Market On ReOpen, Thursday 13 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Government Is … So Back

by Alex King, CEO, Cestrian Capital Research, Inc

Shutdown over, dollars starting to flow once more. We can expect liquidity to return to markets and with that what should happen is that the riskiest of risk assets start to edge up a little; look to crypto for an indicator of whether this “should happen” turns into “actually has happened”. Whether you care for Bitcoin and Ether or not, doesn’t matter, they are each useful canaries as regards Wall Street’s risk appetite. Up, risk appetite rising, down, falling, simple.

It looks also as if the $2k personal checks to a sizable number of Americans will be printed; that is also good news for the economy and the market I would say. Whether it proves inflationary or not is not our concern; if yes, it will hit rates and that will hit bonds first then equities, but that again is in the “what should happen according to market economics 101” file, not the “what is actually happening” file. We can react accordingly if inflation in fact starts to rise.

Now, let’s take a look at where all the moving parts stand. Join our Inner Circle service if you want the good stuff every day in your inbox, earnings reviews on 50-60 stocks through the year, a superb chat community of investors and traders, a weekly live open-mic webinar and of course trade alerts whenever Cestrian staff personal accounts place trades in covered stocks & ETFs.

NEW! Commodities

I don’t know whether commodities are the next bull market after growth stocks start to fade, whenever that happens. But they might be. And what I do know is that commodities and equities have not much of a correlation, particularly if you can trade across a basket of commodities not just gold and oil. So I definitely want to be able to invest and trade them successfully because it gives me a new way to try to make money over and above the usual stocks and ETFs.

I myself am building exposure to a basket of simple commodity ETFs, and I am doing so using our new YX Insights Commodity Signals service.

This the latest in our very successful series of algorithmic signal services. It just launched, so if you join now you’re in at the ground floor, and better yet, you get to sign up at launch pricing - a full 50% discount to where prices will be on 1 January.

You can learn all about the service here.

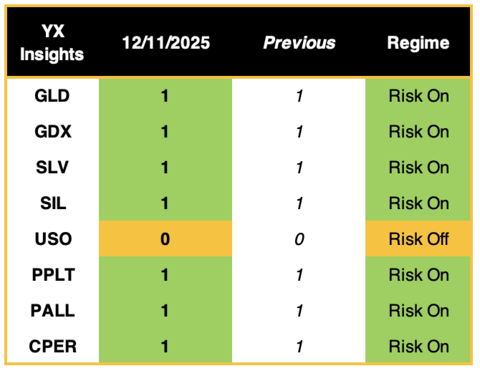

As everyone knows, the future may or may not be like the past, but the service is off to a great start. Here’s the signals printed yesterday before the New York open (the model is built on the assumption that trades are placed at the open, some hours after the signals are printed).

And here’s how each of these ETFs performed yesterday.

GLD +1.6%, GDX +3.3%, SLV +4%, SIL +3.8%, USO -4%, PPLT +1.6%. PALL +1.5%, CPER +0.5%.

Pretty good so far! The algorithmic method is the same as for our Crypto Signals and Systematic Signals services, which gives me confidence as those services have performed well since launch.

OK. Let’s get to work - our daily Market On Open note below covers yields, bonds, equity indices, sectors, oil, gold, Ether, Bitcoin and more, as always.