Marvell Technologies Q1 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The AI Sleeper Stock

If you ask your regular kind of investor to name their top 3 AI stocks, I think they would probably tell you, Nvidia, maybe AMD or Intel, maybe Microsoft, or Meta Platforms, and then I don’t know. I am pretty sure though that one name that people wouldn’t think of is Marvell Technologies, and not only because it sounds like a Spider-Man kind of thing.

I asked our latest analyst recruit, a nerdy kind of analyst, doesn’t speak much but doesn’t take lunch breaks or vacations either (and I think it will be a while before this analyst is hauled to HR to explain their bad behavior at the company offsite), to explain how Marvell fits in the AI value chain. And this is what the analyst, ChatGPT 4-o on Research Mode, said by way of a summary:

'Overall, Marvell positions itself as providing “accelerated infrastructure” for the AI era – the critical plumbing of compute, networking, and storage that must scale in unison. Hyperscalers redesigning their data centers for AI rely on Marvell’s building blocks (custom silicon, fast interconnects, controllers) to assemble optimized AI systems. As Marvell’s CEO Matt Murphy put it, “accelerated infrastructure silicon is what Marvell does” – the company’s mission is to power the foundations of AI in any cloud’ - Source, ChatGPT.

You can ignore the corporate hyperbole that made it through from MRVL’s website and wriggled past OpenAI’s Blarney Filter (TM). But you get the picture. You want to build a fast, scalable datacenter to run AI applications, you need to buy stuff from Marvell to get the job done.

Product Positioning Analysis

From the horse’s mouth - here’s what Sam’s Finest had to say about MRVL’s product setup and how it plays the AI theme. This note is pretty good - if you are even half interested in the product story at MRVL I recommend you read it.

ChatGPT’s Analysis Of How Marvell Fits In The AI Supply Chain.

Financial Fundamentals

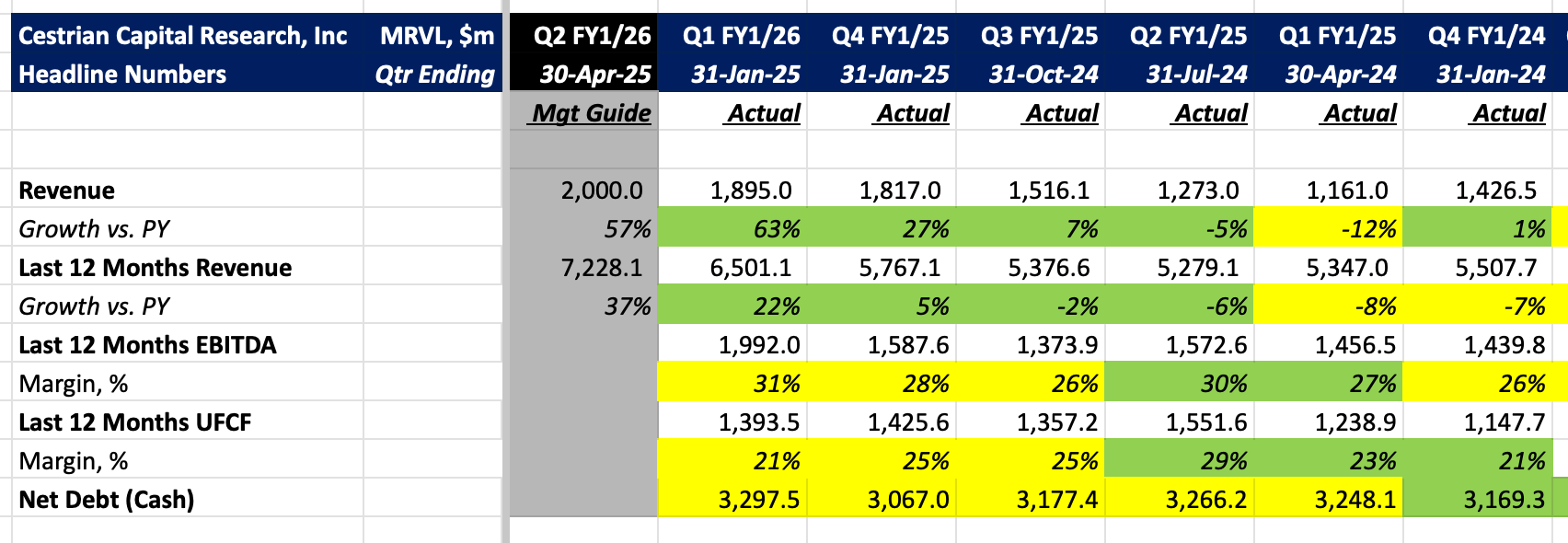

Headlines first, and then we’ll get into the details.

The delayed uptick in revenue growth vs. say NVDA (which saw AI revenue growth really start to click in during early 2023) tells you that the products are second-order demand, as in, they aren’t the first things you buy when you know you have a capacity ramp to put through.

Here’s the full picture.