MARKETS IN TURMOIL, RUN FOR COVER!!

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

A Special No-Paywall Edition Of Our Full Daily Market On Open Note

by Alex King, CEO, Cestrian Capital Research, Inc

At the time of writing, the S&P500 and the Nasdaq are each back at the level they were about a month ago i.e. still at levels that everyone was screaming “BUBBLE!!!".

This kind of selloff is situation normal for markets. When they run up a lot, quickly, with no meaningful corrections since mid April, the pullback when it comes is going to be fast, brutish, and painful for some. The more recently investors bought into the market, and the more leverage they used to do so, the more the pain is felt.

For some weeks - months - now, Finance Twitter, a wonderful place if you use it correctly, has been chock-full of Robinhood users’ YTD returns. +100%, +200%, +300%, +3000%, more. And even if you are as dead-inside as I am, even if you are a grownup and run money with the goal of beating the index each year and keeping volatility to a minimum, even then, the probably-fictional crazy YTD returns this year (note, all the equity curves start 7 April of course) from these people make you think you are doing it wrong. Even though you know you aren’t, because the numbers tell you that!

This is the power of your own limbic brain working against you. If you want to make money in securities markets, your first task is to recognize which ideas come from the twitchy, terrified, fighty little idiot in your brain stem, and which from the calm, sanguine, plays-the-long-game professional in your cortex.

Cut this out and pin it to your monitor if it helps:

Today was an unusually rapid and sizable 1-day drop without much in the way of warning, no spiking Vix, nothing like that. But if you invest thoughtfully and with caution, you probably weren’t max-levered-long going into today. I hope that if you read these notes each day, you use them to keep ahold of where stocks, bonds, oil and crypto have gotten to and what the next moves - up or down - may be, and what to do about that. More than anything, I hope you use these notes to learn to manage risk, be that through hedging, position sizing, or any other such methods.

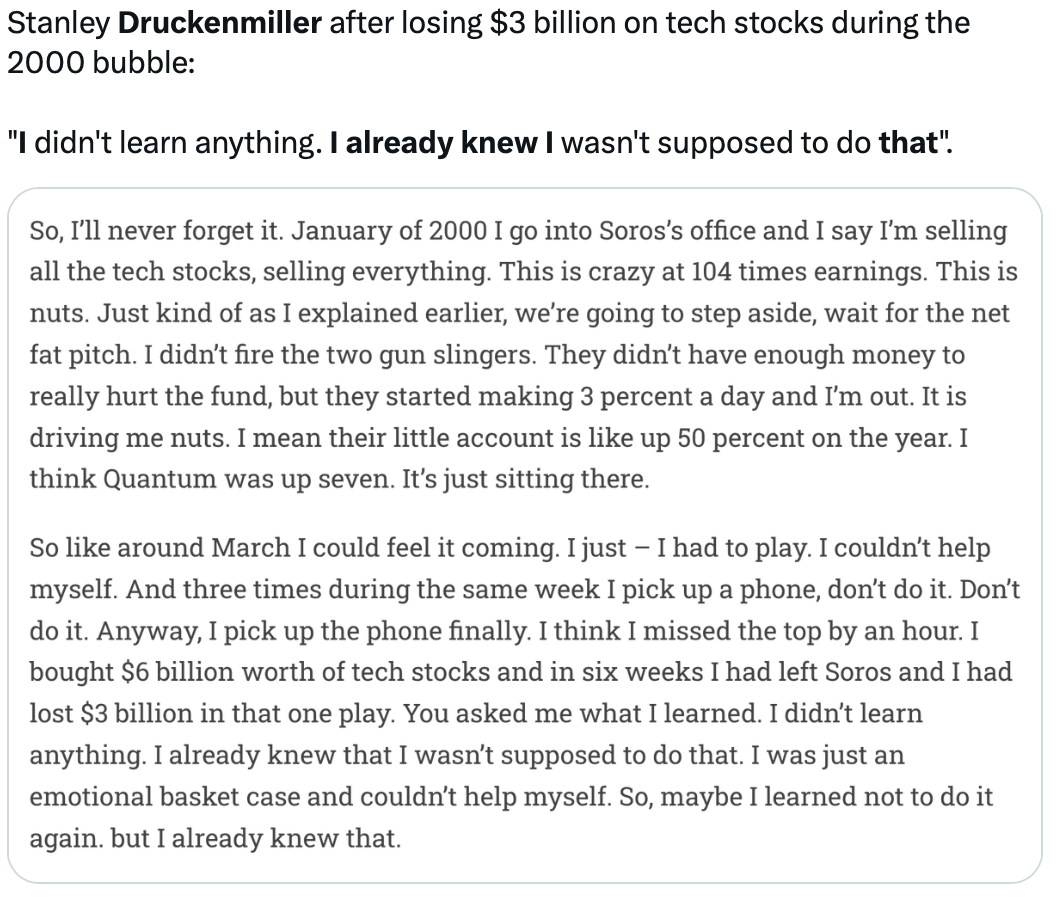

Each of us in our investing careers (I could use the j- word but then I would have to vomit) go through periodic crises where our mistakes are laid bare. It is incumbent upon each of us to then conduct some introspection and figure out (1) what did I mess up (2) why did I mess that up (3) how could I have seen it coming and (4) what would I have done about it if I did see it coming. And I don’t care how long you've been at this game or how much money you have made doing so, the market humbles everyone from time to time.

For me, it was H1 2022. I had a rough first half despite having called the top in November 2021 to within a few days. (That beauty of a top-call is still on the Internet. I have the receipts). I got back in too soon and the market kept falling. It worked out fine in the end, but I had to scramble in H2 to make up for the errors in H1. What I really did though was learn a whole new level of depth in securities markets. The key learning points for me in 2022 were as follows. They are of ongoing value and if these points aren’t second nature to you, I recommend you get to grips with them:

- The options market drags the equities market around, not vice versa. One of our wise subscribers here (thankyou Karan, I remain indebted) put me on to Brent Kochuba at SpotGamma, a former options market-maker turned buyside options market analytics wizard. I continue to learn from him and I frequently turn to SpotGamma analysis to help me understand the market’s moves.

- If you understand how market-makers work, you understand how securities markets work. If you approach the market knowing your opponent - for make no mistake, your opponent is the market-maker - you have an edge over the vast majority of other investors. For this, and for a magnificent hedging method that keeps me safe in all weathers, I am forever grateful to Robert P. Balan, whose work is magisterial. It is heavy-going and it requires thought and effort. But if it was easy, anyone could do it. Right?

If you got caught unawares today, don’t worry. There is always a way back, even when you think there isn’t. If you genuinely want to be consistently successful in investing and trading, then as long as you are numerate, committed to learning, and able to control your emotions, you can do it. The last point is the most difficult. This is how you should feel on a bright green day: nothing. This is how you should feel on a bright red day: nothing. When crypto dumped after the equity close today, I actually laughed out loud especially when I saw that Bitcoin had bounced at the 200-day moving average and then rocketed back to the 50-day. You see, the outcomes of investing and trading, meaning the rate at which you turn mouse clicks into U.S. dollars, are important and serious. But securities markets, the schoolyard in which you go to turn clicks into dollars, you cannot take them seriously; you just have to learn how they work, and play their game accordingly.

I’m proud to see that spirit in our investor and trader community too!

The analysis below is the full version of the note we publish for our Inner Circle members each trading day. We publish a truncated version for our free readers twice per week too. If you’ve yet to sign up, you can choose free or paid options here:

OK, let’s do it. Here’s our daily market note follows, covering yields, bonds, equities, volatility, oil, crypto, and key sectors.

US 10-Year Yield

Bonds continue to be bid so the yield continues to fall.

Equity Volatility

The Vix (=demand for S&P500 puts >30 days to expiry) spiked today. Just a regular spike, not a Liberation Day type spike.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

TLT accumulation continues. Very strong today.

Moving up towards that local Wave 5 high I think.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same for TMF.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

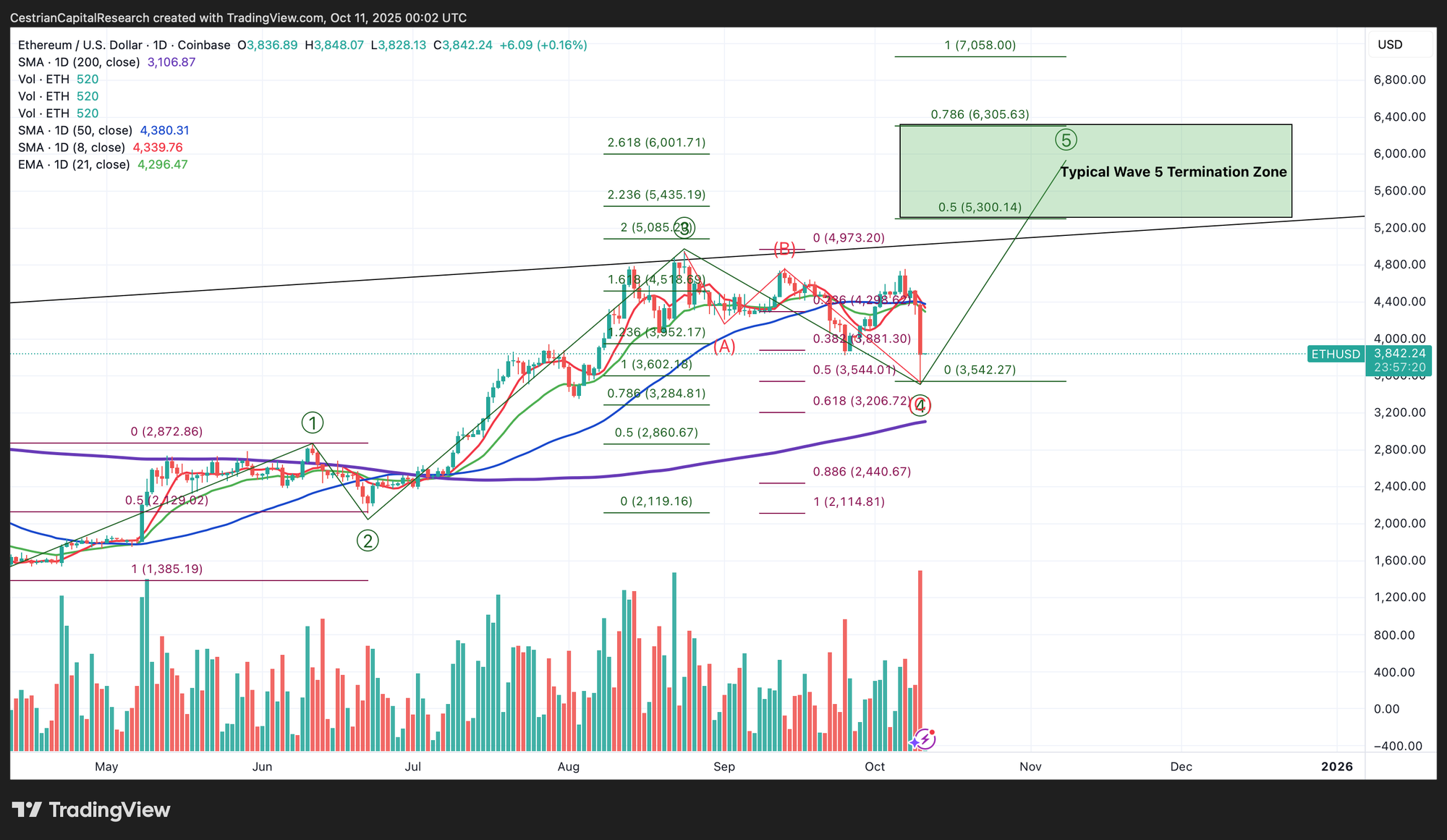

Ether

A classic rug pull in all of crypto today, and Ether was no exception. We reduce our Wave 5 target to 5300-6300 as a result. The chart still looks bullish.

Note, if you are trading Ether then you might note that our Big Money Crypto algorithmic signals flipped bearish on Ether on Wednsday, thus far missing about a ++15% drop since then.

If you’d like to have AI help you to trade Ether, Bitcoin, Solana and key crypto-centric stocks, take a look at those self-same Big Money Crypto algorithmic signals, here (independent investors) and here (investment professionals).

Disclosure - Long $ETHA and others in the Ether complex.

Oil (USO / WTI / UCO)

Still wedgebound.

Well, I’m glad I waited to take a long oil position! Specifically I am waiting for USO to get up and over its 21-day EMA; so far no dice. Oil futures were hit hard today.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

A comprehensive break from support in UCO.

Disclosure: No position in oil.

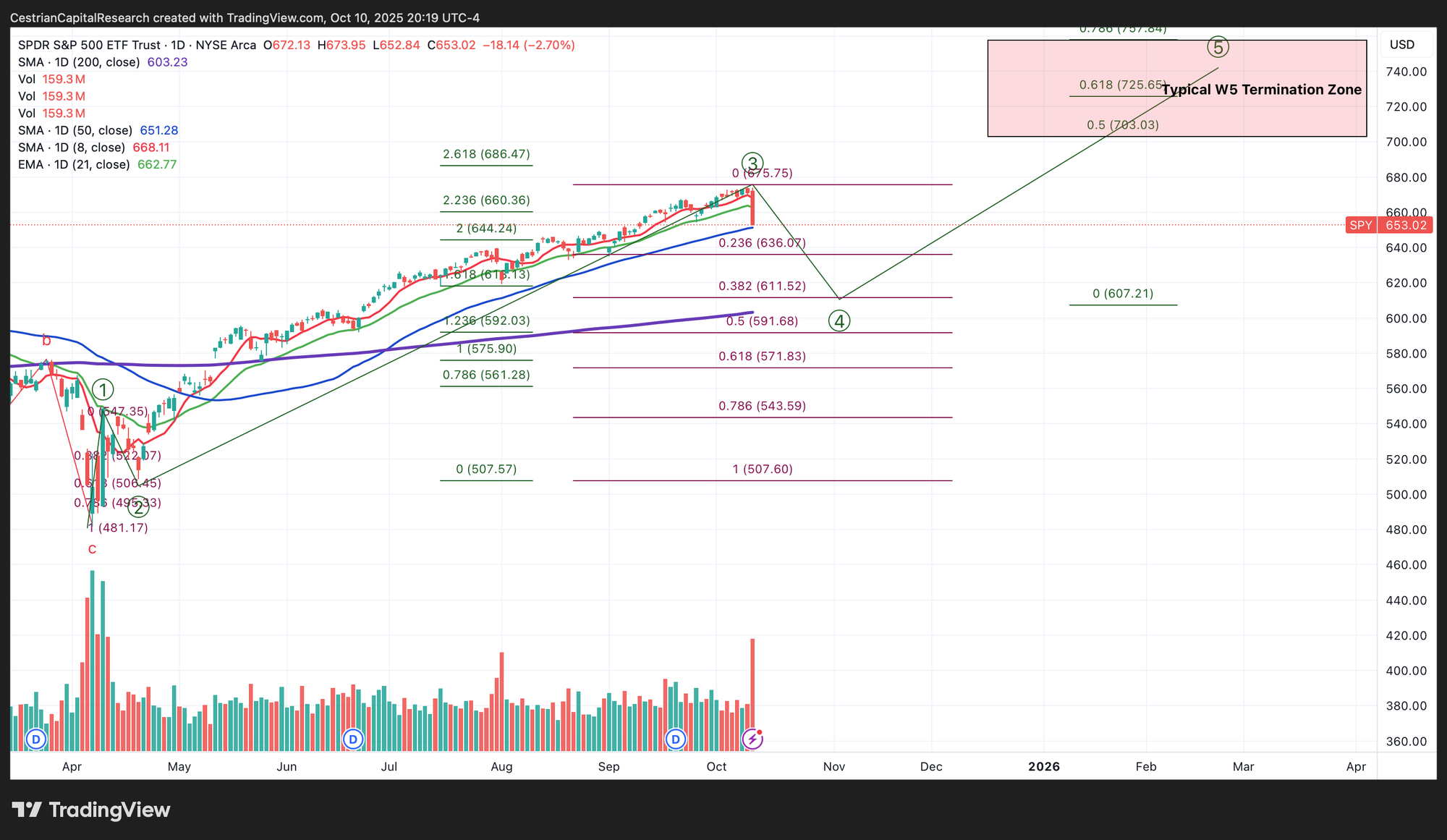

S&P500 / SPY / UPRO

There hasn't been a red month of size since March. April’s Liberation Day crash was quickly reversed, with the month of April barely changed from open to close. In that context the selling today was of minimal significance - just a pullback so far.

You can blame the weather, China, POTUS, whatever, but this the reality:

Thursday morning I wrote here that "SPY has spent four days now butting up against $673 from underneath. That tells you that $673 is resistance. And in the end if it can’t break up through that, we’ll get a correction. Simple."

Well folks, here’s the correction. Holding over the 50-day for now.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UPRO also at the 50-day.

Disclosure: I am long $IUSA, and long SPY puts for December expiry. In aggregate net long the S&P.

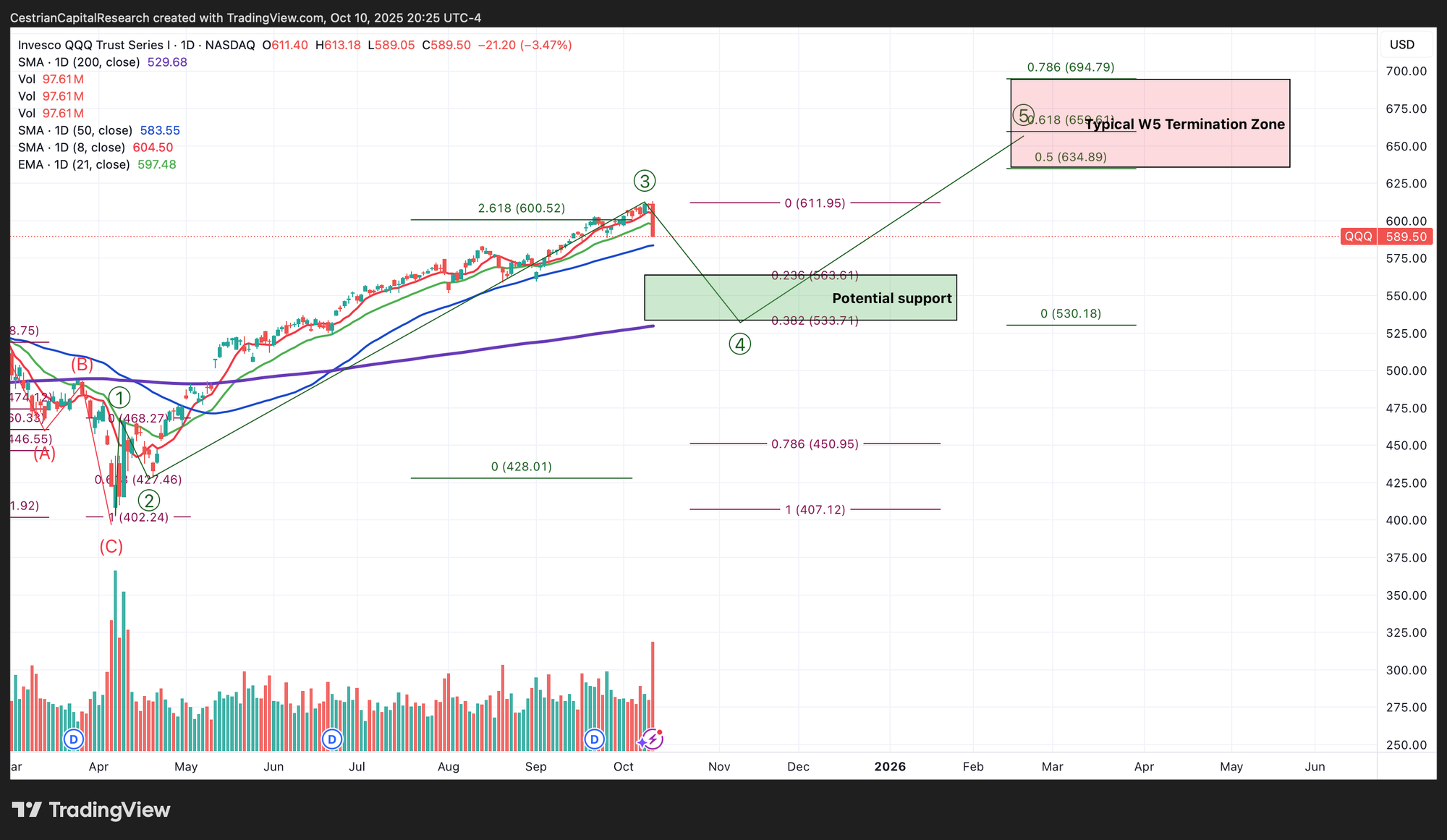

Nasdaq-100 / QQQ / TQQQ

Again, one red week does not make a bear market.

Holding over the 50-day.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

TQQQ also supported at its 200-day.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ, and have $TQQQ and $QQQ puts for December expiry. Overall slightly net short the Nasdaq.

Dow Jones / DIA / UDOW

As published yesterday with only time having passed.

Holding over the 50-day.

3x Levered Dow - UDOW Long / SDOW Short

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in the Dow.

Sector ETFs

Thursday I said: "$296 is in sight. Yikes.” And there we have it - major retreat for us.

Disclosure: No position in XLK.

3x Levered Long/Short Tech - TECL/TECS

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Rebalancing over to TECS.

Disclosure: No position in TECL or TECS

SOXX (Semiconductor)

Holding at the 21-day for now.

3x Levered Long / Short Semiconductor - SOXL / SOXS

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

SOXX leads the way for the levered names.

Disclosure: I am hedged 1:1 $SOXL:$SOXS and also long $SMH - overall net long semiconductor.

Alex King, Cestrian Capital Research, Inc - 10 October 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, IUSA, SOXL, SOXS, SMH, TLT, DTLA, ETHA, XLK; long December TQQQ, QQQ and SPY puts.