Market When Closed, Sunday 9 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Liquidity vs. Fundamentals

by Alex King, CEO, Cestrian Capital Research, Inc

In the very long run, corporate earnings, income and spending levels, inflation, the relatively standing of one country to another, all these things matter in securities pricing. In the very short run, panicky reactions by investors and apex predator responses by market-makers are probably primary. And somewhere in between on the timeline is liquidity.

It looks likely that the market is about to see a material increase in liquidity. It appears that interbank lending between the US money center banks is returning to normal levels (it has been thin in recent weeks). This means that more money at lower prices will become available to investors to deploy into securities markets. The prime brokerage desks of large banks are dependent upon Federal Reserve largesse or otherwise, interbank lending or otherwise, in their supply of money to their fund clients. The availability and price of margin capital to a large swathe of funds drives securities pricing fairly directly.

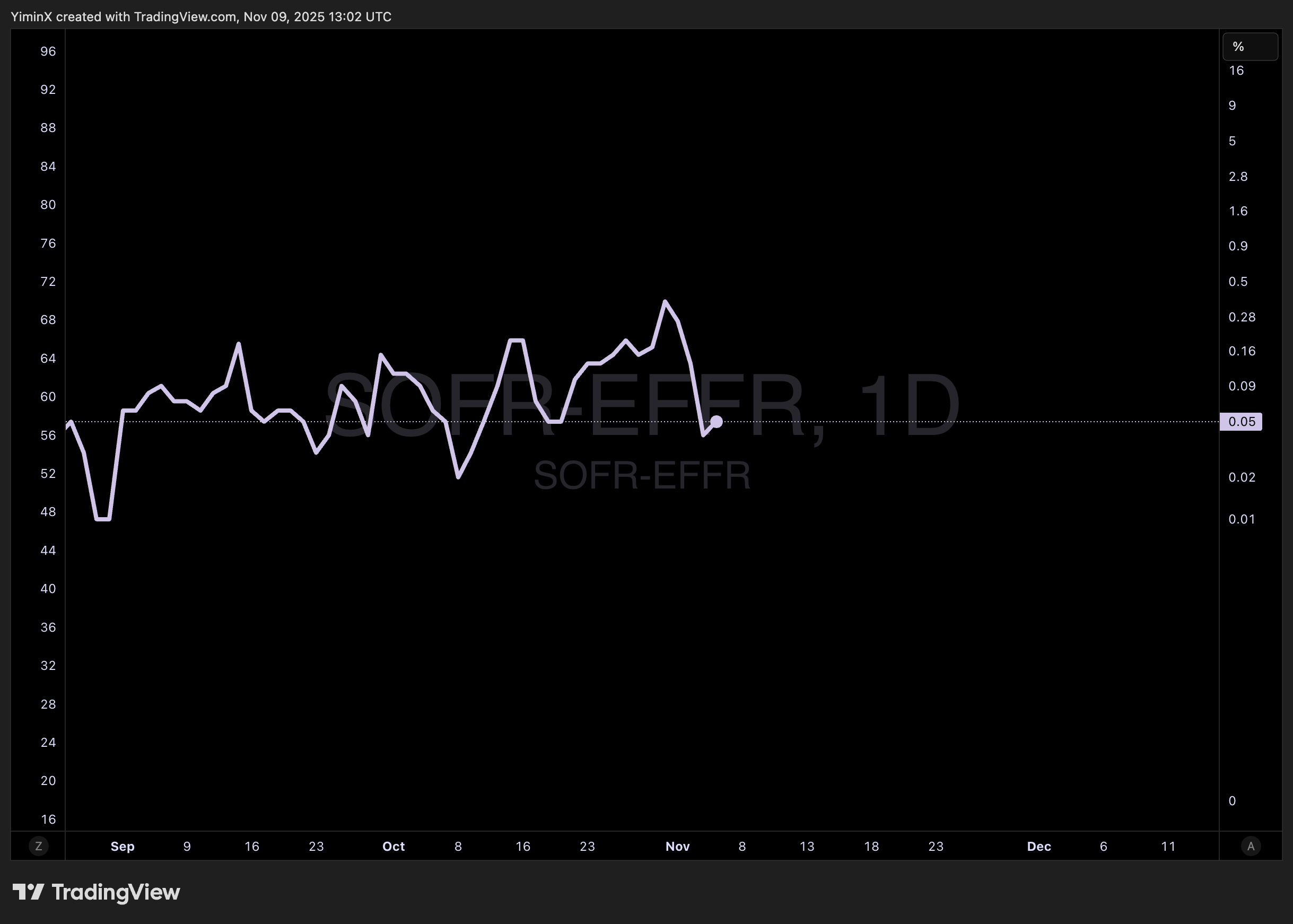

The chart below is very simple but if you understand interbank lending it gives you a heads up that probably more money is going to roll into securities markets shortly. It’s a ratio chart of SOFR (Secured Overnight Financing Rate, the price of interbank lending, which is to LIBOR what statistical analysis is to astrology) to EFFR (the Effective Federal Funds Rate, the cost of money as directed by the Fed). If SOFR > EFFR, interbank lending is expensive ie. unattractive, and if SOFR <= EFFR, interbank lending is cheap ie. attractive.

Now, I don’t understand interbank lending all that much. It’s one of the many aspects of the securities market that is not my wheelhouse. Fortunately, I don’t need to be an expert in this important area (an area which like a handful of others can give you just a little glimpse into the future of securities prices, just enough to be useful), because I have a colleague who is.

If you don’t subscribe to Yimin Xu’s work, you really should. Yimin is a professional investor; his career began as a market-maker in the rates market and today he manages his own capital and publishes the research and algorithms that he uses to do so. I’m delighted to be able to host his work here at Cestrian.

You can subscribe right here on our site to Yimin’s full-service offering, YX Insights (here), or if you prefer you can just use his algorithms. These come in two flavors.

- Systematic Signals - daily risk on / risk off indicators covering the Mag7 stocks and beyond. Click here and scroll down to “Systematic Signals”.

- Crypto Signals - daily risk on / risk off indicators for Bitcoin, Ether, Solana and key crypto stocks. Click here and scroll to “Crypto Signal Service”.

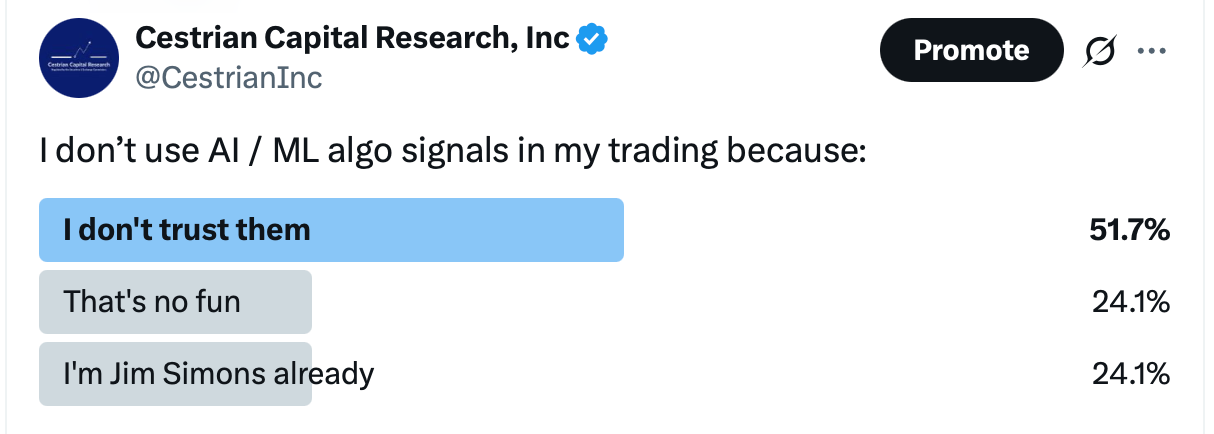

If you aren’t using algorithmic signals in your investing and trading, you’re missing out. This is no longer the preserve of high-end fund managers; the low cost of computing and distribution means professional grade algorithms with very simple user interfaces are available right here on our platform at low cost. We’re early in this offering by the way; most investors don’t care to use algos, for the same reasons no-one wanted sewers, electricity, running water or the telephone; mistrust, a dislike of automation in favor of a mythical artisanal past, oh and arrogance. Here’s the outcome of a recent poll we ran on X:

Me personally? I use AI/ML signals every single day. Why would I not? Do I write these notes with a quill? I do not. Do I illuminate my office with a candle? I do not. Do I conduct fundamental research by visiting the local library to read securities almanacs? (I probably would if I could, but since the library closed in 2017 it’s hard to do so). Algorithms are here now, and working now - don’t miss out.

Now, let’s take a look at where all the moving parts stand. Join our Inner Circle service if you want the good stuff every day in your inbox.

Black Friday Sale

From now through end November we have a singular item on sale, which is our cheapest Inner Circle membership.

Our 6-Yr Extended Membership is available at a 30% discount; normally $19,999 for Independent Investors or $39,999 for Investment Professionals, this can be had for just $13,999 or $27,999 respectively. That’s less than $7/day for independents, less than $14/day for pros. I’m pretty sure you can find multiples of that value in our work.

To join on the monthly or the annual, click the paywall break below. To join on the Extended prices, use these buttons right here.

As always, any questions, you can reach us at minerva@cestriancapital.com or by using this contact form.