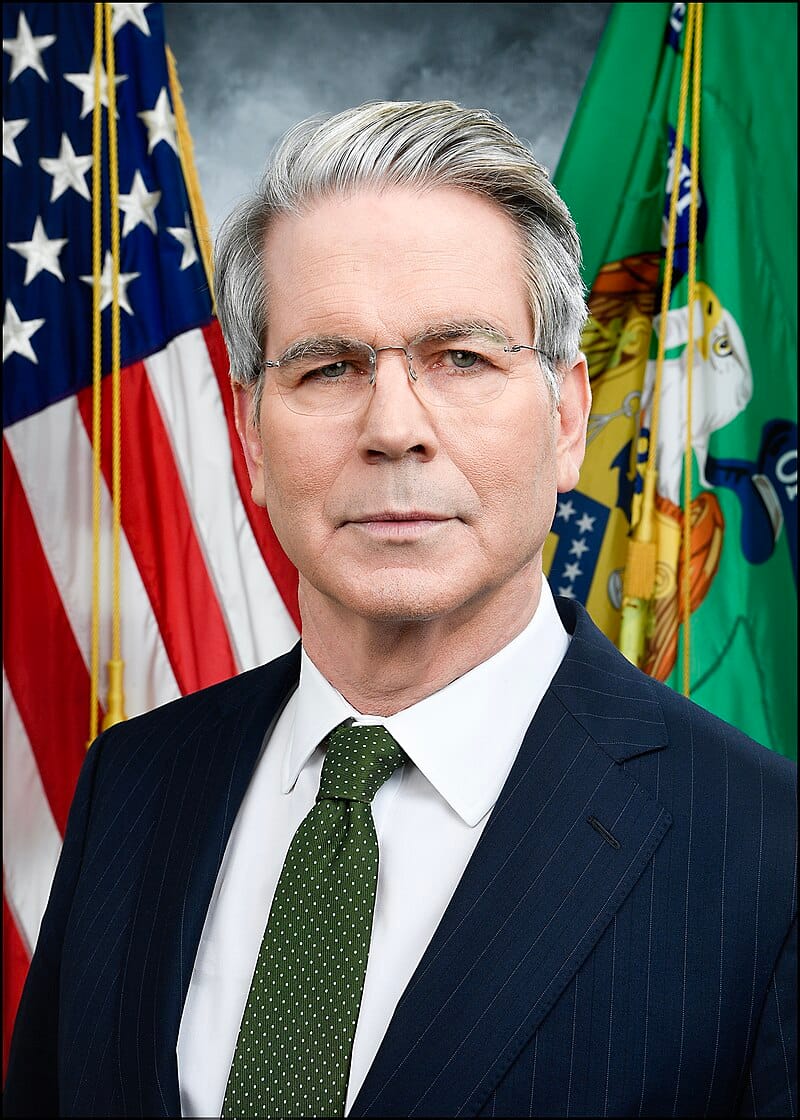

by Alex King, CEO, Cestrian Capital Research, Inc

Secretary Bessent has the toughest job in government right now. The broad coalition of interests that elected the current Administration has, like all broad coaltilions, essentially unreconcilable goals. The populist element seeks the elevation of labor over capital, and the wealth element seeks the (further) elevation of capital over labor. Solving all of this falls on the shoulders of Sec. Bessent first and foremost, since the Treasury’s operations - and the Fed too, and I assume we will see more of Bessent’s hand in the Fed’s work once Chairman Powell retires from his post - have such a deterministic impact on markets.

Bessent set out his stall this week, stating that the Administration intends to pursue “the most America-first policies we can whilst still respecting markets”, or words to that effect. And this is the tightrope the Administration must walk each day. Not easy.

Until things break, until the center cannot hold, it is worth listening to Bessent. I’ve written previously about the David Tepper strategy of “assuming governments will do what they say they are going to do”; obviously this doesn’t apply to all government bodies; if your local city authority tells you it is going to adopt a Bitcoin treasury strategy, you should probably assume any services funded by that city authority will dry up within a couple weeks, oh and maybe move to another city. But the U.S. Federal Government? Usually worth listening. This Administration said that it was focused on getting the 10yr yield down. It was 4.5-4.6% at inauguration time, now 3.9-4.0%. That’s a meaningful drop if you own enough bonds or bond ETFs (which oh by the way everyone was telling you were terrible things to own all this time). I believe that Bessent intends to adopt market-friendly policies to the extent possible. We have the midterms coming up and it’s much easier for incumbents to win elections if voters feel wealthy.

So what will cause this bull market to flip bear, when eventually it does? The answer will be the same as always, which is that suddenly collective appetite for risk dries up and then slowly, then more quickly, then all of a sudden, everyone runs for the door. Right now no-one sensible thinks that valuations are muted or that speculative excess isn’t juiced already, or that risk management in private credit is akin to the Fidelity Fiduciary Bank of Mary Poppins fame (before the run!).

Everyone already knows that things are a little stretched already. The question is when someone starts selling quietly, when that selling gets more visible, and when “the crowd sees the crowd” and the common knowledge that everything has run up too far becomes the dominant narrative and then …. timberrrr!! (With thanks to Epsilon Theory for these concepts).

Is that today? Tomorrow? I doubt it. Today or tomorrow are not, in my view, the time to run for the door. Right now it’s time to work out how to make money when the market turns. Will you just go to cash? (Easy and low stress but suboptimal). Treasuries or bond ETFs? That can work. Short some stuff? If you know what you are doing. BUY DEEP OUT OF THE MONEY PUTS ON EVERYTHING, YOLO STYLE? If you want. Sounds risky to me.

We’ll be talking about this more and more in our Inner Circle service in the coming weeks. Not because we think the market is doomed today or tomorrow, but because the time to get smart and make a plan is - before it happens. If it never happens and this market goes only-up until 2028 and beyond? Great. More free money. I love free money. But if not, let’s be ready.

OK let’s get to it.

Join our Inner Circle service if you want the good stuff every day in your inbox.

Black Friday Sale

From now through November we have a singular item on sale, which is our cheapest Inner Circle membership. Our 6-Yr Extended Membership is available at a 30% discount; normally $19,999 for Independent Investors or $39,999 for Investment Professionals, this can be had for just $13,999 or $27,999 respectively. That’s less than $7/day for independents, less than $14/day for pros. I’m pretty sure you can find multiples of that value in our work.

To join on the monthly or the annual, click the paywall break below. To join on the Extended prices, use these buttons right here.

As always, any questions, you can reach us at minerva@cestriancapital.com or by using this contact form.