Microsoft Q4 FY6/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

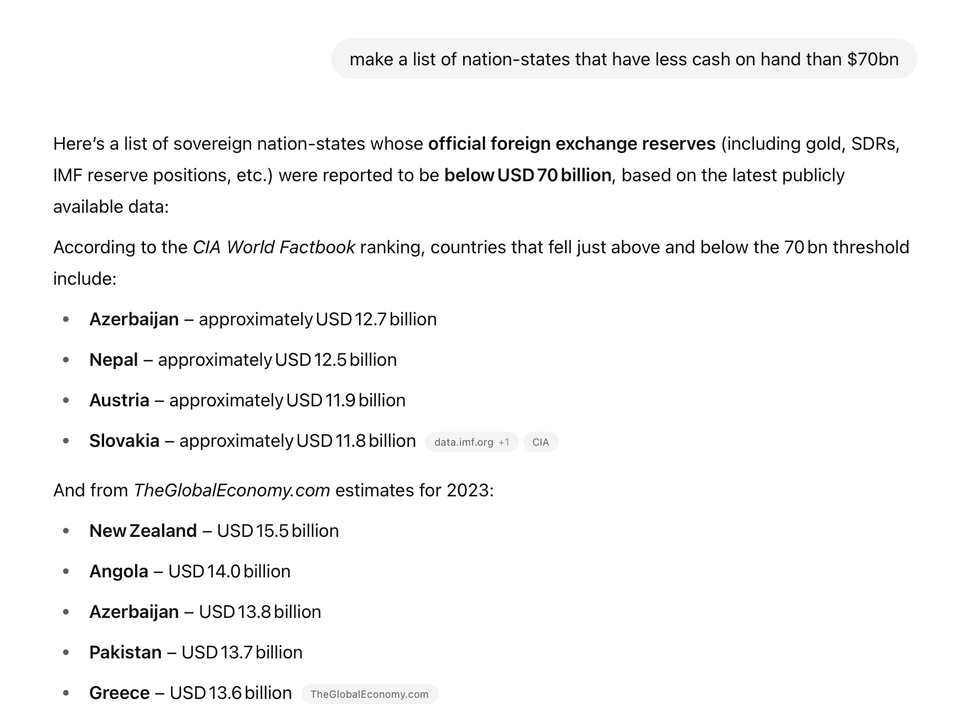

It Takes A Nation Of Billions.

Seventy billions, in fact. Think of a country, any country. Many times it will have less cash on hand than does Microsoft. This is because everything the critics of the wealth divide say is true - a handful of companies are generating a hugely disproportionate amount of market profits and cashflow, and they are - selfishly!! - hoarding those profits. The problem is that these companies - Microsoft, Meta, Google, others - are winning this way because:

- They have products and services that people want to buy, and

- Those products and services can be distributed globally at a very low incremental cost per user, and

- Those products and services have a natural, embedded network effect (MSFT = AT&T for the modern age. Anyone remember Scott McNealy and his Big Fedding Webtone? It’s here, now).

- These exports are not subject to any tariffs because nobody has pushed to include services in the re-organization of world trade.

So the cash continues to pile up. One day in the future, if we get there before the machines take over, a handful of antitrust laws will dismember these Leviathans.

But not this week.

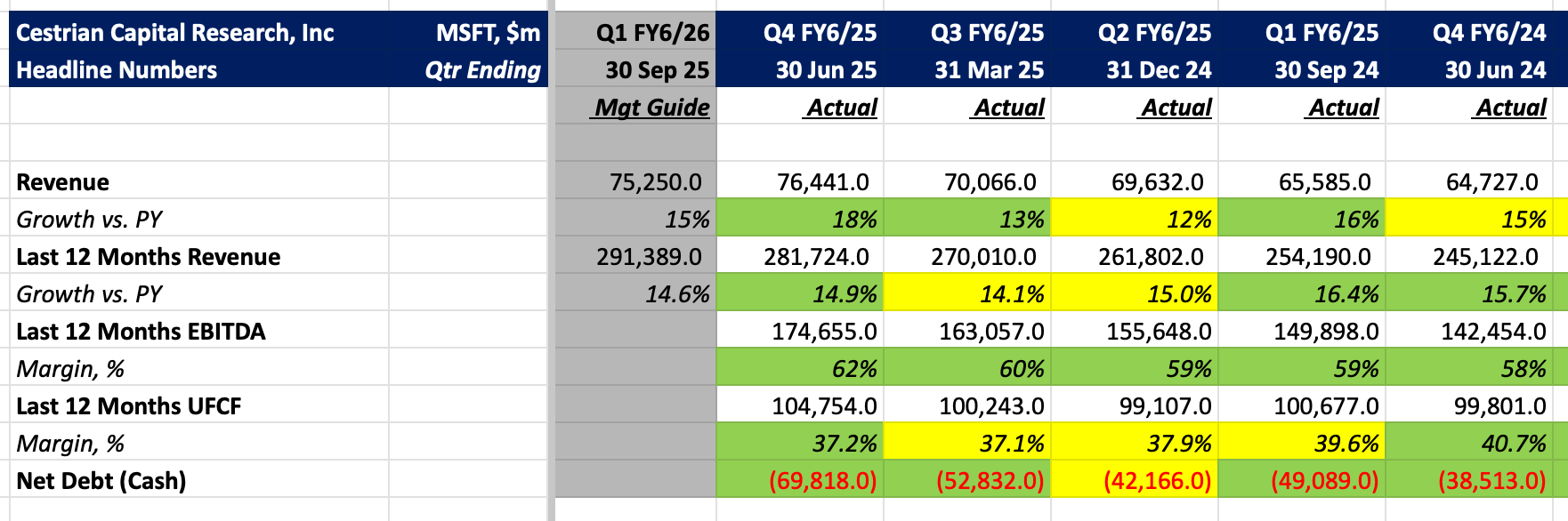

This week, Redmond’s finest has delivered rock-solid accelerating revenue growth, rising EBITDA margins and - before anyone says “yes but capex and the tooth fairy” - very strong unlevered pretax cashflow margins after all that capex. The stock is inexpensive on fundamentals and whilst we may see any manner of short-term pullbacks in the Nasdaq and/or Microsoft stock, until this bull gives way to the next bear, I think MSFT is a going-up name for the patient.

Let’s take a look at the numbers. First, the headlines.

Financial Summary.

Translated: read it and weep, losers.

Next the fundamentals in detail, valuation analysis, stock chart and rating.

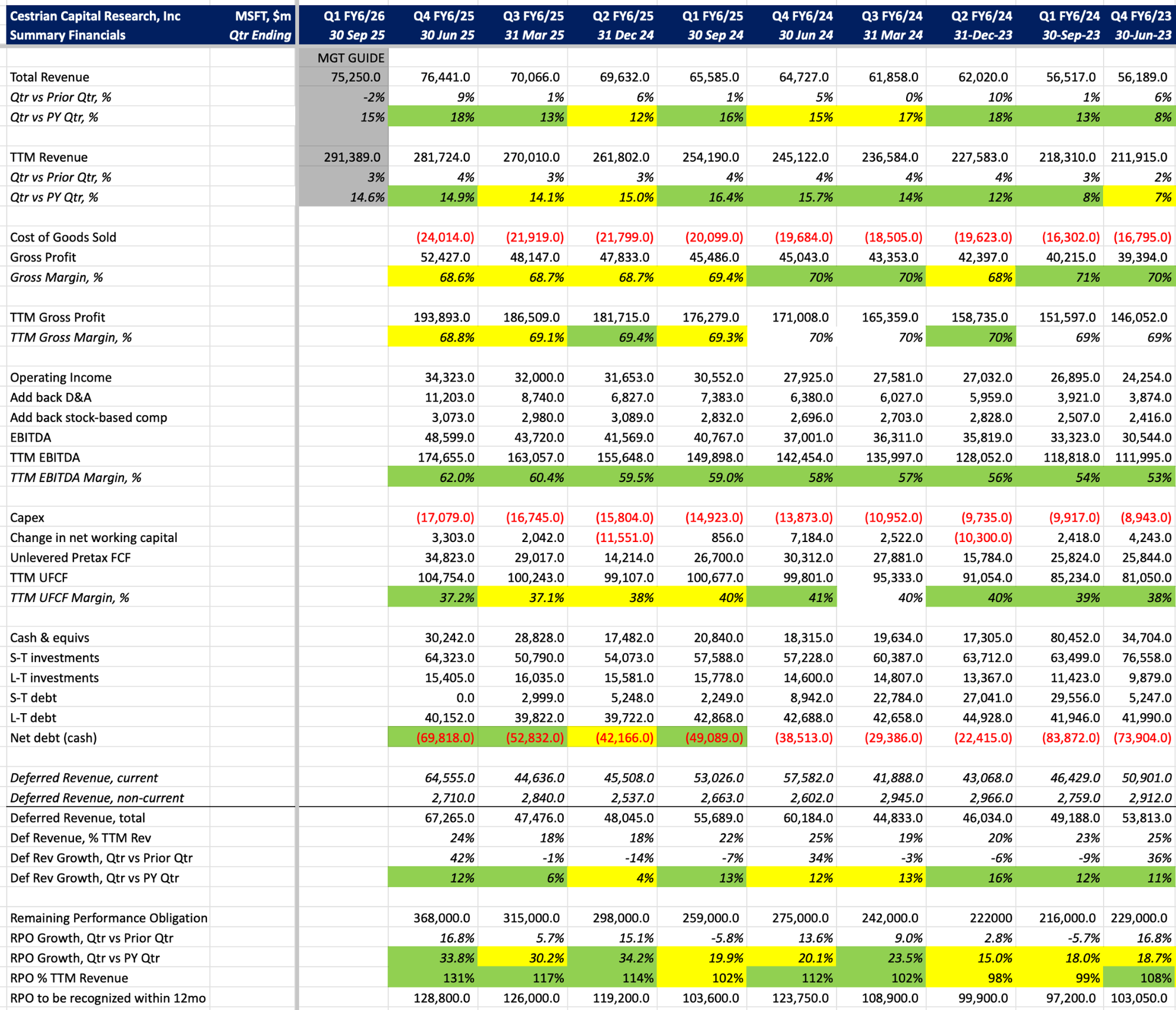

Financial Fundamentals.

As well as all the headlines, RPO growth accelerated - so the order book, which is fully 1.3x TTM revenues, and worth $368bn, is growing at 34%. I don’t really know what to say about that except that it is unprecedented.

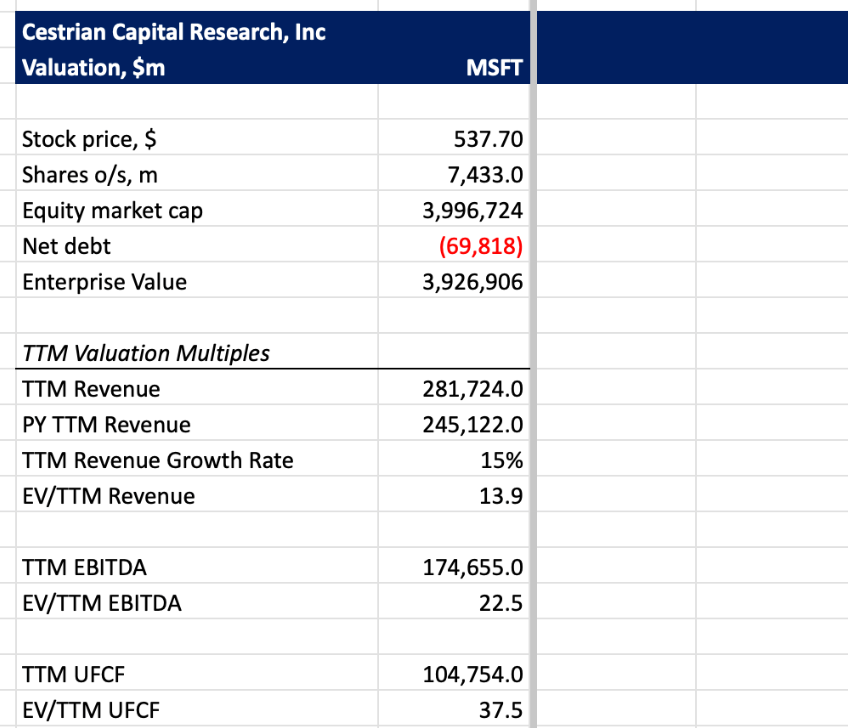

Valuation Metrics.

Is 38x TTM cashflow expensive? It’s not cheap; but I will remind you that what you are buying here is a $368bn book of business (that’s the RPO) growing that book at 34% YoY and, better, the thing turns $1 of revenue into $0.37 of unlevered pretax FCF. So you tell me what you think that’s worth!

Stock Chart.

You can open a full page version of the chart here.

The stock can go higher, of course it can. The fundamentals are wonderful and I would be surprised if this bull market was finished; I think there is a good deal more to come. But a prudent investor would take some gains here. Based on the chart we rate at Distribute for now. I can give you an alternative, more bullish chart where the stock is still in a Wave 3 up, but even then it’s probably around the top of a W3 and so taking some gains still wouldn’t be dumb. Your call as always - it’s your money.

If you’d like to talk about MSFT real time with our team, and you’re not yet an Inner Circle member, consider joining up. You can read about our premium service here.

Cestrian Capital Research, Inc - 1 August 2025.