Micron Q4 FY8/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Even Micron Is On Fire Now

Micron ($MU) is, in my experience, a fiend to trade. Over the very long term it kinda-sorta follows typical technical price patterns but on any timeframe shorter than a couple years, it is hard work. For now though, Micron has settled into an only-up pattern, a result of the extreme levels of demand for high-end memory chips, driven by, of course, LLM memory usage.

Today they printed a very good Q4 of their financial year ending August 2025, together with solid revenue guidance for Q1.

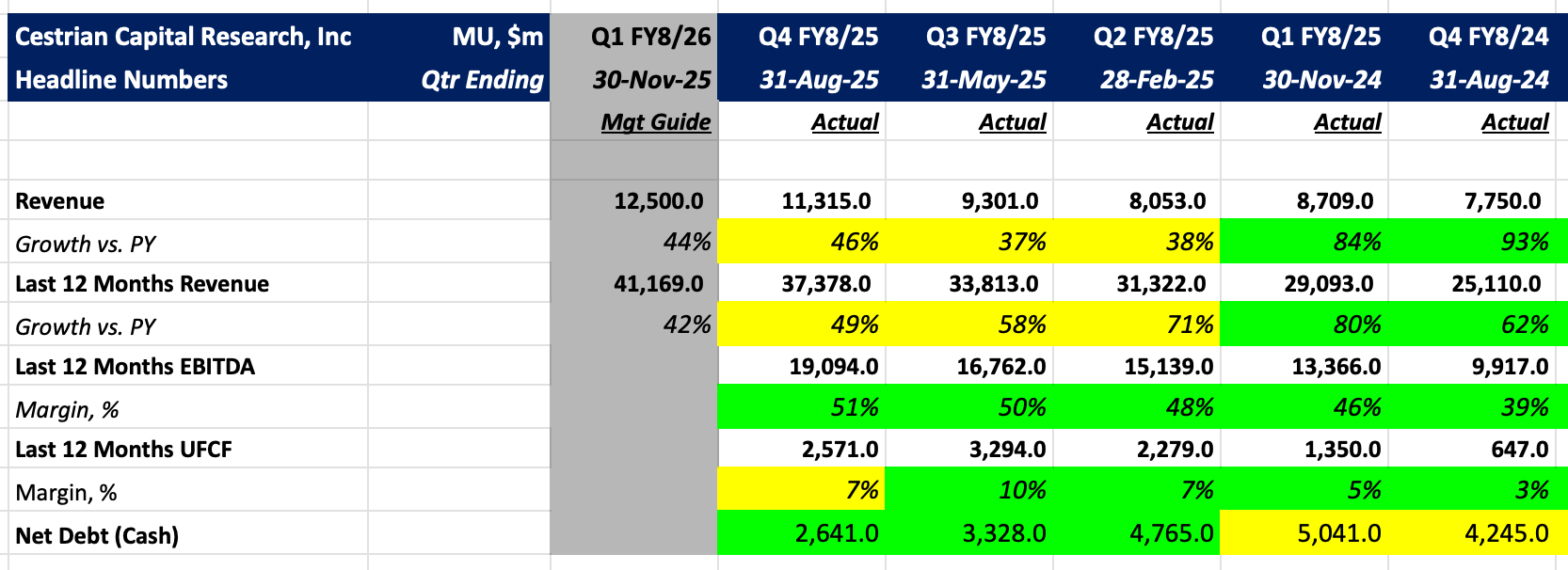

Here’s the headlines.

Let’s take a look at more fundamentals, valuation, the stock chart and our rating.