Microsoft Corporation Q3 FY6/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Read It And Weep, Losers

Look, we can argue all day long about trade policy and its impact on the economy now and in the future, and somewhere in there we may find the truth, once we all find out what trade policy actually is ie. what the prevailing level of tariffs with whom turns out to be. We can talk about the psychological impact of the uncertainty upon capital allocation decisions within real companies doing real things and also within asset management shops. That’s fun too. But another way of getting to reality is … read some earnings reports.

I confess that a lot of the time it is fairly dull work plowing through press releases and SEC filings and earnings call transcripts and blah. But sometimes, just sometimes, it is positively a sparkling way to spend your time, and that’s because (1) US GAAP and (2) fiduciary rules which together means (3) if you are a big public US company you cannot fib all that much about your past or potential future numbers. And that means that by reading the earnings reports published by the largest companies in the US, you can get a pretty good read on how reality is from the perspective of those companies. That doesn’t cover how Bob’s Hardware Store is doing in downtown Wichita, KS, but since the number of drill bits that Bob sells next week doesn’t really matter to the economy, the big earnings reports remain a useful proxy for what is really going on vs. what the narrative peddlers on all sides would like you to think is going on.

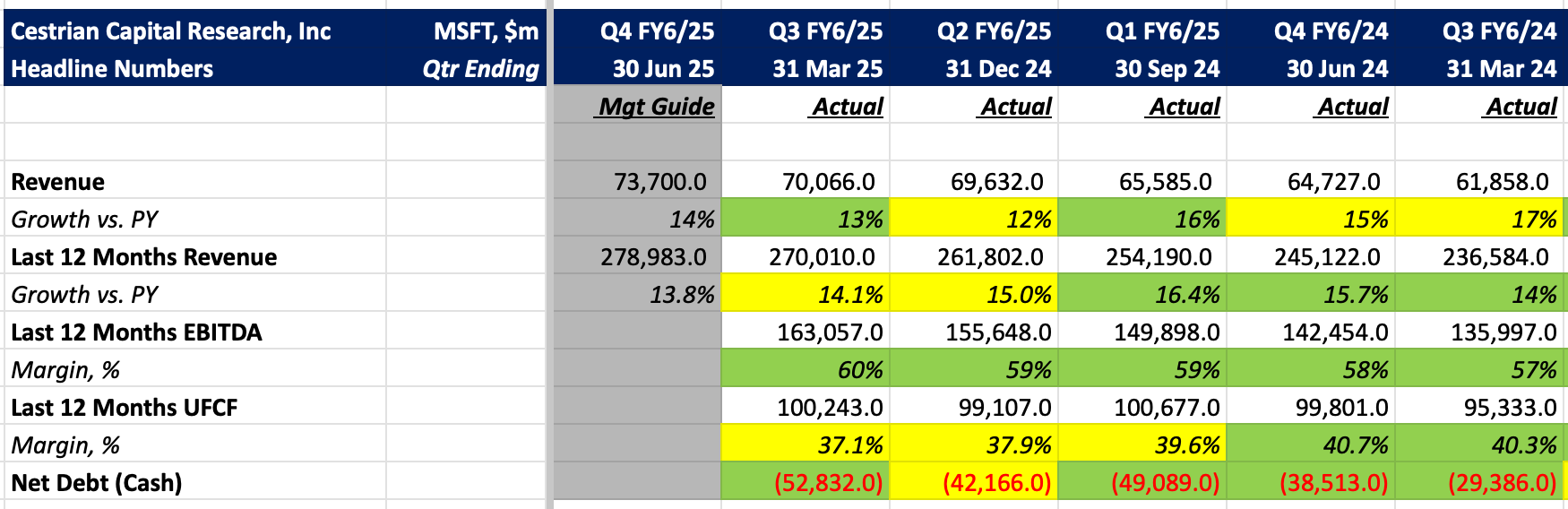

Microsoft earnings were a blowout. Growth accelerated and they guided for further acceleration. Cashflow margins dropped a point but that’s primarily a function of working capital seasonality from what I can see. The balance sheet garnered even more money, as if that were possible.

Oh yes and the order book is worth $315bn and is growing at 30%. Think about that for a while next time someone promotes the R-word.

Official rating for earnings - doubleplusgood.

Let’s take a closer look. Headlines first then the good stuff after the paywall.

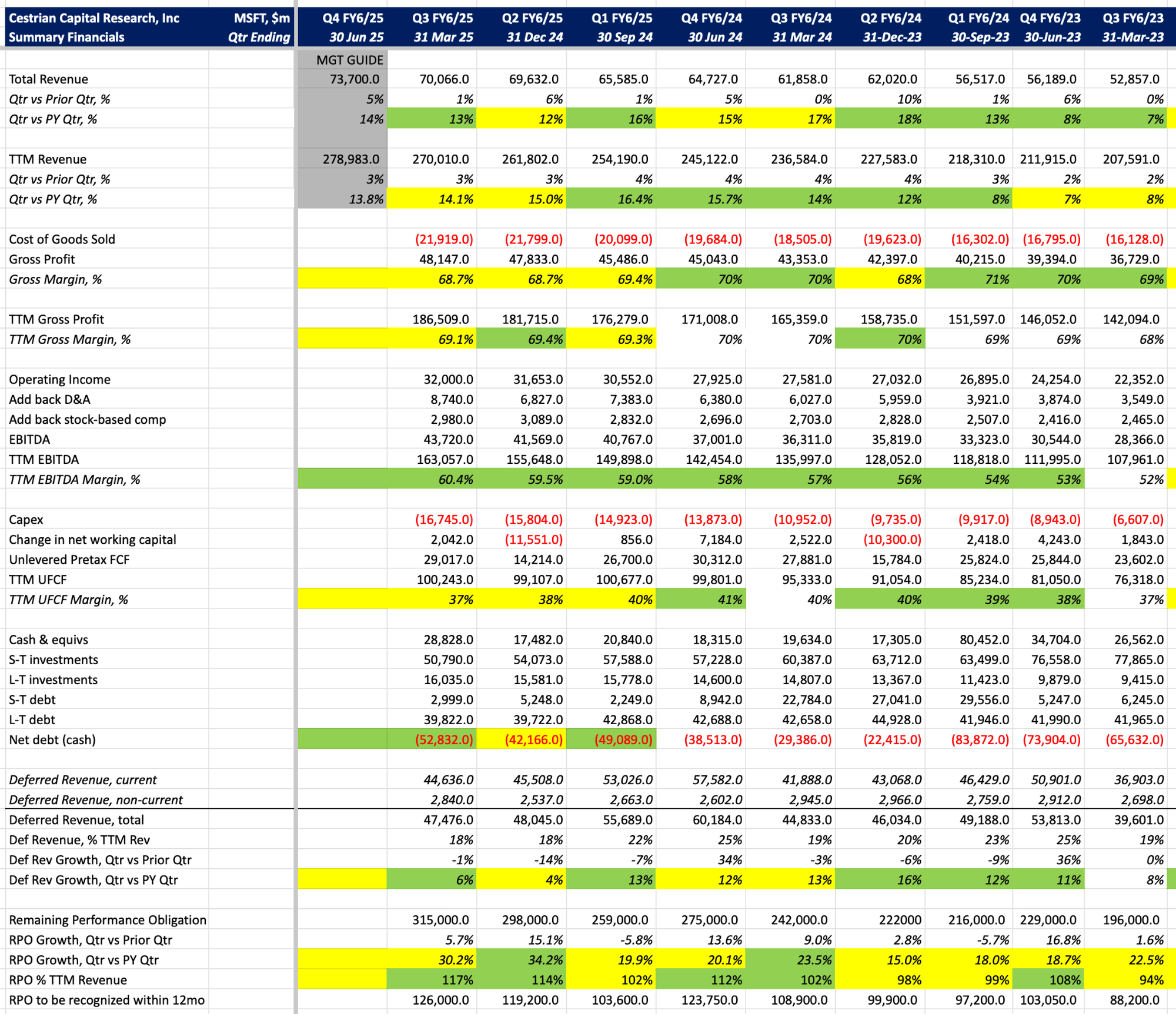

Financial Fundamentals

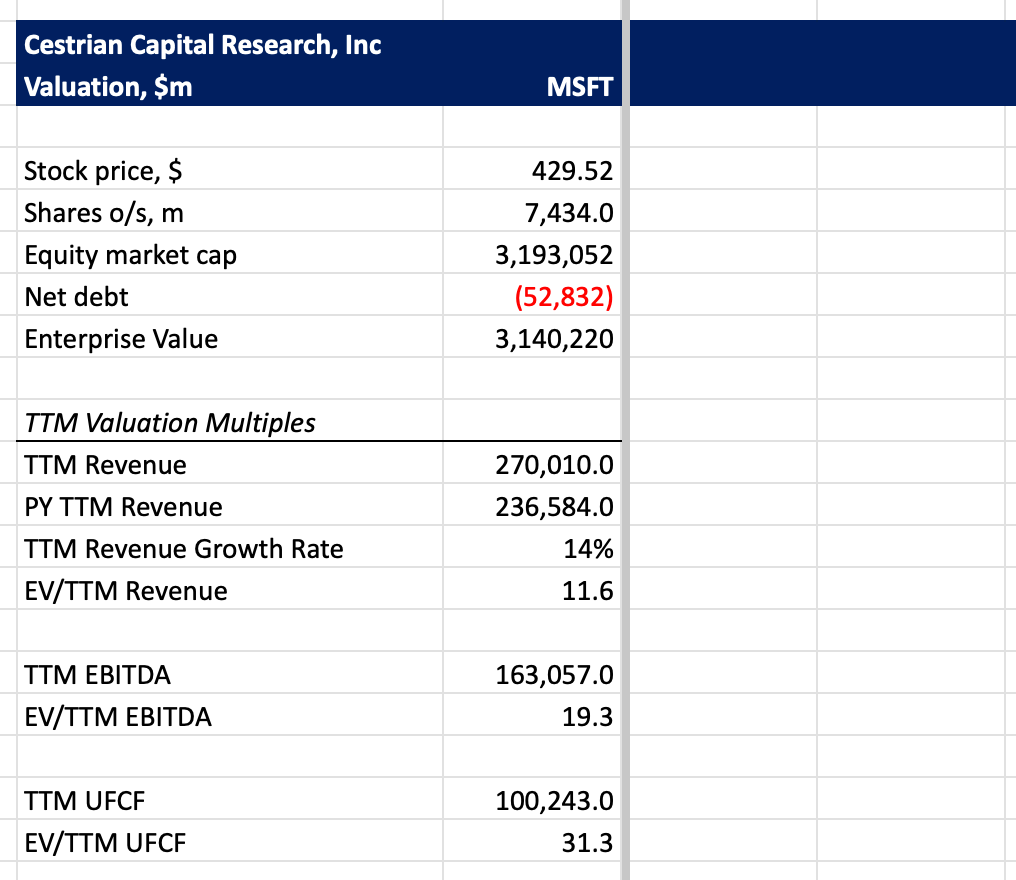

Valuation Analysis

Not expensive for the fundamentals, in my view.

Stock Chart

You can open a full page version of this chart, here.

Price target $474-563; a wide range I know, but let’s see if we are currently in the final Wave 5 up of this cycle (in which case the lower end of that range applies) or still in a Wave 3 (in which case the higher end). Anyway, I think there is meaningful upside from here.

We rate the stock at Hold.

Alex King, Cestrian Capital Research, Inc - 1 May 2025.